Walt Disney Options Trading: A Deep Dive Into Market Sentiment

Walt Disney Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards Walt Disney (NYSE:DIS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DIS usually suggests something big is about to happen.

深謀遠慮的投資者對迪士尼(紐交所:DIS)採取了看跌的策略,這是市場參與者不應忽視的。本財經媒體追蹤公開期權記錄發現了這一重大動向。這些投資者的身份尚未可知,但是DIS股票出現如此重要的變動通常意味着即將發生重大事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 20 extraordinary options activities for Walt Disney. This level of activity is out of the ordinary.

我們從今天的觀察中獲得了這些信息,當Benzinga的期權掃描儀突出了20個瓦特·迪士尼的非凡期權活動。這種活動水平是不同尋常的。

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 60% bearish. Among these notable options, 5 are puts, totaling $502,724, and 15 are calls, amounting to $855,609.

這些重量級投資者中普遍情緒分歧,有40%傾向於看漲,60%看淡。在這些顯著的期權中,有5個看跌,總額爲502,724美元,有15個看漲,總額爲855,609美元。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $140.0 for Walt Disney during the past quarter.

分析這些合約的成交量和未平倉量,似乎大戶一直在關注瓦特·迪士尼在過去一個季度內的定價區間,即從85.0到140.0美元。

Volume & Open Interest Trends

成交量和未平倉量趨勢

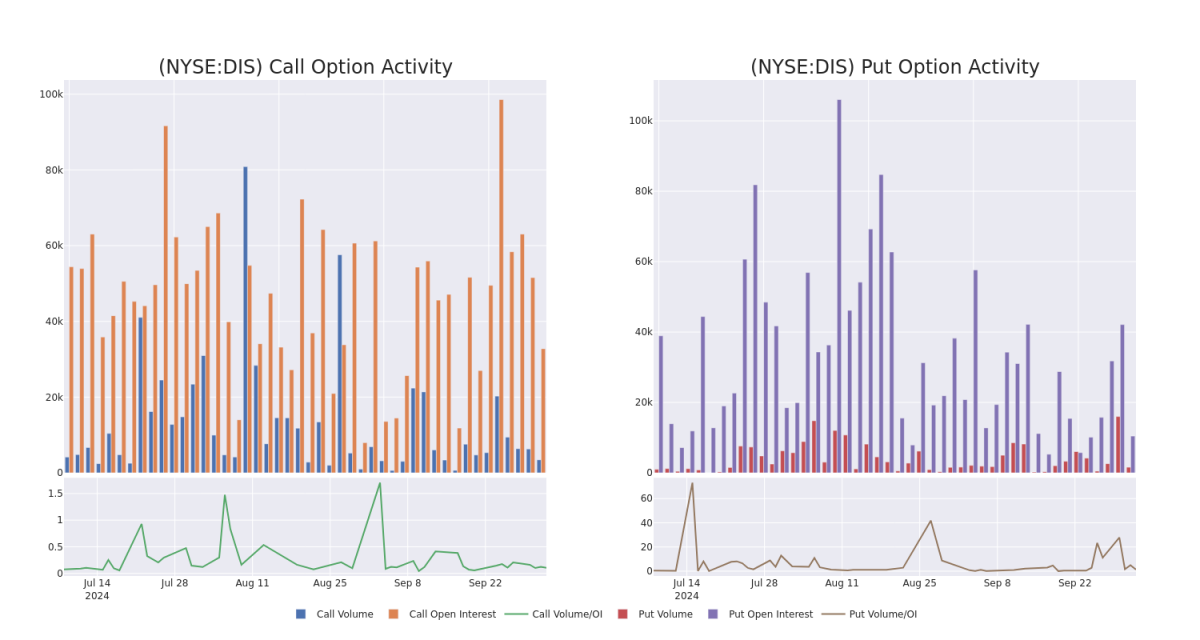

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walt Disney's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Walt Disney's significant trades, within a strike price range of $85.0 to $140.0, over the past month.

檢查成交量和未平倉量爲股票研究提供了關鍵見解。這些信息是衡量瓦特·迪士尼在特定行權價格處的期權流動性和興趣水平的關鍵。在下面,我們展示了瓦特·迪士尼在過去一個月內從85.0到140.0美元行權價格區間內看漲和看跌期權的成交量和未平倉量趨勢的快照。

Walt Disney Option Activity Analysis: Last 30 Days

迪士尼期權活動分析:最近30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | PUT | SWEEP | BEARISH | 09/19/25 | $7.3 | $7.1 | $7.25 | $90.00 | $147.9K | 334 | 226 |

| DIS | PUT | SWEEP | BEARISH | 09/19/25 | $9.55 | $9.4 | $9.5 | $95.00 | $134.9K | 1.2K | 315 |

| DIS | CALL | SWEEP | BEARISH | 09/19/25 | $7.25 | $7.2 | $7.2 | $105.00 | $120.2K | 551 | 369 |

| DIS | CALL | TRADE | BEARISH | 01/16/26 | $2.65 | $2.15 | $2.15 | $140.00 | $99.1K | 3.7K | 39 |

| DIS | PUT | TRADE | BEARISH | 11/15/24 | $1.34 | $1.29 | $1.32 | $85.00 | $99.0K | 8.1K | 763 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 項目8.01 | 看跌 | SWEEP | 看淡 | 09/19/25 | $7.3 | $7.1 | $7.25 | $90.00 | $147.9K | 334 | 226 |

| 項目8.01 | 看跌 | SWEEP | 看淡 | 09/19/25 | $9.55 | 9.4美元 | $9.5 | $ 95.00 | $134.9K | 1.2K | 315 |

| 項目8.01 | 看漲 | SWEEP | 看淡 | 09/19/25 | $7.25 | $7.2 | $7.2 | $105.00 | $120.2K | 551 | 369 |

| 項目8.01 | 看漲 | 交易 | 看淡 | 01/16/26 | $2.65 | $2.15 | $2.15 | $140.00 | $99.1K | 3.7K | 39 |

| 項目8.01 | 看跌 | 交易 | 看淡 | 11/15/24 | $1.34 | $1.29 | $1.32 | $85.00 | $99.0千 | 8.1千 | 763 |

About Walt Disney

關於迪士尼

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

迪士尼分爲三個全球業務板塊:娛樂、體育和體驗。娛樂和體驗都受益於公司一世紀以來創造的特許經營權和角色。娛樂包括ABC廣播網絡、幾個有線電視網絡、迪士尼+和Hulu流媒體服務。在這個板塊中,迪士尼還進行電影和電視製作和分銷,將內容授權給電影院、其他內容提供商,或者越來越多地在自己的流媒體平台和電視網絡內使用。體育板塊包括ESPN和ESPN+流媒體服務。體驗包括迪士尼的主題公園和度假勝地,還受益於商品授權。

After a thorough review of the options trading surrounding Walt Disney, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對迪士尼周邊期權交易進行全面審查後,我們開始對公司進行更詳細的評估。這包括對迪士尼當前市場地位和表現的評估。

Current Position of Walt Disney

華特迪士尼公司的當前位置

- Currently trading with a volume of 2,770,648, the DIS's price is down by -0.14%, now at $94.02.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

- 目前成交量爲2,770,648,迪士尼的價格下跌了-0.14%,目前爲94.02美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預計發佈收益的時間爲42天后。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walt Disney options trades with real-time alerts from Benzinga Pro.

期權交易存在較高的風險和潛在回報。精明的交易員通過不斷地自我教育、調整策略、監控多個因子、密切關注市場走勢來管理這些風險。通過Benzinga Pro實時警報及時了解最新的華特迪士尼期權交易。

譯文內容由第三人軟體翻譯。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $140.0 for Walt Disney during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $140.0 for Walt Disney during the past quarter.