Behind the Scenes of UnitedHealth Group's Latest Options Trends

Behind the Scenes of UnitedHealth Group's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards UnitedHealth Group (NYSE:UNH), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UNH usually suggests something big is about to happen.

資金雄厚的投資者對聯合健康集團(紐交所:UNH)採取了看好的態度,這是市場參與者不應忽視的事情。我們在Benzinga追蹤公共期權記錄的過程中今天揭示了這一重大舉動。這些投資者的身份尚不知曉,但UNH發生如此重大的變化通常意味着即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for UnitedHealth Group. This level of activity is out of the ordinary.

我們從今天的觀察中獲得了這條信息,當Benzinga的期權掃描器突出顯示了聯合健康集團的13個非凡的期權活動。 這種活動水平是非同尋常的。

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 46% bearish. Among these notable options, 9 are puts, totaling $437,393, and 4 are calls, amounting to $363,867.

這些重量級投資者中的整體情緒分爲兩派,46%看漲,46%看跌。 在這些顯著的期權中,有9個看跌,總額爲437,393美元,還有4個看漲,總額爲363,867美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $530.0 to $610.0 for UnitedHealth Group during the past quarter.

分析這些合約的成交量和未平倉量,似乎在過去的一季度裏大型交易商一直在關注聯合健康集團在530.0美元到610.0美元的價格區間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

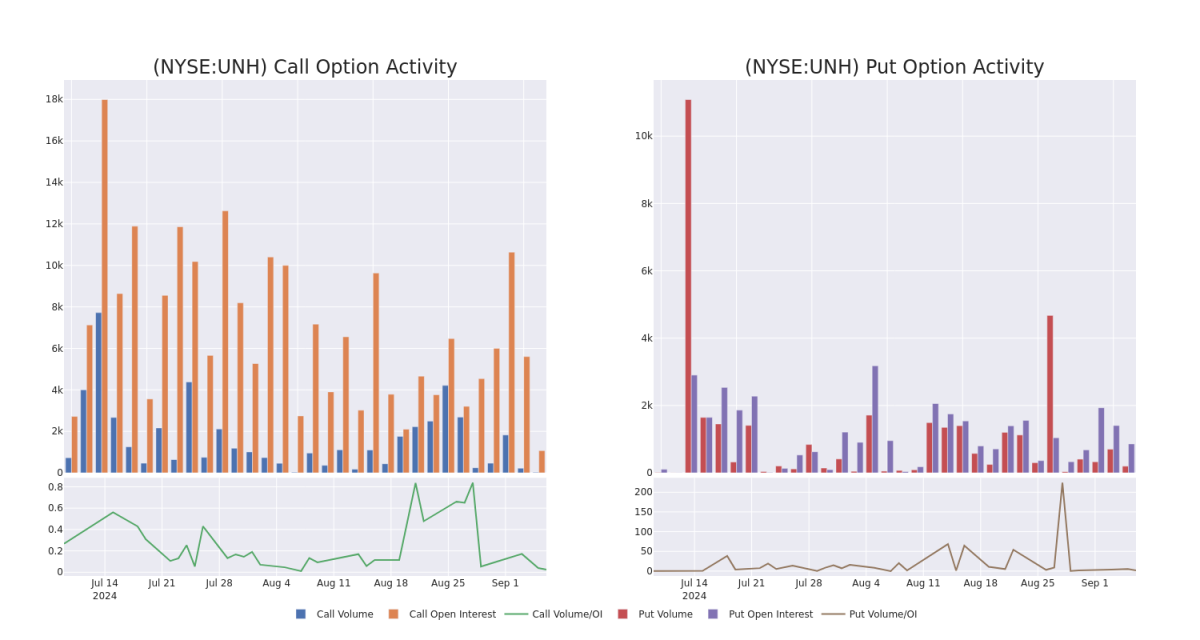

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for UnitedHealth Group's options for a given strike price.

這些數據能幫助你追蹤聯合健康特定行權價的期權的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UnitedHealth Group's whale activity within a strike price range from $530.0 to $610.0 in the last 30 days.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UnitedHealth Group's whale activity within a strike price range from $530.0 to $610.0 in the last 30 days.

UnitedHealth Group Option Activity Analysis: Last 30 Days

聯合健康集團期權活動分析:過去30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | CALL | TRADE | BEARISH | 10/11/24 | $45.75 | $43.4 | $43.4 | $560.00 | $217.0K | 0 | 0 |

| UNH | PUT | SWEEP | BULLISH | 06/20/25 | $41.65 | $37.75 | $37.75 | $580.00 | $68.0K | 209 | 24 |

| UNH | CALL | SWEEP | BEARISH | 09/20/24 | $66.85 | $64.7 | $64.7 | $530.00 | $64.6K | 831 | 10 |

| UNH | PUT | SWEEP | BULLISH | 09/20/24 | $10.9 | $10.8 | $10.8 | $592.50 | $54.1K | 67 | 50 |

| UNH | PUT | TRADE | BULLISH | 11/15/24 | $33.6 | $32.65 | $32.65 | $610.00 | $52.2K | 167 | 16 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 聯合健康 | 看漲 | 交易 | 看淡 | 10/11/24 | $45.75 | $43.4 | $43.4 | $560.00 | 217千美元 | 0 | 0 |

| 聯合健康 | 看跌 | SWEEP | 看好 | 06/20/25 | $41.65 | $37.75 | $37.75 | $68.0K | 209 | 24 | |

| 聯合健康 | 看漲 | SWEEP | 看淡 | 09/20/24 | 66.85美元 | $64.7 | $64.7 | $530.00 | $64.6K | 831 | 10 |

| 聯合健康 | 看跌 | SWEEP | 看好 | 09/20/24 | $10.9 | $10.8 | $10.8 | $592.50 | $54.1千美元 | 67 | 50 |

| 聯合健康 | 看跌 | 交易 | 看好 | 11/15/24 | $33.6 | $32.65 | $32.65 | $610.00 | 52,200 美元 | 167 | 16 |

About UnitedHealth Group

關於聯合健康集團

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 50 million members globally, including 1 million outside the us as June 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

聯合健康集團是全球最大的私人醫療保險提供商之一,爲包括2024年6月外美國的約5000萬會員提供醫療保障。作爲僱主贊助、自主選擇和政府支持的保險計劃的領導者,聯合健康在託管護理方面獲得了大規模的規模。除了其保險資產外,聯合健康繼續投資於其Optum公司,創造了一個醫療保健服務巨頭,涵蓋從醫療和藥品福利到爲關聯和第三方客戶提供門診護理和分析。

After a thorough review of the options trading surrounding UnitedHealth Group, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對聯合健康集團的期權交易進行徹底審查後,我們決定更詳細地研究該公司。這包括對其當前市場地位和業績的評估。

Where Is UnitedHealth Group Standing Right Now?

聯合健康目前處於什麼位置?

- With a trading volume of 264,746, the price of UNH is up by 0.19%, reaching $596.64.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 35 days from now.

- 交易量爲264,746,UNH的價格上漲0.19%,達到596.64美元。

- 當前RSI值表明股票可能已經超買。

- 下一份業績將於35天后公佈。

Expert Opinions on UnitedHealth Group

聯合健康集團專家意見

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $591.0.

過去30天中,共有1位專業分析師對該股票進行了評估,設定了平均目標價爲591.0美元。

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $591.

- 在一個小心謹慎的舉動中,Cantor Fitzgerald的一位分析師將其評級下調爲「增持」,並設定了591美元的目標價。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for UnitedHealth Group with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續教育、戰略性交易調整、利用各種因子並保持對市場動態的敏感來緩解這些風險。使用Benzinga Pro獲取聯合健康集團的最新期權交易實時提醒。

譯文內容由第三人軟體翻譯。