一項最新分析揭示了全球集裝箱航運業在第二季度的驚人利潤,總額超過100億美元。

一項最新分析揭示了全球集裝箱航運業在第二季度的驚人利潤,總額超過100億美元。這一增長主要得益於紅海航線的改道,這不僅增加了貨運量,也推高了運費。

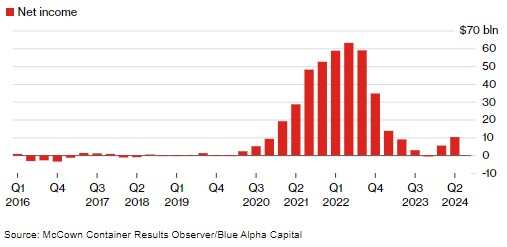

行業資深分析師約翰·麥考恩指出,全球主要集裝箱運輸公司,如丹麥的 $A.P.莫勒 - 馬士基 (AMKBY.US)$、$中遠海控 (01919.HK)$和$東方海外國際 (00316.HK)$,其淨收入較第一季度幾乎翻倍,並且超過了2023年同期的88.8億美元。

麥考恩預測,鑑於國際貿易市場的強勁表現,本季度利潤有望實現更大幅度的增長。他強調,儘管疫情期間供應鏈受到衝擊,但航運業依然保持了強勁的增長勢頭,這一行業承擔着全球80%的商品貿易運輸。然而,2023年最後一個季度,該行業出現了集體虧損。目前,航運公司正受益於供需兩端的積極因素,利潤正在反彈,儘管仍低於疫情高峰時期的水平。

麥考恩預測,鑑於國際貿易市場的強勁表現,本季度利潤有望實現更大幅度的增長。他強調,儘管疫情期間供應鏈受到衝擊,但航運業依然保持了強勁的增長勢頭,這一行業承擔着全球80%的商品貿易運輸。然而,2023年最後一個季度,該行業出現了集體虧損。目前,航運公司正受益於供需兩端的積極因素,利潤正在反彈,儘管仍低於疫情高峰時期的水平。

紅海航線的改道導致船隻不得不繞道南部非洲,這加劇了運力緊張,推高了現貨集裝箱運費,並在一些主要港口造成了擁堵。麥考恩引用集裝箱貿易統計有限公司的數據指出,儘管面臨挑戰,上季度全球集裝箱運輸量仍達到了4640萬個20英尺集裝箱的歷史新高,超過了2021年第二季度4620萬個的記錄。

據悉,美國目前的需求主要由零售商和其他進口商推動,他們在美國對中國商品徵收關稅以及美國碼頭工人可能的罷工前囤貨,這進一步加劇了每年這個時候通常出現的節前訂貨熱潮。

麥考恩警告稱,如果發生覆蓋整個海岸或主要港口的罷工,將對所有大型航運公司的集裝箱網絡造成嚴重破壞,並且這種影響將迅速蔓延至美國航線之外。

美國港口進口量接近歷史高位

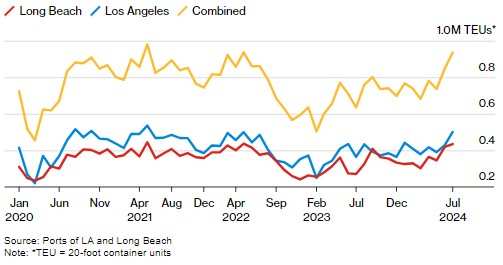

在美國,儘管對經濟降溫的擔憂不斷,但最繁忙的港口綜合體的進口量仍接近疫情期間的高位。洛杉磯港和長灘港,這兩個港口約佔美國集裝箱進口總量的三分之一,7月份的吞吐量創下歷史第三高,略低於2021年5月的歷史最高水平。當時,大量消費品的湧入導致了陸地供應瓶頸,等待靠岸的貨船隊伍也越來越長。

長灘港的首席執行官馬里奧·科爾德羅表示,隨着消費者購買返校用品,託運人在關稅可能上漲之前發貨,港口正處於航運旺季的有利位置。他還提到,碼頭容量充足,貨物運輸繼續高效且可持續。

然而,東海岸和墨西哥灣沿岸碼頭工人與僱主之間的談判陷入僵局,他們的合同將於9月30日到期。這導致部分原本可能通過波士頓港口運往休斯頓的海運貨物轉移到西海岸門戶,直到這一不確定性得到解決。

根據哥本哈根海事數據和諮詢公司Sea-Intelligence的數據,罷工每持續一天,港口需要大約五天時間來清理積壓的貨物。例如,從10月1日開始的爲期一週的罷工,要到11月中旬才能結束。

Sea-Intelligence的首席執行官艾倫·墨菲在上週發佈的研究報告中表示,如果發生爲期兩週的罷工,港口實際上要到2025年才能恢復正常運營。

美國零售聯合會和哈克特協會本月發佈的數據顯示,今年美國通過主要港口的集裝箱進口量預計將達到2490萬個20英尺當量單位,比去年增長12%,接近2021年和2022年超過2500萬個的水平。

航運業強勁漲勢能否持續?

多年來,洛杉磯-長灘港和其他西海岸港口的市場份額一直在輸給東部競爭對手。Hackett Associates的創始人本·哈克特表示,對東部港口勞動力中斷的擔憂導致西海岸的貨運份額「三年來首次超過50%」。

這些因素扭曲了需求狀況,使得難以判斷航運旺季是否提前開始、貿易量是否很快趨於平穩,或者進口商是否會繼續比平時進口更多。然而,還有另一種可能性是,消費者的持續消費能力觸底,導致倉庫爆滿,企業庫存過剩。

最新的零售銷售報告顯示,儘管借貸成本上升、勞動力市場降溫、戰爭和十一月美國總統大選給經濟前景蒙上陰影,但消費者仍然表現出韌性。然而,隨着疫情期間的儲蓄基本消失,加上工資增長放緩,許多美國人越來越多地使用信用卡和其他貸款來支持購物。

不過,到目前爲止,這個佔全球商品貿易 80% 的行業至今尚未顯露出消費放緩的跡象。當被問及是否預見到經濟衰退的來臨,全球第五大集裝箱運輸公司的首席執行官給出了樂觀的看法,他認爲,根據目前的預訂情況,經濟衰退似乎不會出現。

德國集裝箱運輸巨頭Hapag-Lloyd AG的首席執行官羅爾夫·哈本·詹森表示,自5月1日以來,公司對持續強勁的需求感到驚訝,這種勢頭預計將延續至第三季度。

洛杉磯港8月份的初步數據也顯示出港口效率的持續提升。執行董事吉恩·塞洛卡指出,幾乎所有的港口效率指標都達到了或超過了疫情初期激增時的水平,儘管近期出現了一些微觀層面的問題。

例如,集裝箱的停留時間——一個衡量集裝箱在港口流轉效率的指標——已延長至六天以上。塞洛卡認爲,這個數字過長,理想狀態應該在兩到四天之間。

此外,卡車底盤的供應也開始出現緊張,這一問題部分源於2021年和2022年疫情期間洛杉磯-長灘鐵路服務的嚴重延誤。

儘管面臨這些挑戰,塞洛卡並不認爲存在需要過分擔憂的問題。他強調,過去三個月,港口的生產效率一直保持在較高水平。

一些行業分析師預測,美國的進口量可能在7月份達到頂峯,這一觀點與近期現貨運費的下降趨勢相吻合。

塞洛卡表示,他們將密切關注這一預測是否成真,但他同時指出,這在很大程度上將取決於整體經濟的走勢。

編輯/ping

麦考恩预测,鉴于国际贸易市场的强劲表现,本季度利润有望实现更大幅度的增长。他强调,尽管疫情期间供应链受到冲击,但航运业依然保持了强劲的增长势头,这一行业承担着全球80%的商品贸易运输。然而,2023年最后一个季度,该行业出现了集体亏损。目前,航运公司正受益于供需两端的积极因素,利润正在反弹,尽管仍低于疫情高峰时期的水平。

麦考恩预测,鉴于国际贸易市场的强劲表现,本季度利润有望实现更大幅度的增长。他强调,尽管疫情期间供应链受到冲击,但航运业依然保持了强劲的增长势头,这一行业承担着全球80%的商品贸易运输。然而,2023年最后一个季度,该行业出现了集体亏损。目前,航运公司正受益于供需两端的积极因素,利润正在反弹,尽管仍低于疫情高峰时期的水平。