Oracle Vs. Salesforce: Cloud Wars Heat Up, Stocks Take Off

Oracle Vs. Salesforce: Cloud Wars Heat Up, Stocks Take Off

The cloud battle between Oracle Corp (NYSE:ORCL) and Salesforce Inc (NYSE:CRM) is hitting new highs, and both stocks are riding the AI wave to impressive gains.

甲骨文公司(NYSE: ORCL)和賽富時公司(NYSE: CRM)之間的雲市場格鬥正持續升溫,兩家公司的股票都在人工智能浪潮中實現了令人印象深刻的漲幅。

But which one is winning? Let's dive into the numbers, recent moves, and what investors need to know.

但,哪一家公司正獲勝?讓我們深入了解數據、最新動向,以及投資者需要了解的信息。

Oracle's Big Play: Malaysia's Mega Cloud

甲骨文的重大舉措:馬來西亞的雲計算巨頭

Oracle has been flexing its cloud muscles, with a 20% stock jump over the past month, +61% YTD, thanks to impressive growth in its cloud infrastructure services. The latest boost?

甲骨文一直在展示其雲計算實力,過去一個月股價上漲了20%,年初至今增長了61%,這要歸功於其雲基礎服務的驚人增長。最新的助推?

A $6.5 billion investment to establish a public cloud region in Malaysia—outpacing Amazon.com Inc's $6.2 billion AWS plan. Oracle's aggressive push aims to tap into Malaysia's growing demand for AI, data, and analytics, potentially becoming one of the largest tech investments in Southeast Asia.

投資65億美元在馬來西亞建立一個公共雲地域,超過了亞馬遜公司的62億美元AWS計劃。甲骨文的大舉推動旨在抓住馬來西亞對人工智能、數據和分析日益增長的需求,有望成爲東南亞最大的科技投資之一。

Read Also: Oracle Bets Big: Plans Over $6.5B Cloud Expansion In Malaysia To Fuel AI Innovation

繼續閱讀:甲骨文大膽押注:計劃投資超過65億美元在馬來西亞擴展雲計算以推動人工智能創新

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

On the charts, Oracle stock is showing solid bullish signals across the board, trading at $167.71, above its eight-day, 20-day and 50-day moving averages. However, some selling pressure indicates caution for those diving in for short-term gains.

在圖表上,甲骨文股票顯示出積極信號,交易價格爲167.71美元,高於其8天、20天和50天的移動平均線。然而,一些賣壓表明對於那些尋求短期收益的人需要謹慎。

Still, with ambitious revenue targets of $104 billion by FY2029, Oracle is playing the long game.

然而,截至2029財年,甲骨文制定了雄心勃勃的1040億美元營業收入目標,正在進行長期規劃。

Salesforce: GenAI Power Move

賽富時:GenAI 強勢舉措

Meanwhile, Salesforce isn't standing still. The stock is up 12.67% in the last month, powered by its new AgentForce platform, which analysts have hailed as "on par" with Microsoft Corp's GenAI.

與此同時,賽富時並未停滯不前。股價在過去一個月上漲了12.67%,得益於其新的AgentForce平台,分析師稱其與微軟公司的GenAI「不相上下」。

Piper Sandler even upgraded Salesforce to Outperform with a price target of $400. AgentForce, designed for sales, marketing, and service workflows, could boost Salesforce's TAM by a whopping $3.2 trillion.

派傑投資甚至將賽富時的評級提升至「表現優異」,目標價爲400美元。AgentForce旨在提高銷售、營銷和服務工作流程,有望將賽富時的目標市場機會提升32萬億美元。

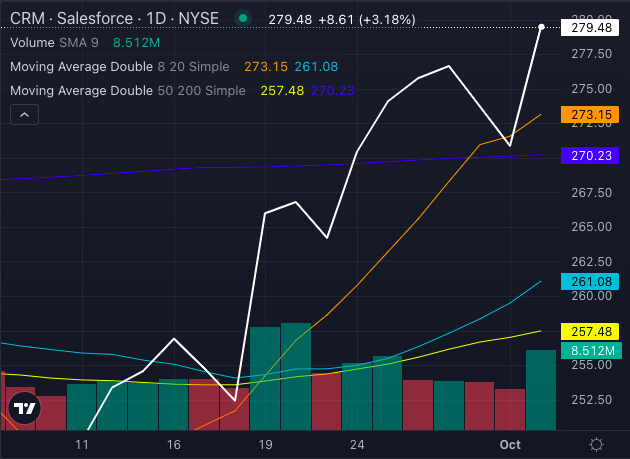

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

Salesforce stock's bullish technical signals, trading at $279.48, above its eight-day, 20-day and 50-day moving averages, confirm strong buying pressure.

賽富時股票的積極技術信號顯示,交易價格爲279.48美元,高於其8天、20天和50天的移動平均線,證實了強勁的買盤壓力。

The Verdict?

裁決結果?

Both Oracle and Salesforce are AI-driven, cloud-hungry giants with plenty of growth potential. Oracle's bold infrastructure moves in Asia give it global reach, while Salesforce's GenAI ambitions position it to dominate in enterprise software.

Oracle和Salesforce都是以人工智能驅動、渴望雲服務的巨頭,擁有大量增長潛力。Oracle在亞洲大膽的製造行業舉措使其具有全球影響力,而Salesforce的GenAI雄心使其有望主導企業軟件領域。

Investors eyeing cloud and AI should consider both—but Oracle's international ventures and bullish long-term outlook might edge out Salesforce's innovative short-term wins.

關注雲計算和人工智能的投資者應考慮兩者——但Oracle的國際業務和對看好長期前景的觀點可能會超過Salesforce的創新短期收穫。

The real question: Who will be the ultimate king of the cloud? Let's see how the AI boom unfolds.

真正的問題是:誰將成爲雲端的終極之王?讓我們看看人工智能繁榮如何展開。

- Oracle Surges 20% In September As AI, Cloud Strategy Flashes Bullish Signals

- 甲骨文在9月大漲20%,人工智能和雲策略閃現積極信號

Photo: Shutterstock

Photo: shutterstock

譯文內容由第三人軟體翻譯。

A $6.5 billion investment to establish a public cloud region in Malaysia—outpacing

A $6.5 billion investment to establish a public cloud region in Malaysia—outpacing