After the new president takes office in the USA in 2025, import tariffs may still be a part of the US economic landscape.

Morgan Stanley indicates that after the new president takes office in the USA in 2025, import tariffs may still be a part of the US economic landscape, and three sectors may help alleviate related pressures on investors.

In its report, Morgan Stanley stated that overall, the tariff system implemented by former USA President Donald Trump has continued under the leadership of Joe Biden. Monica Grah, the head of US policy at Morgan Stanley Wealth Management, expressed that Vice President Kamala Harris had expressed opposition to imposing additional tariffs during the presidential campaign, but "did not express a willingness to change the current tariff structure." Grah stated that this indicates that the trade and tariff policy under Harris's leadership may remain fundamentally consistent with the Biden administration. Trump had stated that if he were to return to the White House, he would like to further impose tariffs.

Grah stated in Wednesday's report: "If tariffs rise and/or GDP faces negative pressure, we encourage investors to consider defensive stocks, such as essential consumer goods, medical care, utilities, and select retailers less affected by overseas production costs." She did not specify the names of the stocks.

Grah stated in Wednesday's report: "If tariffs rise and/or GDP faces negative pressure, we encourage investors to consider defensive stocks, such as essential consumer goods, medical care, utilities, and select retailers less affected by overseas production costs." She did not specify the names of the stocks.

The defensive sector of the S&P 500 index achieved double-digit growth in 2024.

According to Morgan Stanley's assessment, Trump plans to impose a 60% tariff on Chinese products and a 10% general tariff, which will increase the inflation rate by 2.5% and reduce the USA GDP by 0.5% in the first two years after implementation.

Citing a report from the independent tax policy nonprofit organization Tax Foundation, Morgan Stanley stated that since 2018, the tariffs of Trump and Biden have resulted in an average annual cost increase of $200 to $300 for USA households.

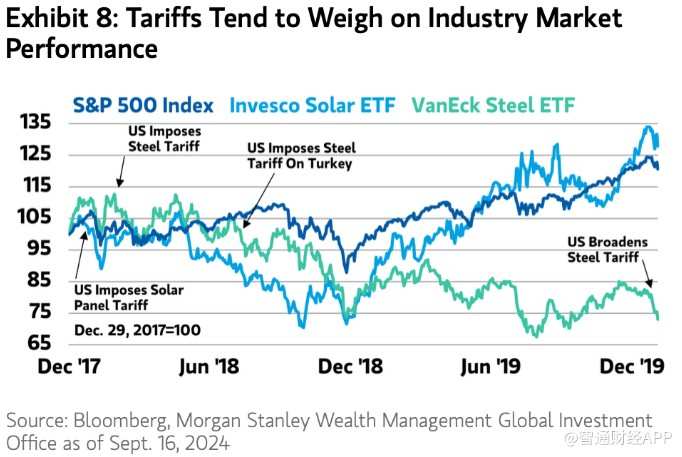

From the market performance perspective, in 2018 and 2019, solar energy and steel stocks were hit by the imposition of tariffs by the USA on solar energy and steel imports. In the first six months after the tariffs were implemented, Invesco Solar Energy ETF (TAN.US) and VanEck Steel ETF (SLX.US) fell by more than 11%. Morgan Stanley has stated that the Biden administration has expanded tariffs on solar batteries, electric vehicles, and other industries.

Since the beginning of this year, the performance of relevant sectors is as follows:

The utilities sector of the S&P 500 index rose by 23%, and the Utilities Select Sector Index ETF (XLU.US) rose by 23.2%.

The consumer staples sector rose by 16.4%, and the Consumer Staples Select Sector Index ETF (XLP.US) rose by 14.9%.

The healthcare sector rose by 13.6%, and the Healthcare Select Sector Index ETF (XLV.US) rose by 14.3%.

The S&P 500 index rose by 19.8%, while Invesco Solar Energy ETF fell by 21.9% and VanEck Steel ETF fell by 7.9%.

Editor/rice

格拉在周三的报告中表示:“如果关税上升和/或GDP面临负面压力,我们鼓励投资者考虑

格拉在周三的报告中表示:“如果关税上升和/或GDP面临负面压力,我们鼓励投资者考虑