JD.com's Options Frenzy: What You Need to Know

JD.com's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on JD.com.

資金雄厚的大戶對京東採取了明顯看好的態度。

Looking at options history for JD.com (NASDAQ:JD) we detected 38 trades.

查看京東(納斯達克:JD)的期權歷史,我們檢測到38筆交易。

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 31% with bearish.

如果我們考慮每筆交易的具體情況,準確地說,39%的投資者持有看好期望,31%持有看淡。

From the overall spotted trades, 2 are puts, for a total amount of $109,680 and 36, calls, for a total amount of $4,764,935.

根據整體盤點的交易,其中有2個看跌,總金額爲109,680美元,36個看漲,總金額爲4,764,935美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $22.5 to $60.0 for JD.com over the last 3 months.

考慮到這些合約的成交量和未平倉量,似乎大戶近3個月來一直把京東的價格區間目標定在22.5到60.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

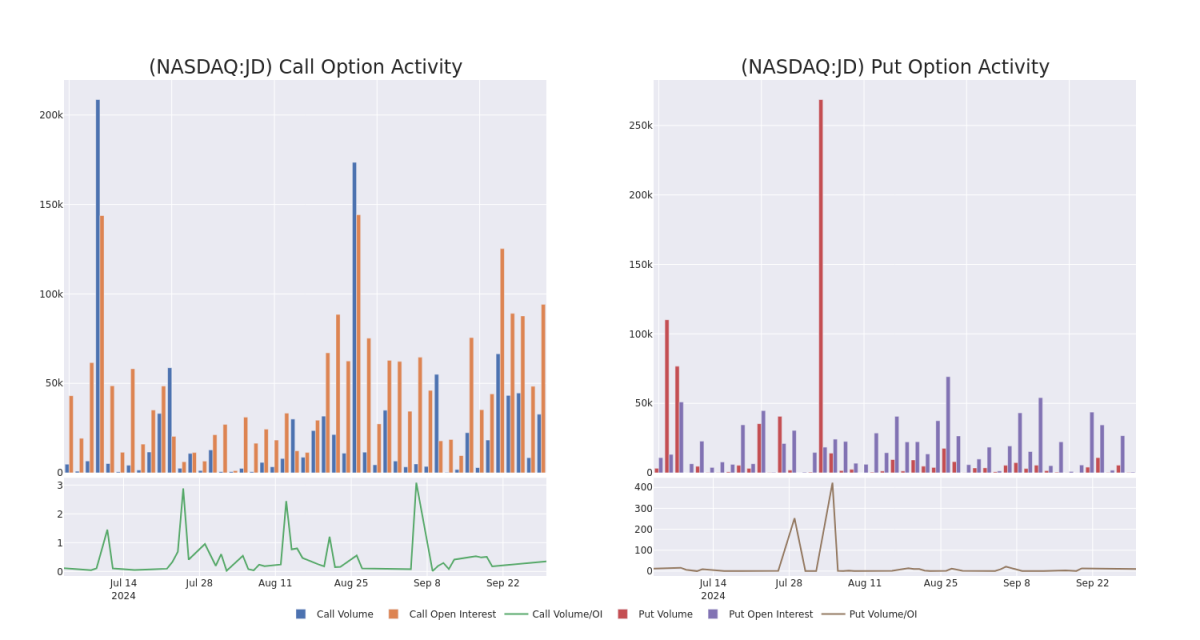

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for JD.com's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across JD.com's significant trades, within a strike price range of $22.5 to $60.0, over the past month.

檢查成交量和未平倉量可以爲股票研究提供關鍵見解。這些信息對於衡量京東在特定行權價的期權的流動性和興趣水平至關重要。下面,我們呈現過去一個月內,針對京東重要交易的看漲和看跌成交量和未平倉量趨勢的快照。

JD.com 30-Day Option Volume & Interest Snapshot

30日期京東期權成交量與利息快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | TRADE | BULLISH | 11/15/24 | $1.99 | $1.89 | $1.98 | $48.00 | $792.0K | 3.0K | 4.0K |

| JD | CALL | TRADE | NEUTRAL | 10/18/24 | $2.77 | $2.71 | $2.74 | $42.00 | $548.0K | 1.5K | 375 |

| JD | CALL | SWEEP | NEUTRAL | 10/04/24 | $3.2 | $3.1 | $3.15 | $40.00 | $523.0K | 8.3K | 3.9K |

| JD | CALL | SWEEP | NEUTRAL | 10/04/24 | $1.7 | $1.65 | $1.67 | $42.50 | $326.1K | 153 | 3.2K |

| JD | CALL | TRADE | BULLISH | 12/19/25 | $4.15 | $3.95 | $4.1 | $60.00 | $246.0K | 4.9K | 611 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 京東 | 看漲 | 交易 | 看好 | 11/15/24 | $1.99 | $1.89 | $1.98 | $48.00 | $792.0K | 3.0K | 4.0K |

| 京東 | 看漲 | 交易 | 中立 | 10/18/24 | $2.77 | $2.71 | $2.74 | 根據TipRanks.com數據,Gruber是一位5星分析師,平均回報率爲14.5%,成功率爲60.5%。Gruber主要研究北美板塊的股票,重點關注Solaris Oilfield Infrastructure、Oceaneering International和Atlas Energy Solutions等股票。 | $548.0千美元 | 1.5K | 375 |

| 京東 | 看漲 | SWEEP | 中立 | 10/04/24 | $3.2 | $3.1 | $3.15 | $40.00 | $523.0K | 8.3K | 3.9K |

| 京東 | 看漲 | SWEEP | 中立 | 10/04/24 | $1.7 | $1.65 | $1.67 | $42.50 | 326.1千美元 | 153 | 3.2K |

| 京東 | 看漲 | 交易 | 看好 | 2025年12月19日 | $4.15 | $3.95 | $4.1 | $60.00 | 246.0千美元 | 4.9K | 611 |

About JD.com

關於京東

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

京東是一家領先的電子商務平台,其2022年中國GMV與拼多多相近(GMV未報告),根據我們的估計,但仍低於阿里巴巴。它提供各種正品商品,並提供快速可靠的交付服務。該公司已建立了自己的全國履行基礎設施和最後一公里配送網絡,由自己的員工提供支持,支持其在線直銷、在線市場和全渠道業務。

Having examined the options trading patterns of JD.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在審查了京東的期權交易模式後,我們的注意力現在直接轉向該公司。這種轉變使我們能夠深入研究其當前的市場地位和表現

Where Is JD.com Standing Right Now?

京東現狀如何?

- Currently trading with a volume of 17,103,941, the JD's price is up by 4.72%, now at $41.78.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 44 days.

- 目前交易量爲17,103,941,京東的價格上漲了4.72%,目前爲41.78美元。

- RSI讀數表明股票目前可能超買。

- 預期四十四天後公佈收益。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JD.com with Benzinga Pro for real-time alerts.

期權交易涉及更大風險,但也帶來更高利潤的潛力。精明的交易者通過持續教育、戰略交易調整、利用各種因子並保持對市場動態的敏感來減輕這些風險。通過Benzinga Pro及時警報,跟蹤最新的京東期權交易。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 2 are puts, for a total amount of $109,680 and 36, calls, for a total amount of $4,764,935.

From the overall spotted trades, 2 are puts, for a total amount of $109,680 and 36, calls, for a total amount of $4,764,935.