Whales with a lot of money to spend have taken a noticeably bullish stance on Viking Therapeutics.

Looking at options history for Viking Therapeutics (NASDAQ:VKTX) we detected 39 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 30% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $81,740 and 36, calls, for a total amount of $1,562,212.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $20.0 to $100.0 for Viking Therapeutics over the recent three months.

Volume & Open Interest Development

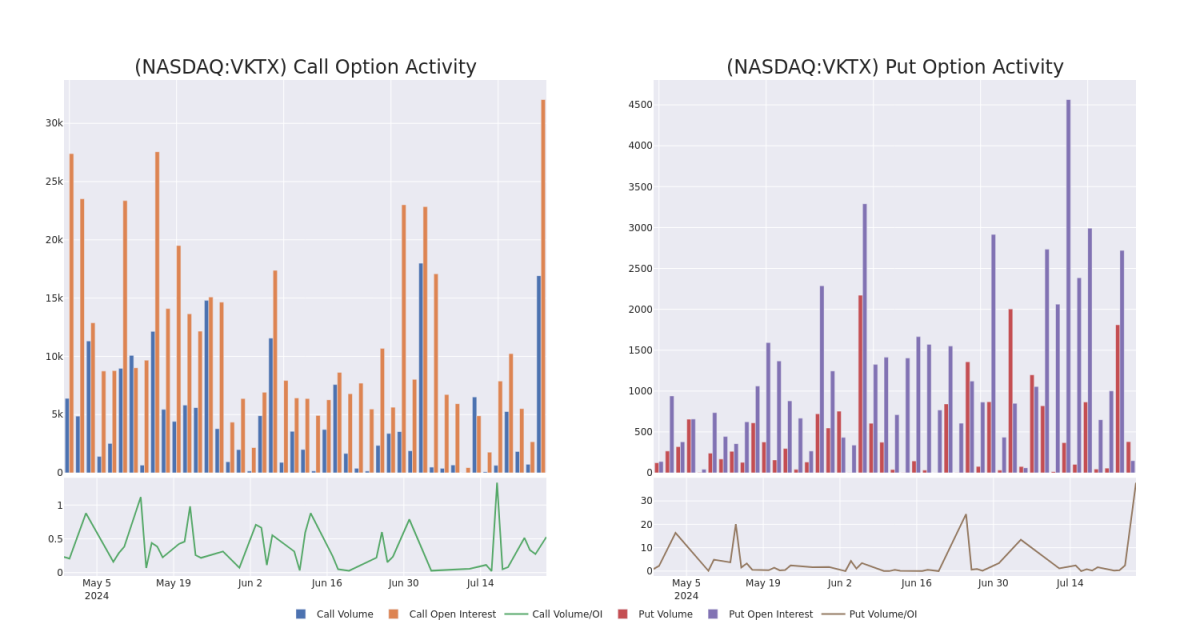

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Viking Therapeutics's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Viking Therapeutics's significant trades, within a strike price range of $20.0 to $100.0, over the past month.

Viking Therapeutics Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | CALL | TRADE | BEARISH | 09/20/24 | $3.0 | $2.5 | $2.5 | $100.00 | $124.5K | 2.4K | 36 |

| VKTX | CALL | SWEEP | BULLISH | 09/20/24 | $5.5 | $4.4 | $5.5 | $80.00 | $82.2K | 1.7K | 252 |

| VKTX | CALL | TRADE | BULLISH | 07/26/24 | $27.0 | $24.5 | $27.0 | $40.00 | $81.0K | 34 | 30 |

| VKTX | CALL | TRADE | BEARISH | 01/17/25 | $7.1 | $7.0 | $7.0 | $100.00 | $70.0K | 2.6K | 375 |

| VKTX | CALL | SWEEP | BULLISH | 08/16/24 | $6.3 | $6.0 | $6.3 | $65.00 | $63.0K | 1.5K | 287 |

About Viking Therapeutics

Viking Therapeutics Inc is a healthcare service provider. The company specializes in the area of biopharmaceutical development focused on metabolic and endocrine disorders. The company's clinical program pipeline consists of VK2809, VK5211, VK0214 products. VK2809 and VK0214 are orally available, tissue and receptor-subtype selective agonists of the thyroid hormone receptor beta. VK5211 is an orally available, non-steroidal selective androgen receptor modulator.

Present Market Standing of Viking Therapeutics

- With a volume of 8,312,421, the price of VKTX is up 2.5% at $66.3.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 89 days.

What Analysts Are Saying About Viking Therapeutics

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $104.33333333333333.

- In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $90.

- Maintaining their stance, an analyst from Raymond James continues to hold a Strong Buy rating for Viking Therapeutics, targeting a price of $118.

- Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Overweight with a new price target of $105.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.