MARA Holdings Options Trading: A Deep Dive Into Market Sentiment

MARA Holdings Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bullish approach towards MARA Holdings (NASDAQ:MARA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MARA usually suggests something big is about to happen.

財力雄厚的投資者對MARA Holdings(納斯達克股票代碼:MARA)採取了看漲態度,這是市場參與者不容忽視的。我們對本辛加公開期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但是MARA的如此重大變動通常表明即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for MARA Holdings. This level of activity is out of the ordinary.

我們從今天的觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了MARA Holdings的9項非同尋常的期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 55% leaning bullish and 33% bearish. Among these notable options, 3 are puts, totaling $141,440, and 6 are calls, amounting to $331,115.

這些重量級投資者的總體情緒存在分歧,55%的人傾向於看漲,33%的人傾向於看跌。在這些值得注意的期權中,有3個是看跌期權,總額爲141,440美元,還有6個是看漲期權,總額爲331,115美元。

Expected Price Movements

預期的價格走勢

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $21.0 for MARA Holdings over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將MARA Holdings的價格區間從5.0美元擴大到21.0美元。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

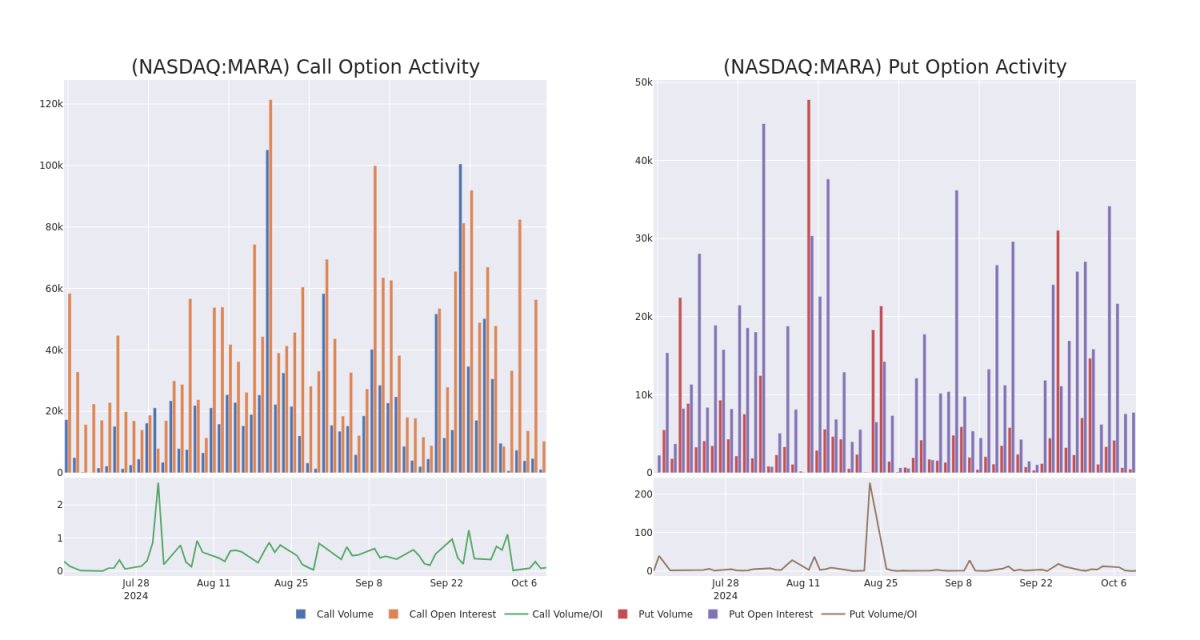

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in MARA Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to MARA Holdings's substantial trades, within a strike price spectrum from $5.0 to $21.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了MARA Holdings期權在指定行使價下的流動性和投資者對它們的興趣。即將發佈的數據顯示了與MARA Holdings的大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,在過去30天內,行使價範圍從5.0美元到21.0美元不等。

MARA Holdings 30-Day Option Volume & Interest Snapshot

MARA Holdings 30 天期權交易量和利息快照

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MARA | CALL | TRADE | BEARISH | 12/20/24 | $11.25 | $10.15 | $10.35 | $5.00 | $164.5K | 209 | 159 |

| MARA | PUT | TRADE | BULLISH | 01/15/27 | $6.65 | $6.45 | $6.52 | $15.00 | $52.1K | 128 | 81 |

| MARA | PUT | SWEEP | BULLISH | 10/18/24 | $4.75 | $4.7 | $4.7 | $20.00 | $47.5K | 3.1K | 204 |

| MARA | CALL | SWEEP | BULLISH | 01/17/25 | $2.83 | $2.74 | $2.82 | $16.00 | $42.3K | 3.9K | 219 |

| MARA | PUT | TRADE | BEARISH | 12/20/24 | $2.32 | $2.3 | $2.32 | $15.00 | $41.7K | 4.4K | 193 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 瑪拉 | 打電話 | 貿易 | 粗魯的 | 12/20/24 | 11.25 美元 | 10.15 美元 | 10.35 美元 | 5.00 美元 | 164.5 萬美元 | 209 | 159 |

| 瑪拉 | 放 | 貿易 | 看漲 | 01/15/27 | 6.65 美元 | 6.45 美元 | 6.52 美元 | 15.00 美元 | 52.1 萬美元 | 128 | 81 |

| 瑪拉 | 放 | 掃 | 看漲 | 10/18/24 | 4.75 美元 | 4.7 美元 | 4.7 美元 | 20.00 美元 | 47.5 萬美元 | 3.1K | 204 |

| 瑪拉 | 打電話 | 掃 | 看漲 | 01/17/25 | 2.83 美元 | 2.74 美元 | 2.82 美元 | 16.00 美元 | 42.3 萬美元 | 3.9K | 219 |

| 瑪拉 | 放 | 貿易 | 粗魯的 | 12/20/24 | 2.32 | 2.3 美元 | 2.32 | 15.00 美元 | 41.7 萬美元 | 4.4K | 193 |

About MARA Holdings

關於 MARA 控股公司

MARA Holdings Inc leverages digital asset compute to support the energy transformation. It secures the blockchain ledger and supports the energy transformation by converting clean, stranded, or underutilized energy into economic value.

MARA Holdings Inc利用數字資產計算來支持能源轉型。它通過將清潔、擱淺或未充分利用的能源轉化爲經濟價值,保護區塊鏈賬本並支持能源轉型。

After a thorough review of the options trading surrounding MARA Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對圍繞MARA Holdings的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Present Market Standing of MARA Holdings

瑪拉控股目前的市場地位

- Currently trading with a volume of 6,592,649, the MARA's price is down by -0.91%, now at $15.3.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 27 days.

- MARA目前的交易量爲6,592,649美元,價格下跌了-0.91%,目前爲15.3美元。

- RSI讀數表明,該股目前在超買和超賣之間處於中立狀態。

- 預計收益將在27天后發佈。

Professional Analyst Ratings for MARA Holdings

瑪拉控股的專業分析師評級

In the last month, 3 experts released ratings on this stock with an average target price of $23.333333333333332.

上個月,3位專家公佈了該股的評級,平均目標價爲23.3333333333332美元。

Turn $1000 into $1270 in just 20 days?

在短短 20 天內將 1000 美元變成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Reflecting concerns, an analyst from Macquarie lowers its rating to Outperform with a new price target of $22.* An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $27. * Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $21.

20年專業期權交易員透露了他的單線圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處查看。* 出於擔憂,麥格理的一位分析師將其評級下調至跑贏大盤,新的目標股價爲22.美元* HC Wainwright & Co. 的一位分析師已將其評級下調至買入,將目標股價調整至27美元。*坎託·菲茨傑拉德的一位分析師將其評級下調至增持,新的目標股價爲21美元,這反映了人們的擔憂。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MARA Holdings with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解MARA控股的最新期權交易,以獲取實時提醒。

譯文內容由第三人軟體翻譯。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $21.0 for MARA Holdings over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $21.0 for MARA Holdings over the recent three months.