Microsoft Stock Nears Death Cross As OpenAI Partnership Weakens: Time To Lock In Gains?

Microsoft Stock Nears Death Cross As OpenAI Partnership Weakens: Time To Lock In Gains?

Microsoft Corp. (NASDAQ:MSFT) has been riding high in 2024, with the stock up 11.38% year-to-date and 25.21% over the past year.

微軟公司(納斯達克:MSFT)在2024年表現不俗,股票年初至今上漲11.38%,過去一年上漲25.21%。

However, dark clouds may be forming on two fronts: technical indicators are flashing bearish signals and Microsoft's high-profile partnership with OpenAI is showing signs of strain.

然而,黑暗的陰雲可能正在兩個方面形成:技術指標發出了消極信號,微軟與OpenAI的備受關注的合作關係顯示出緊張局勢的跡象。

Death Cross Looming: Bearish Signals Pile Up

死亡交叉正在逼近:消極信號不斷堆積

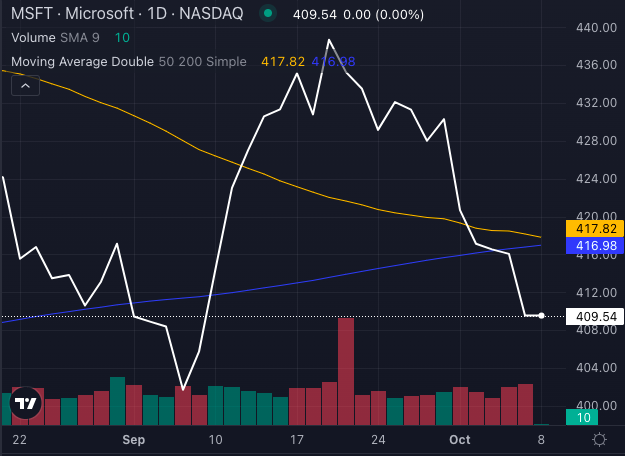

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

Microsoft stock is inching closer to forming a Death Cross, a technical pattern where the 50-day moving average dips below the 200-day moving average, signaling a potential shift from bullish to bearish momentum.

微軟股票正逐漸接近形成死亡交叉,這是一種技術模式,在這種模式中,50天移動平均線跌破200天移動平均線,預示着從看好勢頭到看淡勢頭的潛在轉變。

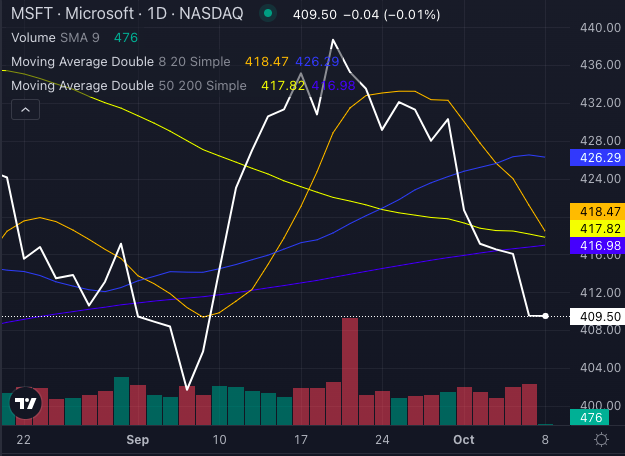

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

Right now, Microsoft stock is already trading below key moving averages, indicating that selling pressure is building.

目前,微軟股票已經跌破關鍵均線,表明賣壓正在積累。

- Eight-day SMA: $418.47 (Bearish)

- 20-day SMA: $426.29 (Bearish)

- 50-day SMA: $417.82 (Bearish)

- 200-day SMA: $416.98 (Bearish)

- 八日 SMA:$418.47(看淡)

- 二十日簡單移動平均線:$426.29(看淡)

- 五十日簡單移動平均線:$417.82(看淡)

- 二百日簡單移動平均線:$416.98(看淡)

At a share price of $409.50, Microsoft's stock is clearly under pressure, with bearish signals stacking up. A Death Cross would only solidify this, potentially signaling a deeper downtrend.

在每股$409.50的價格下,微軟的股價明顯受到壓力,而且看淡信號正在積累。死亡交叉只會進一步鞏固這一點,可能預示着更深的下跌趨勢。

OpenAI Moves To Oracle: Cracks In The Microsoft Partnership?

OpenAI轉向Oracle:微軟合作關係出現裂痕?

Adding to Microsoft's troubles is the evolving relationship with OpenAI. According to The Information, OpenAI is seeking more independence from Microsoft's cloud services, opting to lease data centers from Oracle Corp (NYSE:ORCL) in Texas. This shift comes as OpenAI raised $6.6 billion in new funding and looks to expand its capabilities without being solely dependent on Microsoft.

加劇微軟的困境的是與OpenAI的不斷髮展的關係。據The Information報道,OpenAI正在尋求更多獨立性,不再完全依賴微軟的雲服務,選擇從紐交所的甲骨文公司(NYSE:ORCL)在德克薩斯州租用數據中心。這一轉變發生在OpenAI籌集到60億美元新資金並希望擴大其能力的同時,不再完全依賴於微軟。

Read Also: Intel Vs. Oracle: Can Apollo's Rescue Plan Beat Oracle's AI Cloud Domination?

閱讀更多:英特爾 VS. 甲骨文:阿波羅的拯救計劃能否擊敗甲骨文的人工智能雲統治?

Concerns have emerged over Microsoft's ability to meet OpenAI's growing need for computing power, prompting OpenAI's search for alternative solutions. Though OpenAI maintains that its strategic relationship with Microsoft remains strong, the move toward Oracle signals some level of dissatisfaction.

對於微軟是否有能力滿足OpenAI對計算能力日益增長的需求,一些擔憂已經出現,這促使OpenAI尋找替代方案。儘管OpenAI堅稱與微軟的戰略關係仍然牢固,但轉向甲骨文表明瞭一定程度的不滿。

Time To Lock In Gains?

是時候鎖定收益了?

With Microsoft stock on the brink of a Death Cross and its once rock-solid partnership with OpenAI showing cracks, now might be the perfect time for investors to consider locking in gains.

隨着微軟股價瀕臨死亡交叉,並且與OpenAI曾經堅不可摧的合作關係出現裂痕,現在可能是投資者考慮鎖定收益的絕佳時機。

The combination of bearish technicals and potential shifts in cloud business partnerships adds to the risk of a downturn.

技術面看淡和雲業務夥伴關係潛在變化的結合增加了市場下行的風險。

Investors riding Microsoft's strong 2024 performance might want to reevaluate whether to stay in or take profits before the Death Cross becomes a reality.

乘坐微軟強勁的2024表現的投資者可能希望重新評估是否繼續持有或在死亡交叉變成現實之前獲利。

- Here's How Much $100 Invested In Microsoft 20 Years Ago Would Be Worth Today

- 20年前投資微軟100美元,今天會是多少錢?

Photo: Shutterstock

Photo: shutterstock

譯文內容由第三人軟體翻譯。

Microsoft stock is inching closer to forming a

Microsoft stock is inching closer to forming a