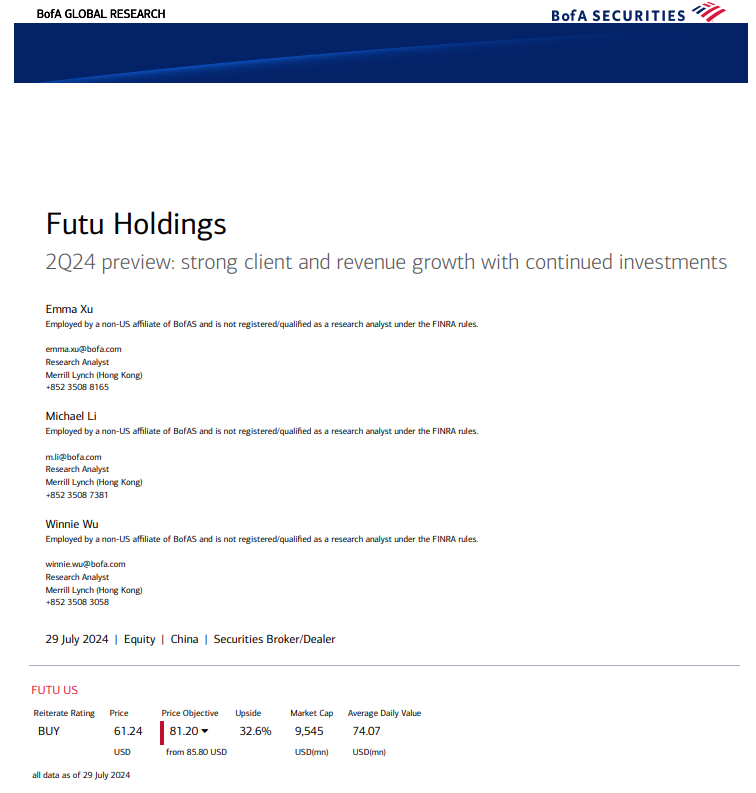

Bank of America reiterates Buy on Futu for its diversified market exposure, robust client and AUM growth, as well as encouraging developments in overseas markets and new products, while trimming the target price by 5% from USD85.80 to USD81.20.

Futu is expected to report 2Q24 results in late-August. BofA expects continued strong new paying clients in 2Q24, driven by robust client acquisition across major markets.

BofA pointed out the key things to watch in 2Q earnings :

1) Client/AUM growth: Will their strong growth momentum continue into 3Q?

1) Client/AUM growth: Will their strong growth momentum continue into 3Q?

2) Operational updates: Have the weaknesses of the HK market and China ADRs and the pullback in NASDAQ/Magnificent 7 stocks led to less active trading?

3) Airstar Bank: on June 7, Futu announced that it had completed a HKD440mn investment in Airstar Bank, a HK licensed virtual bank, to become the second largest beneficial owner holding indirectly 44.11% of the Bank. The plan and progress post the investment will be a focus.

Upside risks are better-than-expected capital market conditions, lower-than-expected competition and faster-than-expected client growth.

Downside risks are stricter-than-expected regulations, large US/HK market correction and intensified competition.

美國銀行維持富途“買入”評級,因其多元化的市場敞口、強勁的客戶和資產管理規模增長,以及海外市場和新產品令人鼓舞的發展,同時將目標價從85.80美元下調5%至81.20美元。

富途預計將於8月底公佈24財年第二季度業績。美銀預計,在主要市場強勁的獲客推動下,富途將在24年第二季度繼續保持強勁的新付費客戶增長勢頭。

美銀指出了第二季度業績中值得關注的關鍵點:

1) 客戶/資產管理規模增長:強勁的增長勢頭是否會持續到第三季度?

1) 客戶/資產管理規模增長:強勁的增長勢頭是否會持續到第三季度?

2) 運營更新:香港市場和中國ADR的疲軟,以及納斯達克/“科技七巨頭”的回調是否導致交易不太活躍?

3) Airstar Bank:6月7日,富途宣佈已完成對香港持牌虛擬銀行Airstar Bank的4.4億港元投資,成爲間接持有該銀行44.11%股份的第二大實益擁有人。投資後的計劃和進展將成爲焦點。

上行風險:資本市場狀況好於預期、競爭低於預期以及客戶增長快於預期。

下行風險:監管比預期嚴格、美國/香港市場大幅回調以及競爭加劇。

1) 客戶/資產管理規模增長:強勁的增長勢頭是否會持續到第三季度?

1) 客戶/資產管理規模增長:強勁的增長勢頭是否會持續到第三季度?

1) Client/AUM growth: Will their strong growth momentum continue into 3Q?

1) Client/AUM growth: Will their strong growth momentum continue into 3Q?