On Oct 17, major Wall Street analysts update their ratings for $Exelixis (EXEL.US)$, with price targets ranging from $30 to $34.

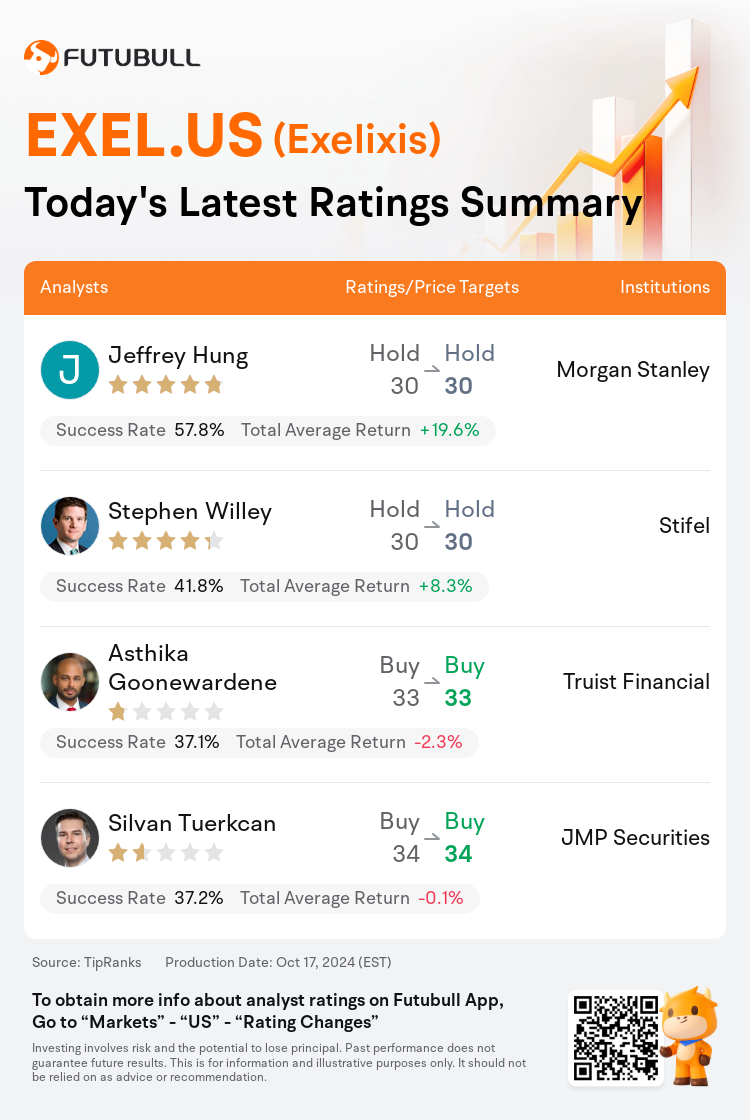

Morgan Stanley analyst Jeffrey Hung maintains with a hold rating, and maintains the target price at $30.

Stifel analyst Stephen Willey maintains with a hold rating, and maintains the target price at $30.

Truist Financial analyst Asthika Goonewardene maintains with a buy rating, and maintains the target price at $33.

Truist Financial analyst Asthika Goonewardene maintains with a buy rating, and maintains the target price at $33.

JMP Securities analyst Silvan Tuerkcan maintains with a buy rating, and maintains the target price at $34.

Furthermore, according to the comprehensive report, the opinions of $Exelixis (EXEL.US)$'s main analysts recently are as follows:

The recent judicial decision regarding the Cabometyx MSN II case confirmed that the Malate Salt Patents remain valid, and the '349 patent was neither infringed upon nor invalid. This outcome is largely favorable as it ensures patent protection until 2030. Nevertheless, the ruling did not reach the most optimistic scenario which would have extended patent protection until 2032.

The recent ruling securing Cabometyx patent protection until 2030 has presented a renewed outlook for the company's shares. The progress of the company's pipeline is now emerging as a key factor for the stock's valuation. The extension of Cabo's exclusivity and the resulting improved outlook for the stock has led to increased optimism.

The recent resolution of the MSN Laboratories litigation is deemed an incremental boon for Exelixis, enhancing the predictability of Cabometyx's market exclusivity and granting the company a clearer perspective on future business development endeavors. The potential of zanzalintinib is seen as a significant element in the firm's strategy to evolve its business model following Cabometyx. Furthermore, the newly formed partnerships with a major pharmaceutical company are viewed with interest.

Following a legal ruling that MSN infringed on certain polymorph patents, it's believed that the validity of the claims for all involved patents stands. This development suggests that each additional year of intellectual protection for Cabometyx could translate into significant free cash flow. The outcome may prompt investors to take a closer look at zanza and other assets in the pipeline.

Here are the latest investment ratings and price targets for $Exelixis (EXEL.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月17日,多家华尔街大行更新了$伊克力西斯 (EXEL.US)$的评级,目标价介于30美元至34美元。

摩根士丹利分析师Jeffrey Hung维持持有评级,维持目标价30美元。

斯迪富分析师Stephen Willey维持持有评级,维持目标价30美元。

储亿银行分析师Asthika Goonewardene维持买入评级,维持目标价33美元。

储亿银行分析师Asthika Goonewardene维持买入评级,维持目标价33美元。

JMP Securities分析师Silvan Tuerkcan维持买入评级,维持目标价34美元。

此外,综合报道,$伊克力西斯 (EXEL.US)$近期主要分析师观点如下:

关于Cabometyx MSN II案件的最新司法裁决确认马来酸盐专利仍然有效,'349专利既未侵犯也非无效。这一结果在很大程度上是有利的,因为它确保了专利保护直至2030年。然而,裁决并未达到最乐观的情况,即延长专利保护至2032年。

最近的裁决确保了Cabometyx的专利保护直至2030年,为公司股票带来了更新的前景。公司管线的进展现在已经成为股票估值的关键因素。Cabometyx专属权的延长以及由此带来的股票前景改善导致了增加的乐观情绪。

MSN Laboratories诉讼的最新解决被认为是对伊克力西斯的增量利好,增强了Cabometyx市场独家性的可预见性,为公司对未来业务发展努力提供了更清晰的展望。zanza诺曲喹的潜力被视为公司在Cabometyx之后发展其业务模式的重要因素。此外,与一家主要药品公司新成立的合作伙伴关系备受关注。

在一项针对MSN侵犯某些多晶型专利的法律裁决后,人们相信所有涉及的专利的索赔有效。这一进展表明,对于Cabometyx的每一年知识产权保护可能会转化为显著的自由现金流。这一结果可能促使投资者更加关注zanza和管线中的其他资产。

以下为今日4位分析师对$伊克力西斯 (EXEL.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

储亿银行分析师Asthika Goonewardene维持买入评级,维持目标价33美元。

储亿银行分析师Asthika Goonewardene维持买入评级,维持目标价33美元。

Truist Financial analyst Asthika Goonewardene maintains with a buy rating, and maintains the target price at $33.

Truist Financial analyst Asthika Goonewardene maintains with a buy rating, and maintains the target price at $33.