Risks To Shareholder Returns Are Elevated At These Prices For Cisco Systems, Inc. (NASDAQ:CSCO)

Risks To Shareholder Returns Are Elevated At These Prices For Cisco Systems, Inc. (NASDAQ:CSCO)

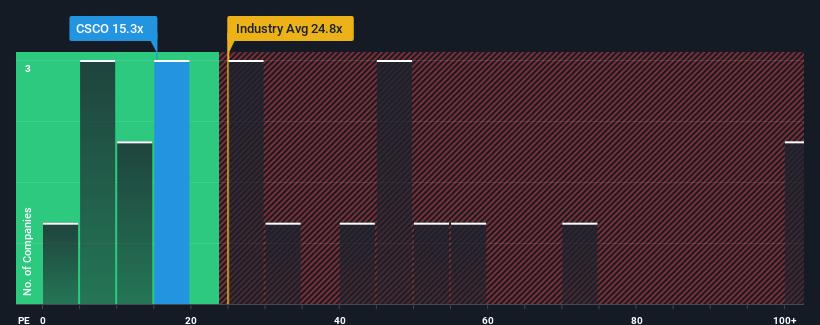

There wouldn't be many who think Cisco Systems, Inc.'s (NASDAQ:CSCO) price-to-earnings (or "P/E") ratio of 15.3x is worth a mention when the median P/E in the United States is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

想到思科系統公司的人不會很多。”s(納斯達克股票代碼:CSCO)市盈率(或 “市盈率”)爲15.3倍,值得一提,因爲美國的市盈率中位數相似,約爲17倍。但是,如果市盈率沒有合理的基礎,投資者可能會忽略明顯的機會或潛在的挫折。

With its earnings growth in positive territory compared to the declining earnings of most other companies, Cisco Systems has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

與大多數其他公司的收益下降相比,思科系統公司的收益增長處於正值區間,最近表現良好。一種可能性是市盈率適中,因爲投資者認爲公司未來的收益彈性將降低。如果你喜歡這家公司,你希望情況並非如此,這樣你就有可能在它不太受青睞的情況下買入一些股票。

NasdaqGS:CSCO Price to Earnings Ratio vs Industry June 19th 2024

NasdaqGS: CSCO 對比行業的市盈率 2024 年 6 月 19 日

Keen to find out how analysts think Cisco Systems' future stacks up against the industry? In that case, our free report is a great place to start.

想了解分析師如何看待思科系統的未來與行業對立嗎?在這種情況下,我們的免費報告是一個很好的起點。

Is There Some Growth For Cisco Systems?

思科系統有增長嗎?

Cisco Systems' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

思科系統的市盈率對於一家預計只會實現適度增長且重要的是表現與市場保持一致的公司來說是典型的。

Retrospectively, the last year delivered a decent 7.0% gain to the company's bottom line. The solid recent performance means it was also able to grow EPS by 24% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

回顧過去,去年的公司利潤實現了7.0%的可觀增長。最近的穩健表現意味着它在過去三年中還能夠將每股收益總共增長24%。因此,股東可能會對中期收益增長率感到滿意。

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 1.2% per year over the next three years. With the market predicted to deliver 10% growth each year, that's a disappointing outcome.

展望未來,報道該公司的分析師的估計表明,收益增長將進入負值區間,未來三年每年下降1.2%。預計市場每年將實現10%的增長,這是一個令人失望的結果。

With this information, we find it concerning that Cisco Systems is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

有了這些信息,我們發現思科系統的交易市盈率與市場相當相似。顯然,該公司的許多投資者拒絕了分析師群體的悲觀情緒,並且不願意立即放棄股票。如果市盈率降至更符合負增長前景的水平,這些股東很有可能爲未來的失望做好準備。

What We Can Learn From Cisco Systems' P/E?

我們可以從思科系統的市盈率中學到什麼?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

有人認爲,市盈率是衡量某些行業價值的次要指標,但它可能是一個有力的商業情緒指標。

Our examination of Cisco Systems' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

我們對思科系統分析師預測的審查顯示,其收益萎縮的前景對市盈率的影響沒有我們預期的那麼大。當我們看到前景不佳,收益倒退時,我們懷疑股價有下跌的風險,從而使溫和的市盈率走低。這使股東的投資處於風險之中,潛在投資者面臨支付不必要的溢價的危險。

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Cisco Systems that you should be aware of.

別忘了可能還有其他風險。例如,我們已經確定了 Cisco Systems 的 1 個警告標誌,您應該注意這一點。

Of course, you might also be able to find a better stock than Cisco Systems. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

當然,你也可以找到比思科系統更好的股票。因此,你不妨免費查看其他市盈率合理且收益強勁增長的公司。

譯文內容由第三人軟體翻譯。