Retirees: 2 Top TSX Dividend Stocks to Buy Now for Steady Income

Retirees: 2 Top TSX Dividend Stocks to Buy Now for Steady Income

Canadian retirees love to receive income from TSX dividend stocks. Why is that? Eligible Canadian dividend income is taxed at lower rates. Let's say you're getting a yield of 5% from interest income and also yielding 5% from a TSX stock generating eligible Canadian dividends. You get to keep more money in your pocket for the latter. That said, investments (such as traditional guaranteed investment certificates and bonds) that provide interest income are typically lower risk than stocks.

加拿大退休人員喜歡從tsx分紅股中獲取收入。爲什麼呢?合格的加拿大股息收入按較低稅率計稅。假設您從利息收入獲得5%的收益,並從產生合格的加拿大股息的tsx股票中獲得5%的收益。您可以在後者中留更多的錢在口袋裏。也就是說,提供利息收入的投資(如傳統的保證投資證書和債券)通常比股票風險較低。

Within the world of TSX dividend stocks, retirees can handpick ones that provide the safety and income they need. Here are two of my top picks for steady income today.

在tsx分紅股的世界中,退休人員可以挑選他們所需的安全和收入。以下是我今天穩定收入的兩個首選。

Bank of Nova Scotia stock yields 6.5%

豐業銀行股票的股息率爲6.5%。

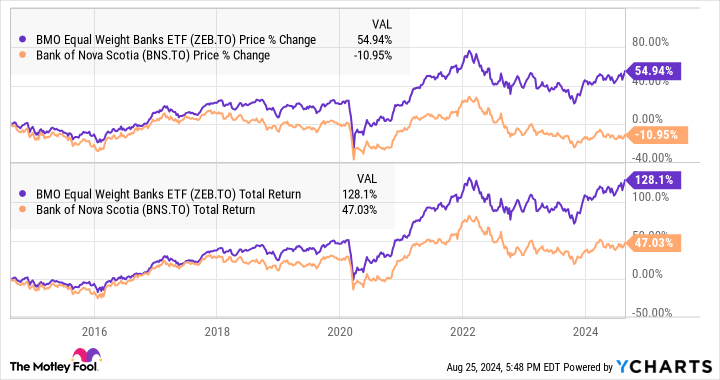

Please allow me to be crystal clear here. Bank of Nova Scotia (TSX:BNS), or Scotiabank, stock is not the lowest-risk big Canadian bank stock to own. Its risk is illustrated in its stock price action compared against its peers through the BMO Equal Weight Banks Index ETF below. Although Scotiabank stock offers a larger dividend, the stock (with or without its dividend) has underperformed over the last decade.

請允許我在這裏非常清楚地說一下,豐業銀行(tsx:bns)股票並不是最低風險的加拿大大型銀行股票。與BMO等權重銀行指數etf相比,其風險在其股票價格行動上得到了體現。儘管豐業銀行股票提供了較大的股息,但其在過去十年中的表現(無論是否帶有股息)不及其同行。

BNS and ZEB 10-year stock price and total return data by YCharts

BNS和ZEb 10年股票價格和總回報數據來源:YCharts

Because of its international exposure, the bank's earnings tend to be more cyclical than its peers. This has resulted in the stock being down close to 30% from its high in 2022.

由於其國際業務,該銀行的收益往往比其同行更具週期性。這導致該股票自2022年高點以來下跌了近30%。

There's not much to lose in the stock if retirees' key focus is steady income. BNS stock offers an attractive dividend yield of close to 6.5%, which is hard to beat. Furthermore, it has price appreciation potential if it were to turn around propelled by an improvement in the economies of the markets it serves, which is primarily Canada and Latin America. In the worst-case scenario, investors get to pocket a large dividend that's covered by earnings.

如果退休人員的關鍵焦點是穩定收入,在該股票上沒有太多虧損。豐業銀行股票提供了近6.5%的吸引人股息收益,這是很難超越的。此外,如果該股票因所服務的市場經濟改善而扭轉局面,它還有價格增值潛力,主要是加拿大和拉丁美洲。在最壞的情況下,投資者將獲得由盈利覆蓋的大股息。

Brookfield Renewable Corporation offers a 5% dividend

brookfield renewable corp提供5%的股息。

Another stock for retirees to consider parking their money in for long-term dividend income is Brookfield Renewable Corp. (TSX:BEPC). It is economically equivalent to its limited partnership counterpart and pays the same cash distribution. Essentially, Brookfield Renewable has increased its dividend/cash distribution for about 14 consecutive years with a 10-year dividend growth rate of 5.7%. The corporation pays out eligible dividends yielding 5%.

另一隻供退休人士考慮的股票是brookfield renewable corp(TSX:BEPC)。它在經濟上與其有限合夥人相等並支付相同的現金分配。基本上,brookfield renewable連續14年增加其股息/現金分配,10年的股息增長率爲5.7%。該公司支付合格股息,收益率爲5%。

It is a name to particularly like if you're supportive of cleaner energy. Brookfield Renewable's diversified portfolio includes quality assets in hydroelectric, wind, solar, distributed energy, and sustainable solutions across five continents. Going forward, retirees can expect the dividend to increase by at least 5% per year, supported by funds from operations (FFO) growth.

如果您支持清潔能源,這是一個特別喜歡的名稱。brookfield renewable的多元化投資組合包括質量資產在水力、風能、太陽能、分佈式能源和可持續解決方案五大洲。未來,退休人員可以預計每年的股息至少增長5%,並得到來自運營資金的支持。

For example, in the first half of the year, Brookfield Renewable increased its FFO per unit by 5.5% to US$0.96, which equates to a sustainable payout ratio of about 74% in the period. The first investors in Brookfield Renewable are sitting on a yield on cost of about 20%. Imagine earning a return on your initial investment of over 20% every year – which is set to occur as the utility stock continues to increase its dividend!

例如,今年上半年,brookfield renewable將其每單位運營資金增加了5.5%,達到了0.96美元,相當於該時期的可持續支付比率約爲74%。早期投資brookfield renewable的投資者享受着成本收益率約爲20%的收益。想象一下每年在初始投資上獲得超過20%的回報——隨着這隻公用事業股票繼續增加分紅,這種情況將會發生!

With an international portfolio, Brookfield Renewable gets to participate in the multi-decade's long mega trend in renewable energy. And it can make the best global risk-adjusted investments because of its international footprint.

由於其國際業務版圖,brookfield renewable可以參與可再生能源這一數十年的長期大趨勢。而且,由於其國際業務版圖,它可以進行最好的全球風險調整投資。

譯文內容由第三人軟體翻譯。

BNS and ZEB 10-year stock price and total return data by YCharts

BNS and ZEB 10-year stock price and total return data by YCharts