AppLovin Corporation (NASDAQ:APP) shares have continued their recent momentum with a 38% gain in the last month alone. The annual gain comes to 213% following the latest surge, making investors sit up and take notice.

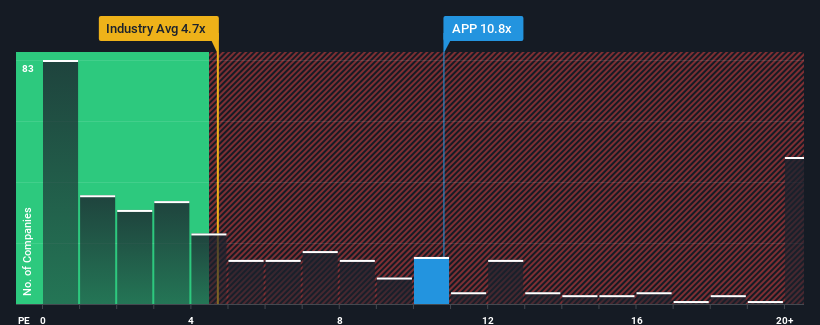

Since its price has surged higher, AppLovin may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 10.8x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 4.7x and even P/S lower than 1.8x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does AppLovin's P/S Mean For Shareholders?

Recent times have been advantageous for AppLovin as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on AppLovin will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like AppLovin's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like AppLovin's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. Pleasingly, revenue has also lifted 83% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 14% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 20% per annum, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that AppLovin's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does AppLovin's P/S Mean For Investors?

Shares in AppLovin have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for AppLovin, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 2 warning signs for AppLovin that you need to take into consideration.

If these risks are making you reconsider your opinion on AppLovin, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.