If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can do a lot better than that by buying good quality businesses for attractive prices. For example, the Adobe Inc. (NASDAQ:ADBE) share price is up 86% in the last five years, slightly above the market return. Also positive is the 17% share price rise over the last year.

The past week has proven to be lucrative for Adobe investors, so let's see if fundamentals drove the company's five-year performance.

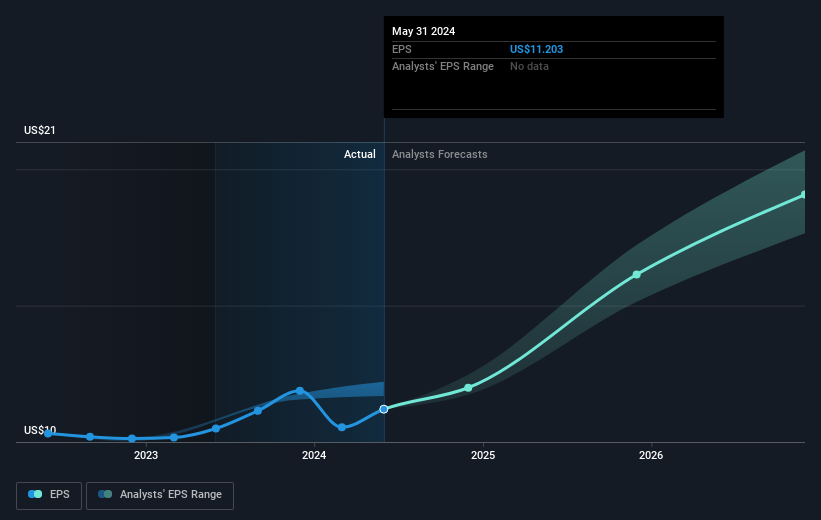

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, Adobe managed to grow its earnings per share at 16% a year. The EPS growth is more impressive than the yearly share price gain of 13% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

NasdaqGS:ADBE Earnings Per Share Growth July 4th 2024

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Adobe provided a TSR of 17% over the last twelve months. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 13% per year over five year. It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Adobe that you should be aware of before investing here.

But note: Adobe may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.