The annual Jackson Hole global central bank conference will be held at Grand Teton National Park in Wyoming, USA from August 22nd to 24th, Eastern Time. The market has already prepared for a interest rate cut in the coming weeks!

The theme of this year's conference is "Reevaluating the Effectiveness and Transmission Mechanism of Monetary Policy". Federal Reserve Chairman Powell's speech, scheduled for 22:00 Beijing time on Friday, August 23rd, is widely expected to provide important clues about the future direction of Federal Reserve monetary policy. What is his stance in this discourse? It will be revealed at 10 pm tonight.

A preview of Powell's speech

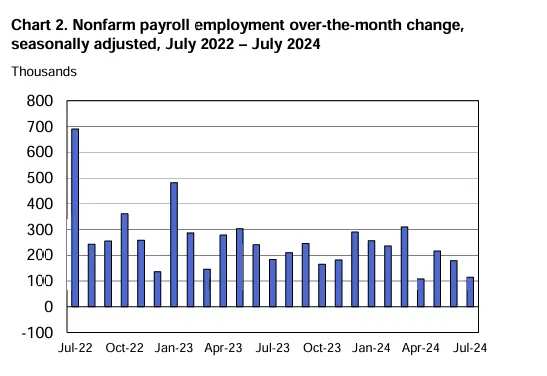

Federal Reserve Chairman Powell's speech tonight is receiving much attention as concerns about the outlook for the US economy intensify. With the weak performance of the US labor market, particularly an unexpected rise in the unemployment rate to 4.3%, the highest level since October 2021, and only 0.114 million job additions in July, these worrying signals have led investors and economists to increase their expectations of a short-term interest rate cut by the Federal Reserve.

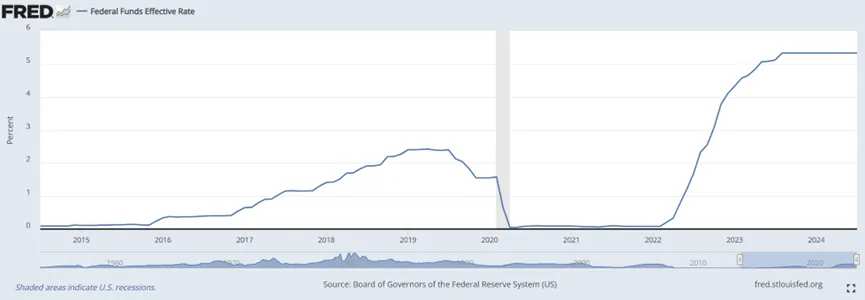

In the past few weeks, there has been intense debate in the market about whether the Federal Reserve will cut interest rates at the September meeting. With the release of the July jobs report, the market generally expects the Federal Reserve to take action and cut interest rates to address the risks of an economic slowdown. The cooling labor market and inflation rate only slightly above the Federal Reserve's 2% target further support this expectation.

In the past few weeks, there has been intense debate in the market about whether the Federal Reserve will cut interest rates at the September meeting. With the release of the July jobs report, the market generally expects the Federal Reserve to take action and cut interest rates to address the risks of an economic slowdown. The cooling labor market and inflation rate only slightly above the Federal Reserve's 2% target further support this expectation.

However, Powell and his colleagues decided not to cut interest rates at the last meeting, a decision that drew criticism from some quarters after the data was released. Some economists are concerned that the Federal Reserve's delay could worsen the weakness in the labor market and even push the economy to the edge of a recession.

The employment data released by the US Bureau of Labor Statistics on Wednesday has heightened these concerns. Over the 12 months ending in March 2024, the US economy created 0.818 million fewer jobs than originally reported. As part of a preliminary annual benchmark revision of nonfarm employment data, the Bureau of Labor Statistics stated that from April 2023 to March of the following year, actual job growth decreased by nearly 30% compared to the initially announced 2.9 million.

Wall Street has been closely watching these data, with many economists expecting the initially released data to drop significantly. This report may be seen as a sign that the labor market is not as robust as previously shown by the Labor Statistics Bureau.

In this context, Powell's speech tonight is particularly important. The market had previously expected the Fed to cut rates by 50 basis points at the September meeting to address the increasingly deteriorating economic conditions. However, in recent weeks, as the sentiment in the US stock market improved, US bond yields fell, and the overall US economy has not fully deteriorated, market expectations have changed. Investors now generally believe that the Fed may not take such aggressive action and is more likely to choose to cut rates by 25 basis points when necessary.

Powell may maintain caution in his speech tonight, trying to avoid creating excessive policy expectations in the market. He may reiterate the Fed's stance that it will continue to rely on data in the decision-making process and adjust policies based on economic developments. He may point out that, although there are some signs of weakness in the labor market, the Fed still needs more time and data to fully assess the economic situation and ensure that the policy measures taken are appropriate.

Furthermore, Powell may mention that the Fed's primary goal remains to maintain stable economic growth and ensure that the inflation rate stays near the 2% target. Even if the labor market cools down slightly, he may emphasize that the current inflation level is slightly above the target, indicating the need to be very cautious before taking significant rate cuts. If Powell's focus tonight leans more towards the labor market rather than inflation, it can be considered a "dovish speech".

Overall, Powell may avoid committing to immediate large-scale policy adjustments but instead focus on the Fed's reliance on future economic data and policy flexibility, especially since there will be another round of non-farm and inflation data to be released before the next Fed meeting.

Jackson Hole speeches are no child's play.

The Jackson Hole conference, as the Federal Reserve's annual economic policy symposium, has always been seen as an important window to observe the direction of Fed policy. For the Fed, Jackson Hole is not only a platform to convey policy intentions but also a crucial moment to shape market expectations. Over the past few years, the important speeches delivered by several Fed chairs at this conference have not only influenced the market trends at the time but also profoundly shaped the importance of the policy framework the Fed releases on this platform.

For example, in 2022, Powell's speech at Jackson Hole was interpreted by the market as a signal that the Fed's interest rate hike cycle was coming to an end, although Powell still left open the possibility of further rate hikes. On that day, the stock market rebounded, and this market interpretation was ultimately proven to be correct, as the Fed did not raise rates again since July 2022.

Jackson Hole is not only a venue for the Federal Reserve Chairman to announce policy signals, but also a platform for them to anticipate and respond to economic changes. In 2010, then Federal Reserve Chairman Bernanke used the Jackson Hole conference to hint at further monetary easing measures. At that time, the U.S. economy was slowly recovering from the Great Recession, and Bernanke mentioned in his speech that the Fed had "policy options to provide additional stimulus," which brought new expectations to the market. Several months later, he announced a new round of bond purchases, QE2, to lower interest rates by buying long-term government bonds and inject momentum into the post-financial crisis economic recovery.

Such examples are not isolated incidents. In 2012, Bernanke once again expressed concerns about the stagnation issue in the labor market at the Jackson Hole conference, calling it a "serious problem." Although Bernanke's speech initially caused a market downturn, the market rebounded afterwards, and shortly thereafter, the Fed indeed launched the third round of quantitative easing (QE3).

Similarly, in 2016, then Federal Reserve Chair Janet Yellen said at the Jackson Hole conference that she believed "the case for an increase in the federal funds rate has strengthened," signaling an upcoming rate hiking cycle. As expected, starting from December 2016, the Fed began a new round of rate hikes, raising rates once every three meetings until 2018. This further highlights the importance of the Jackson Hole conference in guiding market expectations and adjusting policy frameworks.

Through this platform, the Federal Reserve is able to adjust policies in the context of the global economy and influence market expectations through carefully crafted statements. The market's interpretation of these signals not only reflects the current economic situation, but also influences the economic trends of the coming months or even years. Through Jackson Hole, the Fed is able to test market reactions to its policies before the September policy meeting, thereby reducing uncertainty.

This role of managing expectations helps the Fed to more effectively adjust policies and reduce excessive market volatility when facing a complex economic environment. Therefore, the importance of Jackson Hole has been widely recognized and highly regarded in global financial markets.

Key points from the latest meeting minutes:

The minutes of the Federal Open Market Committee (FOMC) meeting in July, which were released early in the morning on August 22nd Beijing time, showed that the majority of officials expected a possible rate cut in September, and even some advocated an immediate reduction in borrowing costs.

At the meeting on July 30-31, the majority of participants believed that if the data continues to align with expectations, it may be appropriate to relax policies at the next meeting, according to the meeting minutes.

The market has fully digested the interest rate cut in September, which will be the first rate cut since the emergency easing policy in early 2020.

Although all members of the Federal Open Market Committee, which sets interest rates, voted to keep the benchmark rate unchanged, some officials favored starting to ease policies at the July meeting instead of waiting until September.

The official document stated, "Several participants noted that recent changes in inflation and unemployment provided a reasonable justification for lowering the target range by 25 basis points at this meeting or that they could have supported such a decision."

The language used by the Federal Reserve in the meeting minutes described "several" as a relatively small number. The minutes did not mention names or specifically specify how many policymakers felt this way.

However, the minutes made it clear that officials are confident in the direction of inflation and are prepared to begin easing monetary policy if the data continues to cooperate.

Stefanie Lang, Chief Investment Officer at Homrich Berg, emphasized the importance of Powell's wording. Citigroup's data shows that options traders currently expect the S&P 500 index to fluctuate by more than 1% on Friday.

Barclays economist Christian Keller wrote in a report, 'Although it may be too early to declare victory now, the Federal Reserve will cautiously avoid this situation in official statements, but the inflation panic that has dominated policy debates since the price surge during the epidemic is now largely fading away. The inflation rate may not have reached the target yet, but it is close and moving in the right direction.'

Jonathan Millar, Senior US Economist at Barclays, pointed out, 'We expect Powell to paint a rather optimistic picture in his speech, namely that inflation is being contained and the labor market is gradually cooling.' However, he also expects Powell not to make any policy commitments.

USA's August PMI is lower than expected.

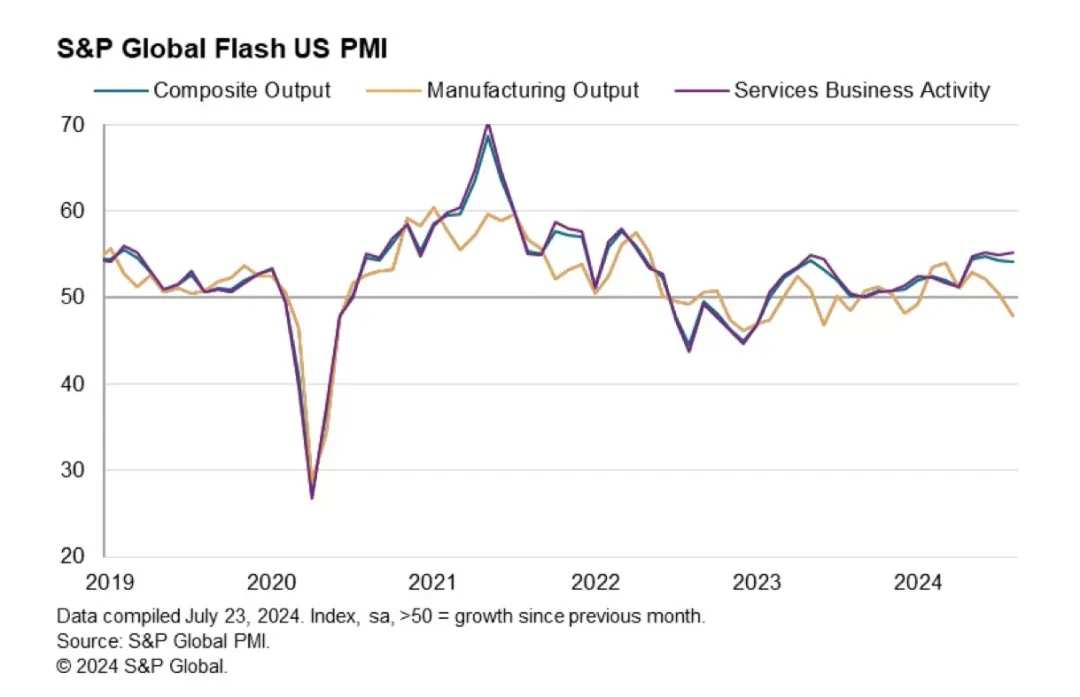

On the evening of August 22, Beijing time, data released by s&p global showed that the U.S. August s&p global manufacturing PMI preliminary value was 48, a new low in 8 months, with an expected 49.6, and a final value of 49.6 in July.

USA's August s&p global services PMI preliminary value is 55.2, expected 54, and the final value in July was 55.

USA's August s&p global composite PMI preliminary value is 54.1, expected 53.5, and the final value in July was 54.3.

From the perspective of the Federal Reserve, the latest PMI data strengthens the need for interest rate cuts.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said: "Overall, inflation is continuing to slowly return to normal levels, and the economy faces risks of slowing down in the imbalance."

Global central banks' movements

In addition to the Federal Reserve, the dynamics of other major central banks are also worth noting. Bank of England Governor Bailey and ECB Chief Economist Philip Lane, among others, will also give speeches at the annual meeting. Against the backdrop of global economic slowdown, how central banks balance supporting economic growth and controlling inflation will also be one of the focuses of the annual meeting.

In addition, central banks in multiple Asian countries will also hold interest rate meetings. Among them, the Bank of Korea recently decided to maintain its policies unchanged, while the central banks of Thailand and Indonesia may announce interest rate cuts to cope with the pressures of continuing price declines and slowing economic growth.

The speech by the Bank of Japan earlier this month has intensified the volatility in global markets, and the market will closely watch the speech by Bank of Japan Governor Kazuo Ueda to lawmakers on Friday.

Performance of US stocks during recent global central bank annual meetings

In recent years, the speeches by Fed Chairman Powell at the annual Jackson Hole Global Central Bank Symposium have caused fluctuations in the US stock market. According to Wind data, in the past 5 years, on the day of Powell's speech at the central bank symposium, the US stock market has not experienced significant gains, but has generally seen major declines when it falls. In 2019 and 2022, Powell's speeches caused a panic in the US stock market, with the three major stock indices plunging more than 2% and 3% respectively. The market also experienced turbulence in 2023, with a slight increase on the day of the speech. However, the day before Powell's speech, the Dow Jones Industrial Average recorded its largest point decline in five months, and the Nasdaq fell nearly 2%.

Editor/Emily

在过去的几周里,市场对于美联储是否会在9月会议上降息展开了激烈讨论。随着7月份就业报告的发布,市场普遍预期美联储可能会采取行动,进行降息以应对经济放缓的风险。劳动力市场的降温和通胀率仅略高于美联储2%的目标,进一步支持了这一预期。

在过去的几周里,市场对于美联储是否会在9月会议上降息展开了激烈讨论。随着7月份就业报告的发布,市场普遍预期美联储可能会采取行动,进行降息以应对经济放缓的风险。劳动力市场的降温和通胀率仅略高于美联储2%的目标,进一步支持了这一预期。