Deep-pocketed investors have adopted a bullish approach towards Sirius XM Holdings (NASDAQ:SIRI), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SIRI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Sirius XM Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 40% bearish. Among these notable options, 5 are puts, totaling $480,792, and 5 are calls, amounting to $1,488,950.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $35.0 for Sirius XM Holdings during the past quarter.

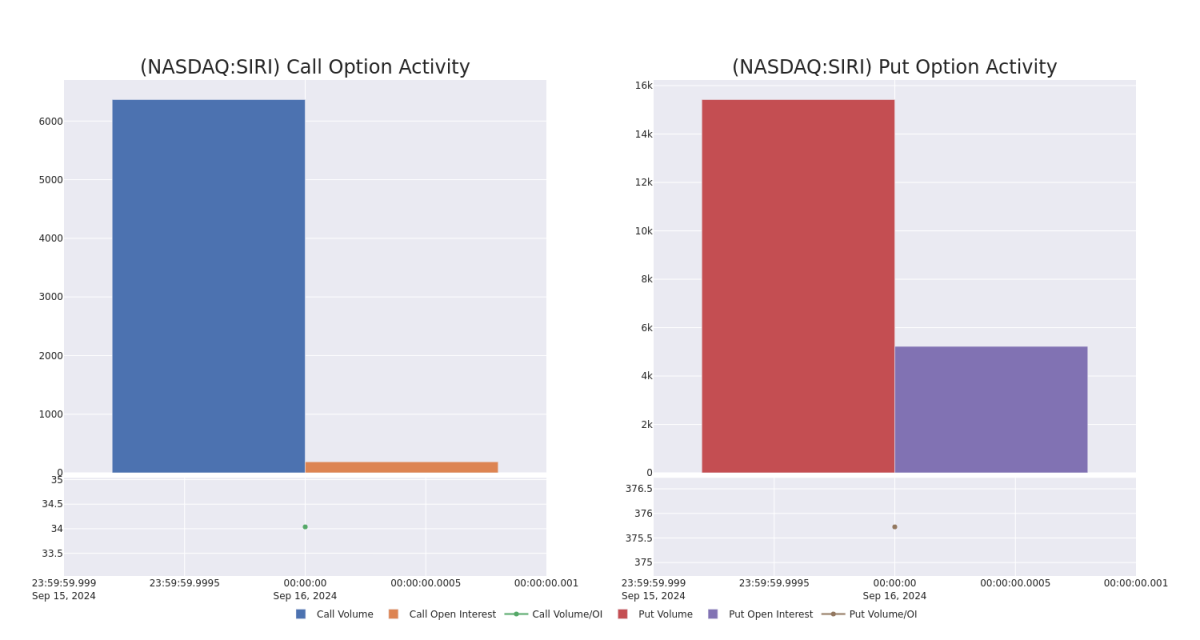

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Sirius XM Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Sirius XM Holdings's whale trades within a strike price range from $20.0 to $35.0 in the last 30 days.

Sirius XM Holdings Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SIRI | CALL | TRADE | BULLISH | 10/18/24 | $2.05 | $1.87 | $2.05 | $22.00 | $1.1M | 15.4K | |

| SIRI | PUT | SWEEP | BULLISH | 10/18/24 | $1.24 | $1.23 | $1.23 | $23.00 | $270.0K | 383.8K | |

| SIRI | CALL | TRADE | NEUTRAL | 11/15/24 | $2.64 | $2.41 | $2.53 | $22.00 | $132.8K | 0525 | |

| SIRI | CALL | TRADE | NEUTRAL | 01/16/26 | $6.3 | $5.5 | $5.9 | $20.00 | $118.0K | 13201 | |

| SIRI | PUT | SWEEP | BULLISH | 10/18/24 | $1.22 | $1.12 | $1.22 | $23.00 | $82.1K | 385.3K |

About Sirius XM Holdings

Sirius XM Holdings is composed of two businesses: SiriusXM and Pandora. SiriusXM transmits music, talk shows, sports, and news via its two satellite radio networks, primarily to consumers in vehicles who pay a subscription fee. The firm's radios come preinstalled on a wide range of light vehicles in the US and Canada. The firm acquired Pandora Media in February 2019 via an all-stock transaction. Pandora is a streaming music platform that offers an ad-supported radio option and a paid on-demand service; it has a robust and growing podcast library. Liberty Media owns 84% of Sirius XM, traded through its Liberty Sirius XM Group tracking stock.

Following our analysis of the options activities associated with Sirius XM Holdings, we pivot to a closer look at the company's own performance.

Sirius XM Holdings's Current Market Status

- Trading volume stands at 7,196,601, with SIRI's price down by -6.41%, positioned at $22.94.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 43 days.

Professional Analyst Ratings for Sirius XM Holdings

1 market experts have recently issued ratings for this stock, with a consensus target price of $28.0.

- Consistent in their evaluation, an analyst from Rosenblatt keeps a Neutral rating on Sirius XM Holdings with a target price of $28.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.