Nikkei Slips As Other Asian Markets Rebound From Wednesday's Sell Off

Nikkei Slips As Other Asian Markets Rebound From Wednesday's Sell Off

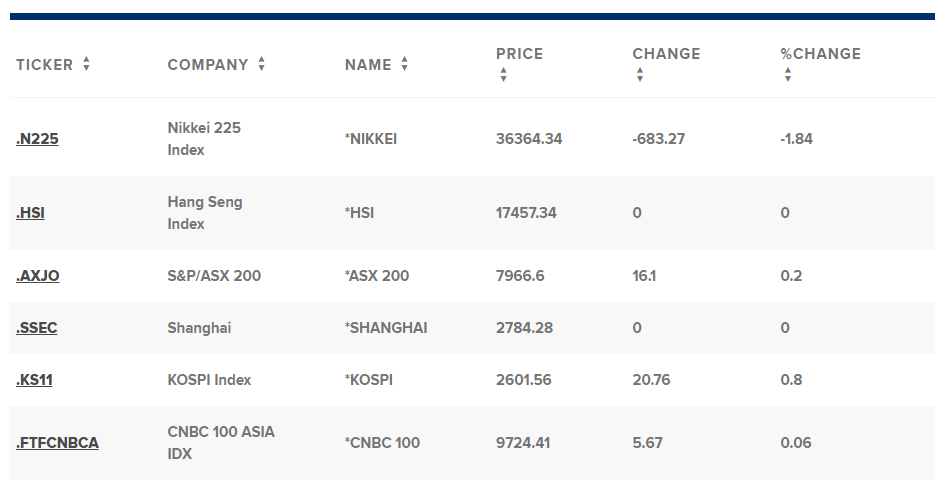

Asia-Pacific markets mostly rebounded on Thursday from the sell-off the day before, except markets in Japan.

亞太地區市場在週四大多數從前一天的拋售中反彈,日本市場除外。

The Nikkei 225 and Topix fell 0.92% and 0.49%, respectively on open, shortly after the release of Japan's July wage data.

日經225指數和Topix指數的開盤分別下跌了0.92%和0.49%,不久之後,日本7月份的工資數據公佈。

Average monthly cash earnings in the country rose 3.6% year-on-year, a softer rise compared to the 4.5% climb seen in June.

該國平均每月現金收入同比上升3.6%,相比6月份的4.5%增長較緩。

Real wages climbed 0.4% year-on-year, the second straight month of increase after the 1.1% rise in June.

實際工資同比增長0.4%,連續兩個月增長,6月份增長了1.1%。

A strong pay report would give the Bank of Japan more room for a rate hike, which could put pressure on equities.

強勢的工資報告將會給日本央行提供更多的加息空間,這可能會對股市施加壓力。

Other economic data coming from the region include trade data from Australia and retail sales numbers from Singapore.

來自該地區的其他經濟數據包括澳大利亞的貿易數據和新加坡的零售銷售數據。

South Korea's Kospi rose 1.15%, while the small cap Kosdaq was 0.75% higher.

韓國的Kospi指數上漲了1.15%,而小盤股Kosdaq指數上漲了0.75%。

Australia's S&P/ASX 200 climbed 0.48% ahead of the trade data release.

澳大利亞的S&P/ASX 200指數在發佈貿易數據前上漲了0.48%。

In contrast, Hong Kong Hang Seng index futures were at 17,461, just marginally higher than the HSI's last close of 17,457.34.

相比之下,香港恒生指數期貨報17461,僅略高於恒生指數上一收盤價17457.34。

Futures for the mainland Chinese CSI 300 were at 3,251.2, marginally lower than its last close of 3,252.16.

中國大陸中證300指數期貨報3251.2,略低於其上一收盤價3252.16。

In the U.S., the S&P 500 and the Nasdaq Composite was down for a second straight session.

在美國,標準普爾500指數和納斯達克綜合指數已連續下跌兩個交易日。

The broad based index lost 0.16%, while the tech heavy index slipped 0.3%. The Dow Jones Industrial Average was the outlier, edging up 0.09%. – CNBC

綜合指數下跌0.16%,而科技股指數下滑0.3%。道瓊斯工業平均指數成爲唯一的例外,微升0.09%。– CNBC

譯文內容由第三人軟體翻譯。