Unpacking the Latest Options Trading Trends in MicroStrategy

Unpacking the Latest Options Trading Trends in MicroStrategy

Whales with a lot of money to spend have taken a noticeably bullish stance on MicroStrategy.

擁有大量資金的鯨魚對MicroStrategy持有顯著的看好態度。

Looking at options history for MicroStrategy (NASDAQ:MSTR) we detected 43 trades.

查看microstrategy (納斯達克:MSTR) 期權歷史記錄,我們檢測到有43筆交易。

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 39% with bearish.

如果我們考慮每筆交易的具體情況,有46%的投資者持看好期望進行交易,而39%持看淡。

From the overall spotted trades, 8 are puts, for a total amount of $467,878 and 35, calls, for a total amount of $2,771,137.

從總體上看,我們發現有8筆看跌交易,總額爲467,878美元,以及35筆看漲交易,總額爲2,771,137美元。

Expected Price Movements

預期價格波動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $250.0 for MicroStrategy over the recent three months.

根據交易活動情況,重要投資者似乎瞄準微觀策略的價格區間,最近三個月內價格區間從100.0美元到250.0美元。

Volume & Open Interest Trends

成交量和未平倉量趨勢

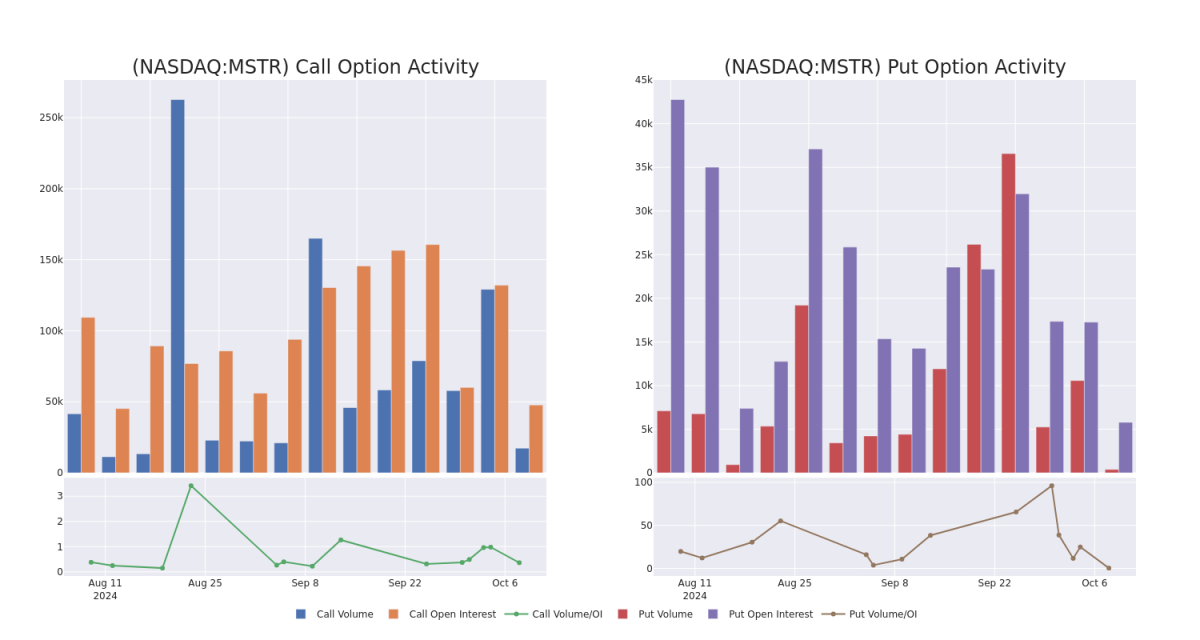

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for MicroStrategy's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MicroStrategy's whale trades within a strike price range from $100.0 to $250.0 in the last 30 days.

在交易期權時,查看成交量和持倉量是一個有效的策略。這些數據可以幫助您追蹤特定行權價格下,微觀策略期權的流動性和興趣。以下,我們可以觀察過去30天內,在100.0美元到250.0美元行權價格範圍內的所有微觀策略大宗交易的看漲和看跌的成交量和持倉量的發展情況。

MicroStrategy Call and Put Volume: 30-Day Overview

Microstrategy Call和Put成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | TRADE | BULLISH | 01/16/26 | $64.0 | $60.65 | $64.0 | $225.00 | $921.6K | 692 | 144 |

| MSTR | CALL | TRADE | BEARISH | 12/20/24 | $22.2 | $21.7 | $21.7 | $220.00 | $217.0K | 487 | 5 |

| MSTR | CALL | TRADE | BULLISH | 11/01/24 | $10.3 | $10.2 | $10.3 | $210.00 | $206.0K | 687 | 249 |

| MSTR | PUT | TRADE | BEARISH | 03/21/25 | $7.7 | $7.35 | $7.6 | $100.00 | $152.0K | 959 | 0 |

| MSTR | CALL | SWEEP | BULLISH | 11/15/24 | $73.55 | $71.6 | $72.84 | $122.00 | $145.6K | 127 | 59 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MicroStrategy | 看漲 | 交易 | 看好 | 01/16/26 | $64.0 | $60.65 | $64.0 | $225.00 | $921.6K | 692 | 144 |

| MicroStrategy | 看漲 | 交易 | 看淡 | 12/20/24 | $22.2 | $21.7 | $21.7 | $220.00 | 217千美元 | 487 | 5 |

| MicroStrategy | 看漲 | 交易 | 看好 | 11/01/24 | $10.3 | $10.2 | $10.3 | 目標股價爲$210.00。 | $206.0K | 687 | 249 |

| MicroStrategy | 看跌 | 交易 | 看淡 | 03/21/25 | $7.7 | $7.35 | $7.6 | $100.00。 | $152.0K | 959 | 0 |

| MicroStrategy | 看漲 | SWEEP | 看好 | 11/15/24 | $73.55 | $71.6 | $72.84 | 目前,關於Boot Barn的分析師共識爲「強烈買入」,平均目標價爲$ 119.08,代表4.6%的上漲空間。摩根大通(J.P. Morgan)在5月21日發佈的一份報告中,也保持了買入評級,並給出了$ 125.00的價格目標。 | 145.6千美元 | 127 | 59 |

About MicroStrategy

關於MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

MicroStrategy是一家企業分析和移動軟件提供商。它提供MicroStrategy Analytics平台,通過移動設備或Web提供報告和儀表板,並使用戶能夠進行臨時分析和分享見解;MicroStrategy Server提供分析處理和作業管理。該公司報告的經營部門從事通過許可安排和雲訂閱及相關服務的方式設計、開發、營銷和銷售其軟件平台。

Following our analysis of the options activities associated with MicroStrategy, we pivot to a closer look at the company's own performance.

在我們分析完MicroStrategy期權活動後,我們再仔細觀察該公司的績效表現。

Current Position of MicroStrategy

MicroStrategy當前持倉

- With a trading volume of 2,033,299, the price of MSTR is up by 2.04%, reaching $189.88.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 22 days from now.

- MicroStrategy的交易量爲2,033,299,股價上漲了2.04%,達到189.88美元。

- 當前RSI值表明股票可能已經超買。

- 下一個業績將於22天后發佈。

Expert Opinions on MicroStrategy

關於MicroStrategy的專家意見

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $182.0.

過去30天裏,共有3位專業分析師對這隻股票發表了意見,設定了182.0美元的平均目標價。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Barclays has decided to maintain their Overweight rating on MicroStrategy, which currently sits at a price target of $173. * Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on MicroStrategy with a target price of $200. * Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for MicroStrategy, targeting a price of $173.

這位擁有20年期權交易經驗的專業交易員揭示了他的一線圖表技術,顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊這裏獲取更多信息。* 巴克萊銀行的分析師決定維持對MicroStrategy的超配評級,當前目標價爲173美元。* 特迪·科溫的分析師保持對MicroStrategy的買入評級,目標價爲200美元。* Canaccord Genuity的分析師繼續堅定立場,繼續給MicroStrategy持有買入評級,目標價爲173美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 8 are puts, for a total amount of $467,878 and 35, calls, for a total amount of $2,771,137.

From the overall spotted trades, 8 are puts, for a total amount of $467,878 and 35, calls, for a total amount of $2,771,137.