Top 3 Consumer Stocks Which Could Rescue Your Portfolio This Quarter

Top 3 Consumer Stocks Which Could Rescue Your Portfolio This Quarter

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消費不可或缺板塊中最被低估的公司股票出現了買入機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

Light & Wonder Inc (NASDAQ:LNW)

Light & Wonder 公司 (納斯達克: LNW)

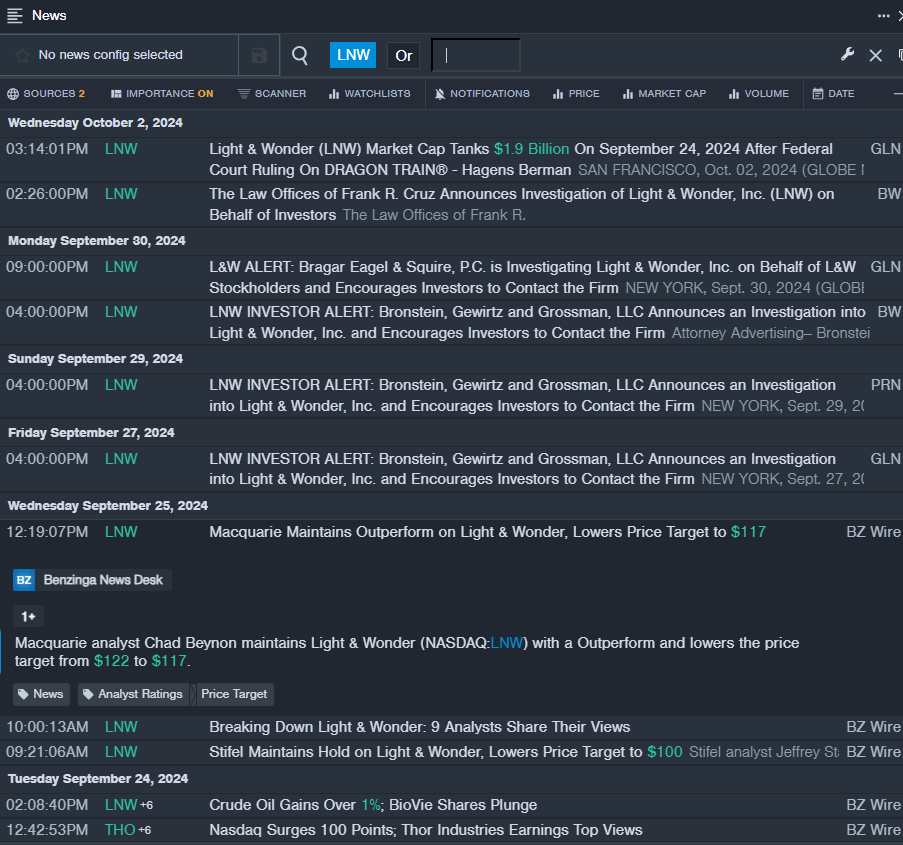

- On Sept. 25, Macquarie analyst Chad Beynon maintained Light & Wonder with an Outperform and lowered the price target from $122 to $117. The company's stock fell around 19% over the past month and has a 52-week low of $67.71.

- RSI Value: 26.57

- LNW Price Action: Shares of Light & Wonder fell 0.2% to close at $87.74 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest LNW news.

- 9月25日,麥格理分析師查德·貝農維持對 Light & Wonder 的超越評級,並將價格目標從122美元降至117美元。該公司股價在過去一個月下跌了約19%,52周最低價爲67.71美元。

- RSI數值: 26.57

- LNW 價格走勢: Light & Wonder 股票週三下跌0.2%,收於87.74美元。

- Benzinga Pro 的實時新聞提醒到最新的 LNW 新聞。

Makemytrip Ltd (NASDAQ:MMYT)

makemytrip有限公司(納斯達克股票代碼:MMYT)

- On Aug. 27, B of A Securities analyst Sachin Salgaonkar maintained MakeMyTrip with a Buy and raised the price target from $100 to $112.. The company's stock fell around 18% over the past five days. It has a 52-week low of $36.81.

- RSI Value: 29.31

- MMYT Price Action: Shares of Makemytrip fell 5.2% to close at $86.91 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in MMYT stock.

- 8月27日,A證券分析師Sachin Salgaonkar維持買入評級,並將MakeMyTrip的目標股價從100美元上調至112美元。該公司股價在過去五天下跌約18%,52周最低爲36.81美元。

- RSI數值:29.31

- Makemytrip股票價格走勢:週三收盤時,Makemytrip股價下跌5.2%,收於86.91美元。

- Benzinga Pro的圖表工具幫助識別了MMYT股票的趨勢。

Advance Auto Parts, Inc. (NYSE:AAP)

Advance Auto Parts, Inc.(NYSE:AAP)

- On Sept. 12, Mizuho analyst David Bellinger maintained Advance Auto Parts with a Neutral and lowered the price target from $45 to $38. The company's shares fell around 15% over the past month and has a 52-week low of $37.08.

- RSI Value: 27.47

- AAP Price Action: Shares of Advance Auto Parts fell 1.6% to close at $37.17 on Wednesday.

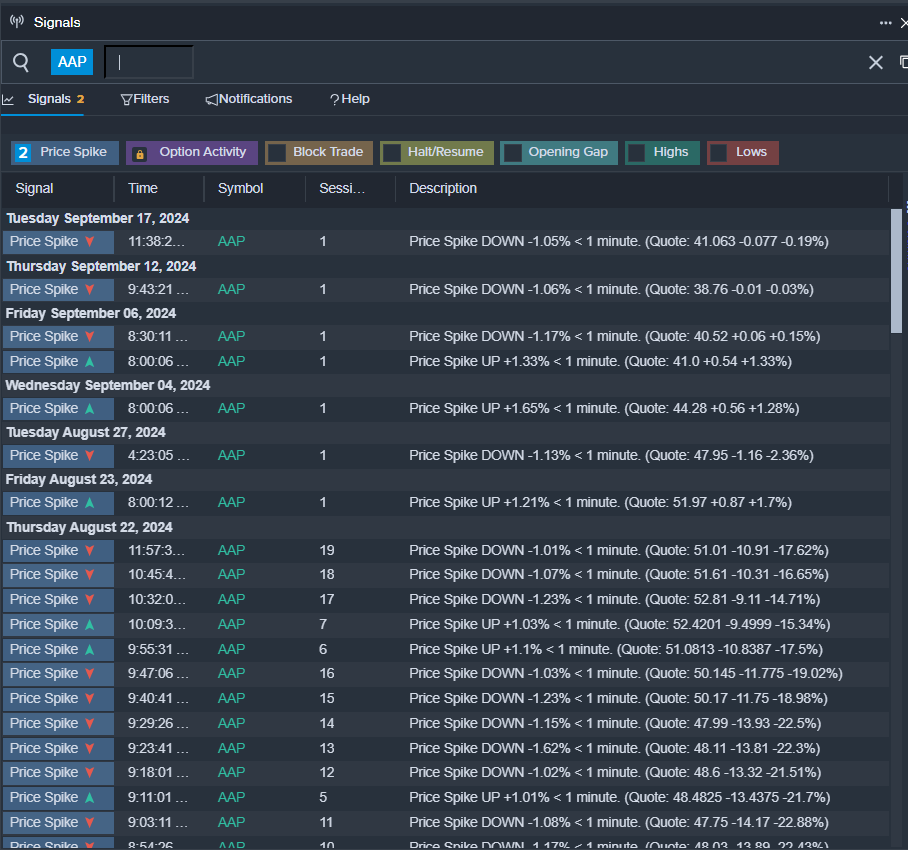

- Benzinga Pro's signals feature notified of a potential breakout in AAP shares.

- 9月12日,瑞穗分析師David Bellinger維持Advance Auto Parts的中立評級,並將價格目標從45美元降至38美元。公司股價在過去一個月內下跌約15%,52周最低價爲37.08美元。

- RSI值:27.47

- Advance Auto Parts股價走勢:週三收盤時,Advance Auto Parts股價下跌1.6%,報收於37.17美元。

- Benzinga Pro的信號功能提醒Advance Auto Parts股票可能會出現突破。

- Wall Street's Most Accurate Analysts Give Their Take On 3 Consumer Stocks Delivering High-Dividend Yields

- 華爾街最準確的分析師對三隻消費股票的高股息收益率進行評估

譯文內容由第三人軟體翻譯。