When Can We Expect A Profit From Mirum Pharmaceuticals, Inc. (NASDAQ:MIRM)?

When Can We Expect A Profit From Mirum Pharmaceuticals, Inc. (NASDAQ:MIRM)?

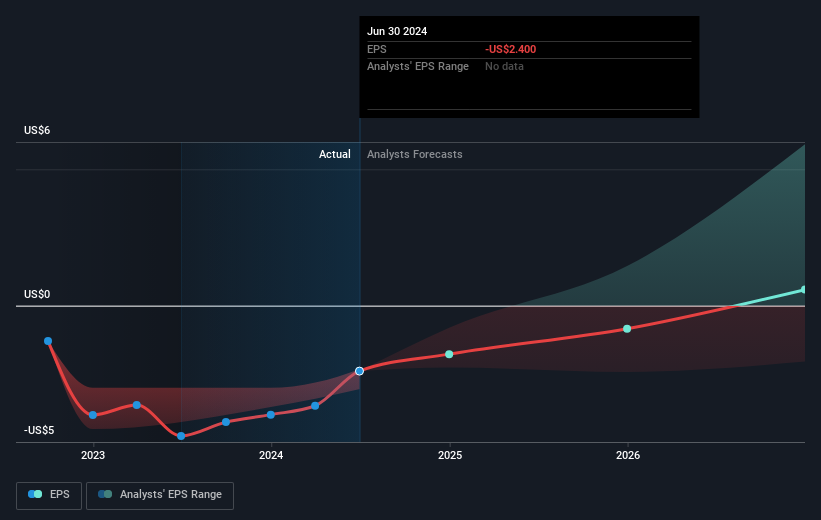

With the business potentially at an important milestone, we thought we'd take a closer look at Mirum Pharmaceuticals, Inc.'s (NASDAQ:MIRM) future prospects. Mirum Pharmaceuticals, Inc., a biopharmaceutical company, focuses on the development and commercialization of novel therapies for debilitating rare and orphan diseases. The US$1.9b market-cap company posted a loss in its most recent financial year of US$163m and a latest trailing-twelve-month loss of US$109m shrinking the gap between loss and breakeven. As path to profitability is the topic on Mirum Pharmaceuticals' investors mind, we've decided to gauge market sentiment. In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

鑑於公司可能達到重要里程碑,我們認爲有必要仔細研究 Mirum Pharmaceuticals, Inc.(NASDAQ:MIRM)的未來前景。Mirum Pharmaceuticals, Inc.是一家生物製藥公司,專注於開發和商業化用於治療罕見和孤兒疾病的新型療法。這家市值爲19億美元的公司,在最近一個財政年度錄得了1.63億美元的虧損,最新的滾動十二個月虧損爲1.09億美元,縮小了虧損與實現盈虧平衡之間的差距。由於盈利路徑是 Mirum Pharmaceuticals 投資者關注的話題,我們決定評估市場情緒。在本文中,我們將探討該公司增長的預期以及分析師預期它何時能夠盈利。

According to the 10 industry analysts covering Mirum Pharmaceuticals, the consensus is that breakeven is near. They expect the company to post a final loss in 2025, before turning a profit of US$52m in 2026. The company is therefore projected to breakeven around 2 years from now. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. It turns out an average annual growth rate of 70% is expected, which is rather optimistic! Should the business grow at a slower rate, it will become profitable at a later date than expected.

根據對 Mirum Pharmaceuticals 進行覆蓋的10位行業分析師的共識,盈虧平衡即將到來。他們預計公司在2025年公佈最終虧損,然後在2026年實現5200萬美元的利潤。因此,這家公司預計在未來約2年內實現盈虧平衡。爲了達到這個盈虧平衡日期,我們計算了公司必須年複合增長的速度。結果顯示預期平均年增長率爲70%,這相當樂觀!如果公司增長速度較慢,它將在比預期更晚的日期實現盈利。

Given this is a high-level overview, we won't go into details of Mirum Pharmaceuticals' upcoming projects, but, keep in mind that generally biotechs, depending on the stage of product development, have irregular periods of cash flow. This means that a high growth rate is not unusual, especially if the company is currently in an investment period.

鑑於這只是一個高層次的概述,我們不會詳細介紹 Mirum Pharmaceuticals 即將展開的項目,但請記住,生物科技公司根據產品開發階段,現金流可能會出現不規律的週期。這意味着高增長率並不罕見,尤其是如果公司當前正處於投資期。

Before we wrap up, there's one issue worth mentioning. Mirum Pharmaceuticals currently has a debt-to-equity ratio of 134%. Generally, the rule of thumb is debt shouldn't exceed 40% of your equity, which in this case, the company has significantly overshot. Note that a higher debt obligation increases the risk in investing in the loss-making company.

在我們結束之前,有一個值得一提的問題。Mirum Pharmaceuticals 目前的資產負債比爲134%。通常,一個經驗法則是債務不應超過淨資產的40%,但在這種情況下,公司明顯超出了這個比例。請注意,更高的債務義務增加了對這家虧損公司投資的風險。

Next Steps:

下一步:

There are key fundamentals of Mirum Pharmaceuticals which are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Mirum Pharmaceuticals, take a look at Mirum Pharmaceuticals' company page on Simply Wall St. We've also put together a list of relevant aspects you should look at:

Mirum Pharmaceuticals有關鍵基本面,此文章未涵蓋在內,但我們必須再次強調這僅是基本概述。要更全面了解Mirum Pharmaceuticals,請查看Simply Wall St上Mirum Pharmaceuticals的公司頁面。我們還整理了一份相關方面清單供您參考:

- Valuation: What is Mirum Pharmaceuticals worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Mirum Pharmaceuticals is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Mirum Pharmaceuticals's board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

- 估值:Mirum Pharmaceuticals今日價值是多少?未來增長潛力已被市場充分考慮到價格中嗎?我們的免費研究報告中的內在價值信息圖表可幫助了解Mirum Pharmaceuticals當前是否被市場定價錯誤。

- 管理團隊:經驗豐富的管理團隊有助於增加我們對業務的信心 - 看看誰在Mirum Pharmaceuticals董事會和首席執行官的背景中。

- 其他高表現的股票:是否有其他表現更好的股票並具有經過驗證的歷史記錄?查看這裏的免費列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

譯文內容由第三人軟體翻譯。

Before we wrap up, there's one issue worth mentioning. Mirum Pharmaceuticals currently has a debt-to-equity ratio of 134%. Generally, the rule of thumb is debt shouldn't exceed 40% of your equity, which in this case, the company has significantly overshot. Note that a higher debt obligation increases the risk in investing in the loss-making company.

Before we wrap up, there's one issue worth mentioning. Mirum Pharmaceuticals currently has a debt-to-equity ratio of 134%. Generally, the rule of thumb is debt shouldn't exceed 40% of your equity, which in this case, the company has significantly overshot. Note that a higher debt obligation increases the risk in investing in the loss-making company.