AMD Vs. Nvidia: AMD's Surprising Strategy Shift in Gaming GPU Battle

AMD Vs. Nvidia: AMD's Surprising Strategy Shift in Gaming GPU Battle

Advanced Micro Devices, Inc. (NASDAQ:AMD) is shifting its focus to the gaming GPU market, prioritizing a strategy to gain a larger market share.

Advanced Micro Devices, Inc.(納斯達克股票代碼:AMD)正在將重點轉移到遊戲GPU市場,優先考慮一項獲得更大市場份額的戰略。

This approach marks a significant shift away from competing directly with Nvidia Corp's (NASDAQ:NVDA) highest-end gaming GPUs, at least for now, Tom's Hardware cites Jack Huynh, AMD's Senior Vice President and General Manager.

Tom's Hardware援引AMD高級副總裁兼總經理傑克·休恩的話說,這種方法標誌着人們從直接與英偉達公司(納斯達克股票代碼:NVDA)的最高端遊戲GPU競爭發生了重大轉變,至少目前是如此。

In an interview during IFA 2024, Huynh emphasized that AMD aims to capture 40%-50% of the total addressable market by focusing on mainstream and mid-range GPUs.

在IFA 2024期間的一次採訪中,Huynh強調說,AMD的目標是通過專注於主流和中端GPU,佔領整個潛在市場的40%-50%。

Nvidia currently holds 88% of the discrete GPU market, leaving AMD with just 12%, compelling the latter to focus on building scale.

英偉達目前佔有獨立GPU市場的88%,而AMD僅佔12%,這迫使後者專注於擴大規模。

AMD remains engaged in many activities to boost shareholder value as analysts continue to claim Nvidia as the key AI beneficiary.

隨着分析師繼續聲稱Nvidia是主要的人工智能受益者,AMD仍在參與許多提高股東價值的活動。

Recently, AMD tapped Nvidia's Keith Strier, who was responsible for boosting Nvidia's commercial engagements with foreign governments. AMD also shared plans to snap AI server company ZT Systems for $4.9 billion as its Ryzen 9000 series failed to gain traction.

最近,AMD聘請了英偉達的基思·斯特里爾,他負責促進英偉達與外國政府的商業合作。由於其銳龍9000系列未能獲得關注,AMD還分享了以49億美元收購人工智能服務器公司Zt Systems的計劃。

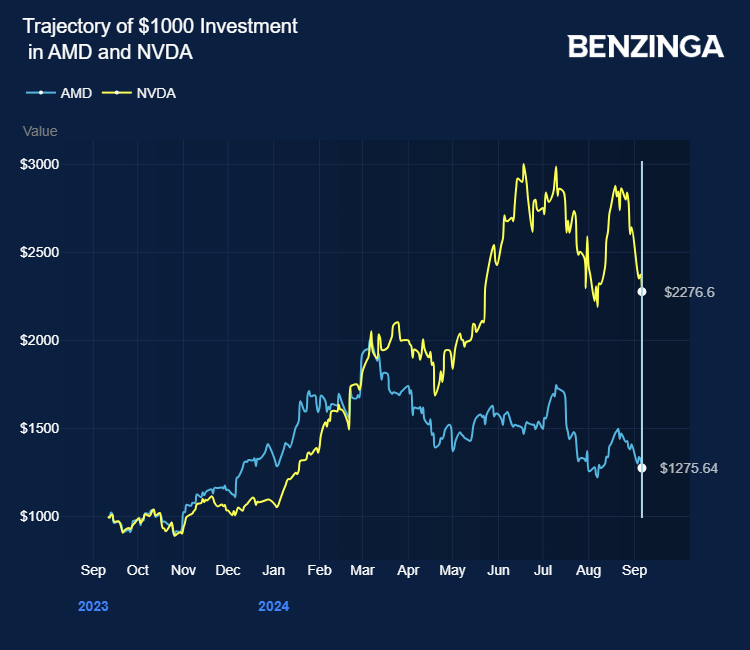

AMD has been up 28% in the last 12 months versus Nvidia, which has gained 128%.

在過去的12個月中,AMD上漲了28%,而英偉達上漲了128%。

Semiconductor and AI-linked stocks, including Nvidia and AMD, faced a continued selloff despite strong quarterly results from Nvidia and Broadcom Inc (NASDAQ:AVGO). VanEck Semiconductor ETF (NASDAQ:SMH) and iShares Semiconductor ETF (NASDAQ:SOXX) dropped over 12% in the past five days.

儘管英偉達和博通公司(納斯達克股票代碼:AVGO)的季度業績強勁,但包括英偉達和AMD在內的半導體和人工智能相關股票仍面臨持續拋售。VanEck半導體ETF(納斯達克股票代碼:SMH)和iShares半導體ETF(納斯達克股票代碼:SOXX)在過去五天中下跌了12%以上。

Price Actions: AMD stock is up 1.37% at $136.20 at the last check on Monday. NVDA is up 1.22% at $104.05.

價格走勢:在週一的最後一次檢查中,AMD股價上漲1.37%,至136.20美元。NVDA上漲1.22%,至104.05美元。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明:此內容部分是在人工智能工具的幫助下製作的,並由Benzinga的編輯審閱和發佈。

Photo via Shutterstock

照片來自 Shutterstock

譯文內容由第三人軟體翻譯。