Tech, AI Drive $12.2B Inflows Into Growth ETFs, Marking Record Outperformance Over Value

Tech, AI Drive $12.2B Inflows Into Growth ETFs, Marking Record Outperformance Over Value

Exchange-traded funds (ETFs) focused on growth equities – characterized by robust revenue growth, high valuations, and strong potential for innovation – experienced elevated inflows in June.

6月份以來,聚焦於營業收入快速增長、估值高、創新潛力強的成長股的交易所交易基金(etf)吸引了大量資金流入。

This surge in interest towards growth-linked funds coincided with a significant outperformance of growth over value stocks, reflecting increased investor confidence in the tech sector and disruptive innovations like artificial intelligence.

對成長股基金興趣的激增,與成長股相比價值股表現不佳有關,反映了投資者對科技板塊和人工智能等顛覆性創新的信懇智能上升。

The eight largest growth-linked ETFs by assets under management (AUM) collectively experienced a substantial $12.2 billion in inflows from the beginning of the month through June 24.

按資產管理規模排序的8只最大的成長股etf總共吸引了122億美元的大量資金流入,時間區間爲本月初至6月24日。

Leading the pack, the Vanguard Growth ETF (NYSE:VUG) saw the highest monthly inflows among its peers, attracting an impressive $5.68 billion. This remarkable figure is set to mark the Vanguard Growth ETF's record monthly inflows, ranking second in June only to the nearly $10 billion attracted by the broader iShares Core S&P 500 ETF (NYSE:IVV).

在這些基金中,成長股etf-vanguard是領頭羊,相比同類產品在6月份漲了最多,吸引了驚人的56.8億美元資金流入,這一出色表現是成長股etf-vanguard的創紀錄的月度資金淨流入,僅次於黑巖標普500 etf (nyse:ivv)吸引的近100億美元流入。

| Growth ETF | AUM | June Flows (as of June 24) |

|---|---|---|

| Total | $12.2B | |

| Vanguard Growth ETF | $139.84B | $5.68B |

| IShares Russell 1000 Growth ETF (NYSE:IWF) | $97.00B | $0.03B |

| IShares S&P 500 Growth ETF (NYSE:IVW) | $52.96B | $4.01B |

| Schwab U.S. Large-Cap Growth ETF (NYSE:SCHG) | $30.62B | $0.44B |

| SPDR Portfolio S&P 500 Growth ETF (NYSE:SPYG) | $29.40B | $0.47B |

| Vanguard Mega Cap Growth ETF (NYSE:MGK) | $22.39B | $1.08B |

| Vanguard Russell 1000 Growth ETF (NYSE:VONG) | $20.81B | $0.08B |

| IShares Core S&P U.S. Growth ETF (NYSE:IUSG) | $18.94B | $0.15B |

| Vanguard Small-Cap Growth ETF (NYSE:VBK) | $17.25B | $0.26B |

| 成長股etf | 資產管理規模 | 6月資金流向 (截至6月24日) |

|---|---|---|

| 總費用 | 122億美元 | |

| 成長股etf-vanguard | $139.84B | $5.68B |

| 羅素1000成長指數etf-ishares (NYSE:IWF) | $97.00B | $0.03B |

| 標普500成長指數etf-ishares(NYSE:IVW) | $52.96B | $4.01B |

| 查布美國大型成長股ETF (NYSE:SCHG) | $30.62B | 440百萬美元 |

| SPDR組合標普500成長股票ETF(NYSE:SPYG) | 2940億美元 | 470百萬美元 |

| 大型成長股ETF-Vanguard (NYSE:MGK) | 2239億美元 | 108百萬美元 |

| 羅素1000成長指數ETF-Vanguard (NYSE:VONG) | 2081億美元 | 8百萬美元 |

| iShares Core S&P美國成長ETF (NYSE:IUSG) | 1894億美元 | 15百萬美元 |

| 小盤成長股ETF-Vanguard (NYSE:VBK) | 1725億美元 | 26百萬美元 |

Growth Stocks Surge To Record Highs Against Value

成長股票創下對價值股票的創紀錄高峰

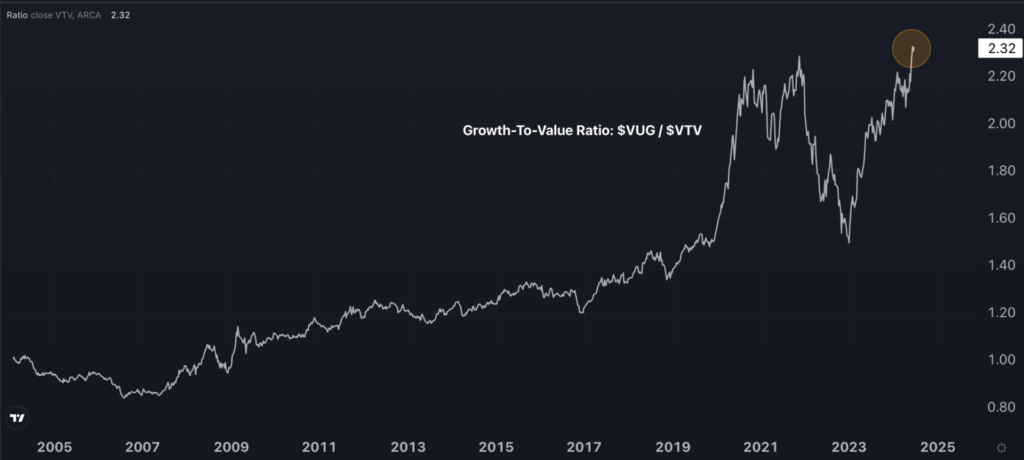

The Vanguard Growth ETF's relative performance against its counterpart, the Vanguard Value ETF (NYSE:VTV), set new record highs in June, surpassing the previous peaks achieved in November 2021, as illustrated in the chart below, sourced from Benzinga Pro.

該指數來源於Benzinga Pro,圖表顯示,Vanguard Growth ETF與其對手Vanguard Value ETF (NYSE:VTV) 相對錶現在6月份創下了新高,超過了2021年11月的歷史峯值。

The primary drivers of the growth style's outperformance in June were tech giants Nvidia Corp. (NASDAQ:NVDA) and Apple Inc. (NASDAQ:AAPL), which saw robust rallies of 15% and 8.8%, respectively.

六月成長股票風格表現的主要推動力來自技術巨頭Nvidia Corp. (NASDAQ:NVDA)和Apple Inc. (NASDAQ:AAPL),分別實現了15%和8.8%的強勁上漲。

- Growth Stocks Leave Value Stocks In The Dust: 4 Reasons For Biggest Monthly Lead In Over A Year

- 成長型股票表現遠超價值型股票:超過一年來的最大月度領先的4個原因

Image generated using artificial intelligence via Midjourney.

這張圖片是通過Midjourney使用人工智能生成的。

譯文內容由第三人軟體翻譯。

Leading the pack, the Vanguard Growth ETF (NYSE:VUG) saw the highest monthly inflows among its peers, attracting an impressive $5.68 billion. This remarkable figure is set to mark the Vanguard Growth ETF's record monthly inflows, ranking second in June only to the nearly $10 billion attracted by the broader iShares Core S&P 500 ETF (NYSE:IVV).

Leading the pack, the Vanguard Growth ETF (NYSE:VUG) saw the highest monthly inflows among its peers, attracting an impressive $5.68 billion. This remarkable figure is set to mark the Vanguard Growth ETF's record monthly inflows, ranking second in June only to the nearly $10 billion attracted by the broader iShares Core S&P 500 ETF (NYSE:IVV).