Key Insights

Institutions' substantial holdings in Grab Holdings implies that they have significant influence over the company's share price

A total of 9 investors have a majority stake in the company with 50% ownership

Analyst forecasts along with ownership data serve to give a strong idea about prospects for a business

To get a sense of who is truly in control of Grab Holdings Limited (NASDAQ:GRAB), it is important to understand the ownership structure of the business. The group holding the most number of shares in the company, around 41% to be precise, is institutions. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

Given the vast amount of money and research capacities at their disposal, institutional ownership tends to carry a lot of weight, especially with individual investors. Therefore, a good portion of institutional money invested in the company is usually a huge vote of confidence on its future.

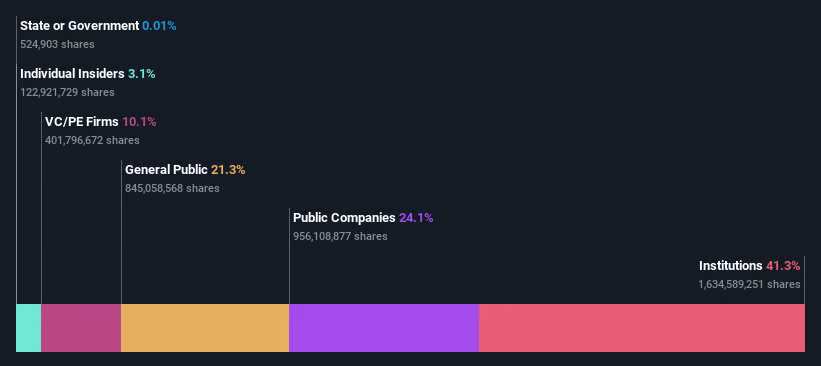

In the chart below, we zoom in on the different ownership groups of Grab Holdings.

NasdaqGS:GRAB Ownership Breakdown August 24th 2024

What Does The Institutional Ownership Tell Us About Grab Holdings?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

As you can see, institutional investors have a fair amount of stake in Grab Holdings. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Grab Holdings, (below). Of course, keep in mind that there are other factors to consider, too.

NasdaqGS:GRAB Earnings and Revenue Growth August 24th 2024

Grab Holdings is not owned by hedge funds. The company's largest shareholder is Uber Technologies, Inc., with ownership of 14%. Meanwhile, the second and third largest shareholders, hold 10% and 5.6%, of the shares outstanding, respectively.

We did some more digging and found that 9 of the top shareholders account for roughly 50% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Grab Holdings

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

We can report that insiders do own shares in Grab Holdings Limited. Insiders own US$393m worth of shares (at current prices). Most would say this shows a good alignment of interests between shareholders and the board. Still, it might be worth checking if those insiders have been selling.

General Public Ownership

The general public-- including retail investors -- own 21% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

Private equity firms hold a 10% stake in Grab Holdings. This suggests they can be influential in key policy decisions. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Public Company Ownership

We can see that public companies hold 24% of the Grab Holdings shares on issue. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Grab Holdings better, we need to consider many other factors.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.