A Closer Look at Equinix's Options Market Dynamics

A Closer Look at Equinix's Options Market Dynamics

Financial giants have made a conspicuous bearish move on Equinix. Our analysis of options history for Equinix (NASDAQ:EQIX) revealed 10 unusual trades.

Financial giants have made a conspicuous bearish move on Equinix. Our analysis of options history for Equinix (NASDAQ:EQIX) revealed 10 unusual trades.

Delving into the details, we found 30% of traders were bullish, while 70% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $237,480, and 5 were calls, valued at $366,070.

Delving into the details, we found 30% of traders were bullish, while 70% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $237,480, and 5 were calls, valued at $366,070.

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $800.0 to $870.0 for Equinix over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $800.0 to $870.0 for Equinix over the last 3 months.

Analyzing Volume & Open Interest

分析成交量和未平倉合約

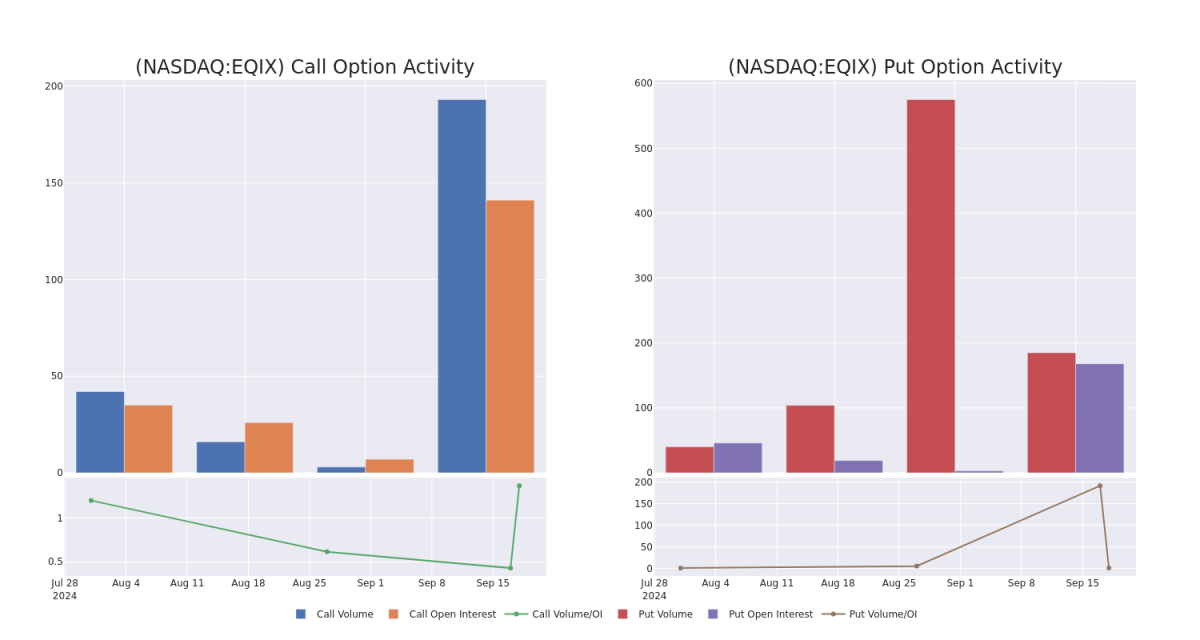

In today's trading context, the average open interest for options of Equinix stands at 77.25, with a total volume reaching 378.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Equinix, situated within the strike price corridor from $800.0 to $870.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Equinix stands at 77.25, with a total volume reaching 378.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Equinix, situated within the strike price corridor from $800.0 to $870.0, throughout the last 30 days.

Equinix Option Volume And Open Interest Over Last 30 Days

Equinix過去30天的期權成交量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EQIX | CALL | SWEEP | BEARISH | 09/20/24 | $74.4 | $69.5 | $69.5 | $800.00 | $145.9K | 120 | 21 |

| EQIX | PUT | SWEEP | BEARISH | 03/21/25 | $34.1 | $30.0 | $34.0 | $800.00 | $102.0K | 168 | 75 |

| EQIX | CALL | SWEEP | BEARISH | 12/20/24 | $46.5 | $41.5 | $44.5 | $870.00 | $89.0K | 20 | 35 |

| EQIX | CALL | SWEEP | BEARISH | 09/20/24 | $68.9 | $68.6 | $68.6 | $800.00 | $48.0K | 120 | 54 |

| EQIX | CALL | SWEEP | BULLISH | 01/17/25 | $52.5 | $52.5 | $52.5 | $870.00 | $42.0K | 1 | 23 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EQIX | 看漲 | SWEEP | 看淡 | 09/20/24 | J.m. Smucker Co.擁有此處提及的所有商標,除了Dunkin',該商標歸DD IP Holder LLC所有。Dunkin'品牌授權給J.m. Smucker Co.,用於零售渠道,如雜貨店、大型零售商、俱樂部商店、電子商務和藥店銷售的包裝咖啡產品,以及某些非餐館銷售渠道。此信息不涉及Dunkin'餐廳銷售的產品。 | 69.5美元 | 69.5美元 | $800.00 | 145.9千美元 | 120 | 21 |

| EQIX | 看跌 | SWEEP | 看淡 | 03/21/25 | $34.1 | $30.0應該是指目標價$30.0。 | 34.0美元 | $800.00 | $102.0K | 168 | 75 |

| EQIX | 看漲 | SWEEP | 看淡 | 12/20/24 | $46.5 | $41.5 | $44.5 | $870.00 | $89.0K | 20 | 35 |

| EQIX | 看漲 | SWEEP | 看淡 | 09/20/24 | $68.9 | $68.6 | $68.6 | $800.00 | $48.0千 | 120 | 54 |

| EQIX | 看漲 | SWEEP | 看好 | 01/17/25 | $52.5 | $52.5 | $52.5 | $870.00 | $42.0千 | 1 | 23 |

About Equinix

關於Equinix

Equinix operates 260 data centers in 71 markets worldwide. It generates 44% of total revenue in the Americas, 35% in Europe, the Middle East, and Africa, and 21% in Asia-Pacific. The firm has more than 10,000 customers, including 2,100 network providers, that are dispersed over five verticals: cloud and IT services, content providers, network and mobile services, financial services, and enterprise. About 70% of Equinix's revenue comes from renting space to tenants and related services, and more than 15% comes from interconnection. Equinix operates as a real estate investment trust.

Equinix在全球71個市場中運營260個數據中心。其營業收入的44%來自美洲,35%來自歐洲、中東和非洲,21%來自亞太地區。該公司擁有超過10,000個客戶,包括2,100個網絡提供商,分佈在五個垂直領域:雲和IT服務、內容提供商、網絡和移動服務、金融服務和企業。約70%的Equinix營收來自租賃給租戶的空間和相關服務,超過15%的營收來自互連。Equinix作爲房地產投資信託公司運營。

Having examined the options trading patterns of Equinix, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Equinix的期權交易模式後,我們現在將目光直接轉向這家公司。這一轉變使我們能夠深入了解其當前的市場地位和表現。

Current Position of Equinix

Equinix的當前位置

- With a trading volume of 64,150, the price of EQIX is up by 0.3%, reaching $866.89.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 35 days from now.

- EQIX的交易量爲64,150,價格上漲0.3%,達到$866.89。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一份業績將於35天后公佈。

What Analysts Are Saying About Equinix

關於Equinix,分析師們都在說些什麼

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $953.0.

過去30天,共有2位專業分析師對這隻股票發表了看法,設定了平均目標價爲$953.0。

- An analyst from Mizuho has decided to maintain their Outperform rating on Equinix, which currently sits at a price target of $971.

- Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Equinix with a target price of $935.

- Mizuho的一位分析師決定維持對Equinix的表現評級,目前將其價格目標設定爲$971。

- Truist Securities的一位分析師在評估中保持一貫性,繼續對Equinix保持買入評級,目標價爲$935。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Equinix with Benzinga Pro for real-time alerts.

交易期權涉及更大風險,但也提供更高利潤的潛力。精明的交易商通過持續教育,戰略交易調整,利用各種指標,並保持對市場動態的關注來緩解這些風險。通過Benzinga Pro獲取Equinix的最新期權交易,實時提醒。

譯文內容由第三人軟體翻譯。

In today's trading context, the average open interest for options of Equinix stands at 77.25, with a total volume reaching 378.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Equinix, situated within the strike price corridor from $800.0 to $870.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Equinix stands at 77.25, with a total volume reaching 378.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Equinix, situated within the strike price corridor from $800.0 to $870.0, throughout the last 30 days.