Some Confidence Is Lacking In Bandwidth Inc. (NASDAQ:BAND) As Shares Slide 26%

Some Confidence Is Lacking In Bandwidth Inc. (NASDAQ:BAND) As Shares Slide 26%

Bandwidth Inc. (NASDAQ:BAND) shares have had a horrible month, losing 26% after a relatively good period beforehand. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 25%.

Bandwidth公司(NASDAQ:BAND)的股票經歷了一個可怕的月份,在此之前,該公司經歷的是一個相對不錯的時期,股價下跌了26%。回顧過去12個月,儘管如此,該股仍是表現不錯的股票,漲幅達25%。

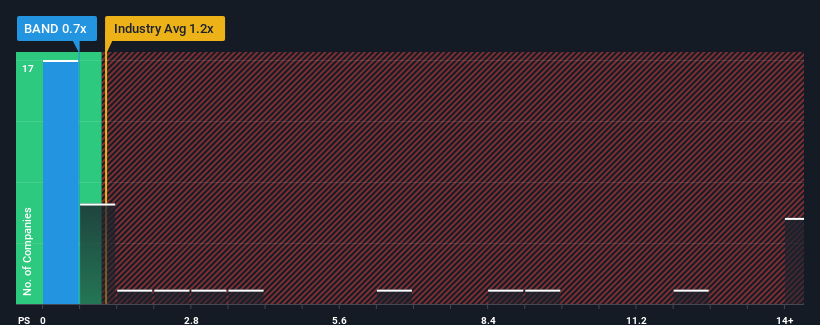

Although its price has dipped substantially, there still wouldn't be many who think Bandwidth's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in the United States' Telecom industry is similar at about 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

雖然它的價格大幅下跌,但在美國電信行業中位數市銷率約爲1.2倍時,Bandwidth的市銷率(或“P/S”)0.7倍還是不值一提。然而,如果沒有市銷率的合理基礎,投資者可能會忽略一個明顯的機會或潛在的風險。

NasdaqGS:BAND Price to Sales Ratio vs Industry June 22nd 2024

NasdaqGS:BAND 市銷率與行業板塊之比 2024 年 6 月 22 日

What Does Bandwidth's P/S Mean For Shareholders?

Bandwidth的市銷率對股東意味着什麼?

Bandwidth certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Bandwidth最近做得很好,營業收入增長爲正,而大多數其他公司的營業收入卻在下降。也許市場預計其目前的強勁表現將隨着行業的其餘部分而逐漸減弱,這使市銷率得以保持在一個較穩定的水平。如果是這樣的話,那麼現有股東有理由對股價未來的走向感到樂觀。

Want the full picture on analyst estimates for the company? Then our free report on Bandwidth will help you uncover what's on the horizon.

想了解該公司分析師預測的全面情況嗎?我們的Bandwidth免費報告將幫助您揭示未來的前景。

Is There Some Revenue Growth Forecasted For Bandwidth?

Bandwidth 是否有營收增長預測?

The only time you'd be comfortable seeing a P/S like Bandwidth's is when the company's growth is tracking the industry closely.

唯一讓您對類似於Bandwidth的市銷率感到滿意的時間是,當公司的增長跟蹤行業非常接近。

Retrospectively, the last year delivered a decent 9.4% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 63% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

回顧過去一年,公司營收增長率達到了不錯的9.4%。這在前一個過程中得到了支持,過去三年中總營收增長爲63%。因此,我們可以確認該公司在增長營收方面做得非常好。

Turning to the outlook, the next year should generate growth of 14% as estimated by the eight analysts watching the company. With the industry predicted to deliver 89% growth, the company is positioned for a weaker revenue result.

轉向展望,明年將有8位分析師預測該公司將會增長14%。隨着預測該行業將實現89%的增長,該公司的營收表現較差。

With this in mind, we find it intriguing that Bandwidth's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

考慮到這一點,我們發現Bandwidth的市銷率與其行業同行相當接近。顯然,該公司的許多投資者比分析師所表明的要看淡,暫時不願放棄股票。然而,隨着收入增長水平的上升,維持這些價格將很難實現,最終可能會壓低股票價格。

The Final Word

最終結論

Bandwidth's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Bandwidth的股票價格暴跌使其市銷率回到了與行業其他公司相似的區域。雖然市銷率不應該成爲您是否購買股票的決定性因素,但它確實是一種很好的衡量收入預期的方法。

When you consider that Bandwidth's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

考慮到Bandwidth的營收增長預測與整個行業相比相對較低,很容易看出爲何我們認爲其當前的市銷率比較出乎意料。目前,我們對市銷率並不自信,因爲預測的未來營收不太可能長期支撐更積極的情緒。這將會使股東的投資風險增加,潛在投資者也有被要求支付不必要的溢價之嫌。

We don't want to rain on the parade too much, but we did also find 3 warning signs for Bandwidth that you need to be mindful of.

我們不想太多地打擊您的信心,但我們還發現了Bandwidth的3個警告信號,您需要注意。

If these risks are making you reconsider your opinion on Bandwidth, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果這些風險讓您重新考慮對Bandwidth的看法,請查看我們的高質量股票互動名單,以了解其他投資機會。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?關注內容?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有反饋? 對內容感到擔憂? 請直接與我們聯繫。 或者,發送電子郵件至editorial-team@simplywallst.com。

譯文內容由第三人軟體翻譯。