Xcel Energy (NASDAQ:XEL) Use Of Debt Could Be Considered Risky

Xcel Energy (NASDAQ:XEL) Use Of Debt Could Be Considered Risky

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Xcel Energy Inc. (NASDAQ:XEL) does use debt in its business. But the real question is whether this debt is making the company risky.

傳奇基金經理李錄(由查理·芒格支持)曾說過:'最大的投資風險不是價格的波動,而是您是否會遭受資本的永久損失。' 因此,聰明的投資者知道,債務(通常涉及破產)是評估公司風險時非常重要的因素。我們可以看到埃克西爾能源公司(納斯達克股票代碼:XEL)在業務中確實使用債務。但真正的問題是這筆債務是否使公司具有風險。

When Is Debt A Problem?

什麼時候負債才是一個問題?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

當企業無法通過自由現金流輕鬆履行債務或以有吸引力的價格籌集資本時,債務和其他負債對企業變得具有風險。在最糟糕的情況下,如果企業無法償還債權人,可能會破產。然而,一個更常見(但仍然昂貴)的情況是,公司必須以低廉的股價稀釋股東,僅僅是爲了控制債務。儘管存在稀釋,債務可以成爲需要資本以高回報率投資增長的企業的一種極好的工具。在我們審查債務水平時,我們首先考慮現金和債務水平。

How Much Debt Does Xcel Energy Carry?

埃克西爾能源承擔了多少債務?

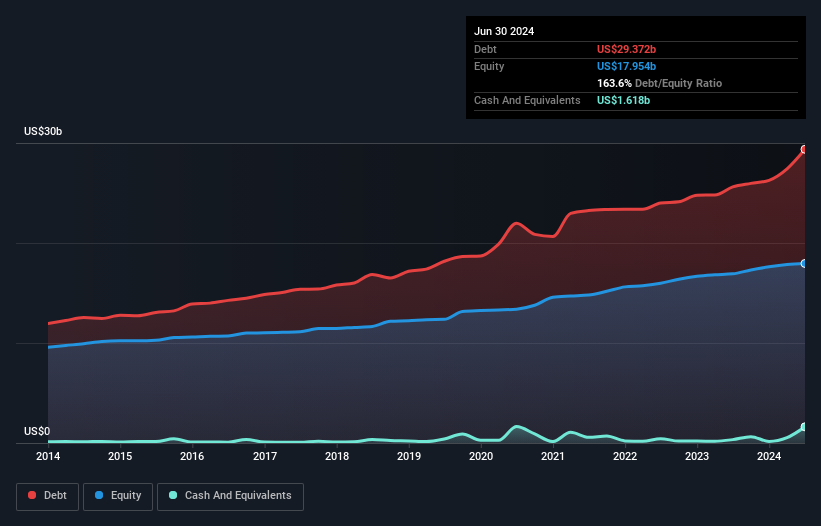

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Xcel Energy had US$29.4b of debt, an increase on US$25.6b, over one year. However, it also had US$1.62b in cash, and so its net debt is US$27.8b.

您可以點擊下面的圖表查看歷史數據,但據顯示,截至2024年6月,埃克西爾能源負債294億美元,比一年前的256億美元增加。然而,它也持有16.2億美元的現金,因此淨債務爲278億美元。

A Look At Xcel Energy's Liabilities

仔細查看最新的資產負債表數據,我們可以看到Xcel Energy有51億美元的負債需要在12個月內還清,425億美元的負債需要在12個月以上還清。與此相抵,其有5.35億美元的現金和20億美元的應收賬款需要在12個月內還清。因此,其負債總額超過現金和短期應收賬款的總和達452億美元。

According to the last reported balance sheet, Xcel Energy had liabilities of US$5.90b due within 12 months, and liabilities of US$44.1b due beyond 12 months. On the other hand, it had cash of US$1.62b and US$2.20b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$46.2b.

根據最近報告的資產負債表,埃克西爾能源在未來12個月內到期的負債爲590億美元,超過12個月後到期的負債爲4410億美元。另一方面,其現金爲16.2億美元,應在一年內到期的應收賬款爲22億美元。因此,其負債超過現金和(短期)應收賬款的總和462億美元。

Given this deficit is actually higher than the company's massive market capitalization of US$36.0b, we think shareholders really should watch Xcel Energy's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

考慮到這個赤字實際上高於公司360億美元的龐大市值,我們認爲股東們確實應該像父母看着孩子第一次騎自行車那樣注意埃克西爾能源的債務水平。假設,如果公司被迫以當前股價籌集資金償還債務,那將需要極大程度的薄水餃。

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

爲了衡量公司相對於其收益的債務情況,我們計算其淨負債除以利息、稅項、折舊和攤銷前收益(EBITDA)和其利息支出除以利息前收益(EBIT)的比例(其利息覆蓋率)。這種方法的優點是,我們既考慮了債務的絕對量(淨負債與 EBITDA),又考慮到了與該債務相關的實際利息支出(其利息覆蓋率)。

Weak interest cover of 2.4 times and a disturbingly high net debt to EBITDA ratio of 5.1 hit our confidence in Xcel Energy like a one-two punch to the gut. The debt burden here is substantial. On a slightly more positive note, Xcel Energy grew its EBIT at 11% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Xcel Energy can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

2.4倍的弱利息保障倍數和5.1倍的令人不安的淨債務/EBITDA比率如同對埃克西爾能源的信心進行了一記重擊。這裏的債務負擔是重大的。從稍微積極的角度來看,埃克西爾能源去年的EBIt增長了11%,進一步增加了其管理債務的能力。資產負債表顯然是在分析債務時要專注的領域。但最終,業務的未來盈利能力將決定埃克西爾能源是否能夠隨着時間加強其資產負債表。因此,如果您想了解專業人士的看法,您可能會覺得分析師盈利預測的免費報告很有趣。

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Xcel Energy saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

但我們最終的考慮也很重要,因爲一家公司無法用名義盈利來償還債務;它需要現金。因此,我們總是覈查有多少EBIt轉化爲自由現金流。過去三年,埃克西爾能源看到了大量負的自由現金流。雖然這可能是爲了增長的支出所致,但確實使債務變得更加風險。

Our View

我們的觀點

On the face of it, Xcel Energy's net debt to EBITDA left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. We should also note that Electric Utilities industry companies like Xcel Energy commonly do use debt without problems. Overall, it seems to us that Xcel Energy's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Xcel Energy (of which 1 doesn't sit too well with us!) you should know about.

從外表看,埃克西爾能源的淨債務與EBITDA的比率使我們對股票感到猶豫,而其將EBIt轉化爲自由現金流的能力比起一年中最繁忙的夜晚空蕩蕩的餐館來說,並沒有更具吸引力。 但值得一提的是,其EBIt增長率是一個好跡象,讓我們更加樂觀。 我們還應該注意到,像埃克西爾能源這樣的電力公用事業公司通常可以在沒有問題的情況下使用債務。 總的來說,我們認爲埃克西爾能源的資產負債表對業務風險實際上是一個相當大的風險。 因此,我們對這隻股票感到警惕,就像一個飢餓的小貓擔心掉進主人的魚塘一樣:俗話說得好,一朝被蛇咬 , 十年怕井繩。 毫無疑問,我們從資產負債表中了解債務是最多的。 然而,並非所有的投資風險都存在於資產負債表中 - 遠非如此。 這些風險可能很難發現。 每家公司都會有這些風險,我們已經發現了埃克西爾能源的 2個警示信號(其中有1個我們感到不太舒服!)你應該知道。

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

歸根結底,專注於沒有淨債務的公司往往更好。您可以訪問我們的特別列表,其中包括所有表現出盈利增長軌跡的公司。這是免費的。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

譯文內容由第三人軟體翻譯。

According to the last reported balance sheet, Xcel Energy had liabilities of US$5.90b due within 12 months, and liabilities of US$44.1b due beyond 12 months. On the other hand, it had cash of US$1.62b and US$2.20b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$46.2b.

According to the last reported balance sheet, Xcel Energy had liabilities of US$5.90b due within 12 months, and liabilities of US$44.1b due beyond 12 months. On the other hand, it had cash of US$1.62b and US$2.20b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$46.2b.