Here's How Much You Would Have Made Owning Nike Stock In The Last 20 Years

Here's How Much You Would Have Made Owning Nike Stock In The Last 20 Years

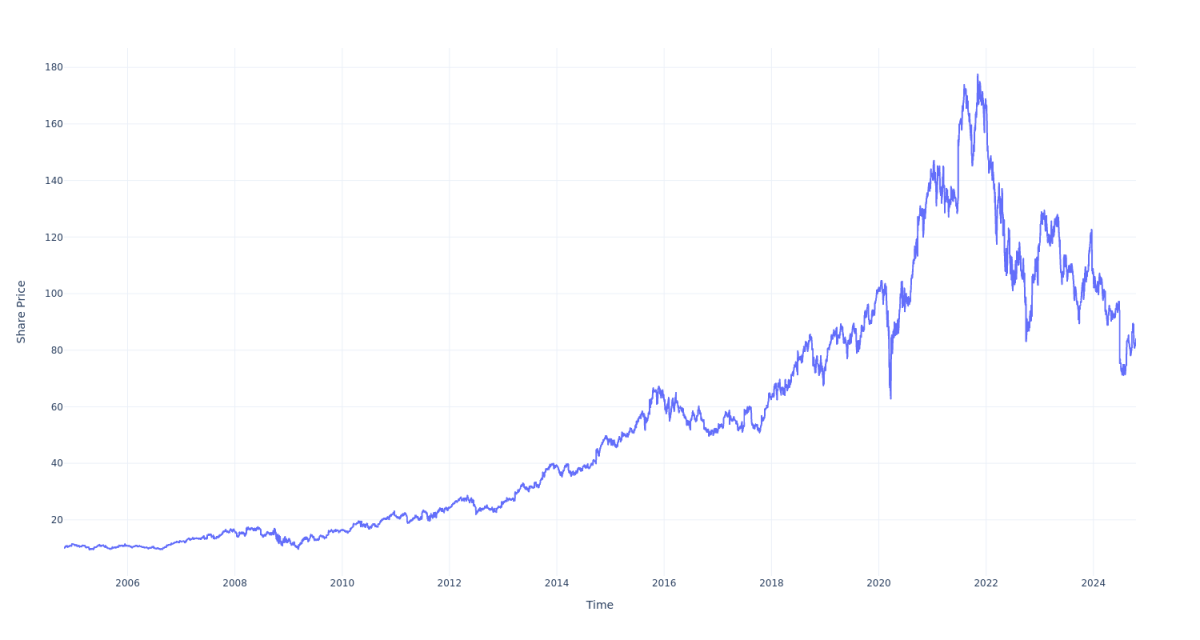

Nike (NYSE:NKE) has outperformed the market over the past 20 years by 2.54% on an annualized basis producing an average annual return of 11.16%. Currently, Nike has a market capitalization of $124.83 billion.

耐克(紐交所:NKE)在過去20年中的表現優於市場,年化基礎上的表現高出2.54%,平均年回報率爲11.16%。目前,耐克的市值爲$1248.3億。

Buying $100 In NKE: If an investor had bought $100 of NKE stock 20 years ago, it would be worth $839.44 today based on a price of $83.86 for NKE at the time of writing.

購買NKE股票的$100:如果投資者在20年前購買了$100的NKE股票,根據撰寫時NKE的價格爲$83.86,今天價值爲$839.44。

Nike's Performance Over Last 20 Years

耐克過去20年的表現

Finally -- what's the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

最終,所有這些的意義是什麼?從這篇文章中得出的核心見解是注意到複利對於一段時間內現金增長的巨大影響。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動化內容引擎生成並由編輯審查。

譯文內容由第三人軟體翻譯。