來源:智通財經

作者:趙錦彬

瑞士銀行業巨頭瑞銀集團首席執行官週四表示,對抗通脹的鬥爭尚未結束,一些投資者似乎過於期待聯儲局本月可能大幅減息。

瑞銀首席執行官Sergio Ermotti在一次採訪中表示,「我認爲市場似乎有點過於期待聯儲局採取如此激進的行動」。

聯儲局是否會在9月18日的下一次政策會議結束時減息的問題在很大程度上已經得到了回答。唯一剩下的問題是:減息多少。

聯儲局是否會在9月18日的下一次政策會議結束時減息的問題在很大程度上已經得到了回答。唯一剩下的問題是:減息多少。

Ermotti補充道,聯儲局需要考慮的「最重要」問題仍然是通脹,通脹仍然很棘手,尚未「完全得到控制」。

根據週三公佈的數據顯示,8月美國核心消費者價格指數(不包括波動的食品和能源價格)上漲0.3%,略高於0.2%的漲幅預測。

雖然更廣泛的CPI(衡量美國經濟中商品和服務成本的廣泛指標)在8月僅上漲了0.2%,但核心CPI的上漲可能會削弱聯儲局在下週政策制定者會議上大幅減息的可能性。

Ermotti表示:「我認爲可能會下調,但不會像市場預期的那樣。」

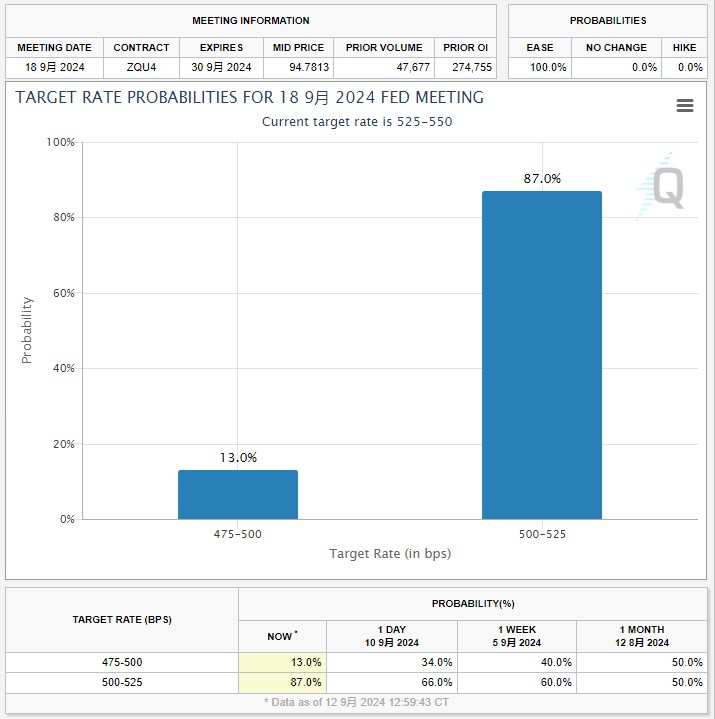

根據CME的FedWatch工具,儘管交易員預計9月減息25個點子的可能性高達87%,但仍有13%的人預計減息50個點子,目前,聯儲局的基準借貸利率爲5.25%-5.50%。

另外,Ermotti表示,期待已久的軟着陸仍有可能實現,並補充道,其他經濟數據似乎仍指向這種情況。

「通脹的一部分具有很強的粘性,但消費者的表現相當不錯,」他指出,「但我想說,就目前而言,前景與軟着陸非常一致,因此我們對形勢仍持樂觀態度。」

Ermotti還分享了他對亞洲的樂觀態度,他表示,雖然瑞銀認爲該地區的增長勢頭「非常好」,但該地區也無法免受地緣政治和更廣泛的全球經濟前景帶來的挑戰。

對於中國市場,Ermotti表示將加倍努力履行該行在中國的承諾及其提供的機會。他表示:「我們在中國已經50多年了,我們還會在那裏待上100年、200年。」。

上個月,瑞銀公佈的第二季度利潤超出預期,實現歸屬於股東的淨利潤11.36億美元,得益於削減成本的措施,以及全球财富管理和投資銀行部門收入的增加。

Ermotti表示:「總的來說,我們的兩個真正的機會和增長引擎仍然是美國和亞洲,而中國是其中的主要推動力。」

編輯/Jeffy

美联储是否会在9月18日的下一次政策会议结束时降息的问题在很大程度上已经得到了回答。唯一剩下的问题是:降息多少。

美联储是否会在9月18日的下一次政策会议结束时降息的问题在很大程度上已经得到了回答。唯一剩下的问题是:降息多少。