Top 2 Utilities Stocks That May Rocket Higher In June

Top 2 Utilities Stocks That May Rocket Higher In June

The most oversold stocks in the utilities sector presents an opportunity to buy into undervalued companies.

公用事業板塊中最超賣的股票提供了買進低估公司的機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

National Grid plc (NYSE:NGG)

National Grid plc(紐交所:NGG)

- On May 23, National Grid reported an equity raise of £7 billion and a year-over-year decrease in full-year revenue results. John Pettigrew, Chief Executive, said, "Alongside our new five-year financial framework, we are also today further evolving our strategy to focus on networks and will therefore be streamlining our business as we announce our intention to sell Grain LNG, our UK LNG asset, and National Grid Renewables, our US onshore renewables business." The company's stock fell around 22% over the past month and has a 52-week low of $55.13.

- RSI Value: 28.78

- NGG Price Action: Shares of National Grid fell 1.8% to close at $55.50 on Tuesday.

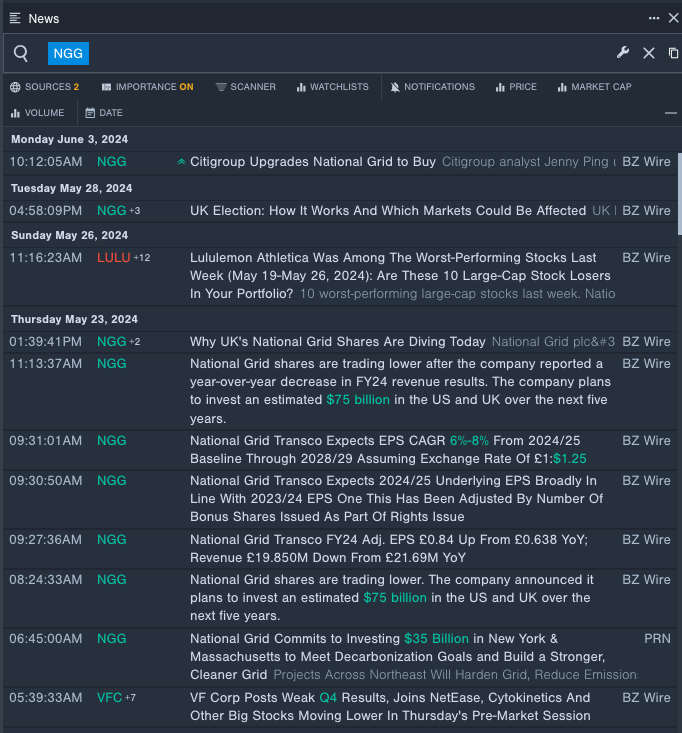

- Benzinga Pro's real-time newsfeed alerted to latest National Grid's news.

- 5月23日,National Grid宣佈股權發行籌集了70億英鎊,全年營業收入同比下降。首席執行官約翰·佩蒂格魯表示:“在我們新的五年財務框架的同時,我們今天還進一步調整了我們的策略,專注於網絡,並將因此簡化我們的業務,並宣佈打算出售我們的英國LNG資產——Grain LNG和我們的美國陸上可再生能源業務——National Grid Renewables。”該公司股價在過去一個月內下跌約22%,52周最低價爲55.13美元。

- RSI值:28.78

- NGG價格走勢:週二,National Grid的股價下跌1.8%,收於55.50美元。

- Benzinga Pro的實時新聞提醒您National Grid的最新消息。

Pure Cycle Corporation (NASDAQ:PCYO)

Pure Cycle(納斯達克股票代碼:PCYO)

- On April 10, Pure Cycle posted an increase in quarterly sales. "Due to the continued success of our Sky Ranch Master Planned community, we have three phases of lot development now under construction accelerating the timing of delivering our lots to our home builder customers as well as lots for our single-family rental segment. As we complete final landscaping in Phase 2A, lot production through our seasonally slow winter months will see accelerated deliveries in the remaining half of our fiscal year with completion of approximately 211 lots in Phase 2B and substantial progress on our overlapping production of 228 lots in Phase 2C" commented Mark Harding, CEO of Pure Cycle. The company's stock fell around 4% over the past month. It has a 52-week low of $9.00.

- RSI Value: 21.49

- PCYO Price Action: Shares of Pure Cycle rose 0.9% to close at $9.23 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in Pure Cycle's stock.

- 4月10日,Pure Cycle公佈季度銷售額增加。 Pure Cycle的首席執行官馬克·哈丁(Mark Harding)評論說:“由於Sky Ranch Master Planned社區的持續成功,我們現在正在建造三個批次的地段開發,加速將地段交付給我們的住房建築商客戶以及土地的單戶租賃部分。當我們完成第2A階段的最終景觀時,我們在本財年剩餘的半年將加速交付大約211個地段,並且在我們重疊的第2C階段的228個地段的生產上有實質性進展。”該公司股價在過去一個月內下跌約4%,52周最低價爲9.00美元。

- RSI值:21.49

- PCYO價格走勢:週二,Pure Cycle的股價上漲0.9%,收於9.23美元。

- Benzinga Pro的圖表工具有助於識別Pure Cycle股票的趨勢。

Also Check This Out: S&P 500, Nasdaq Hit Record Highs As Apple Shares Surge: Fear And Greed Index Shows Progress Amid Improving Market Sentiment

還請查閱:隨着蘋果股價暴漲,標普500,納斯達克創歷史新高:恐懼與貪婪指數顯示市場情緒正在好轉。

譯文內容由第三人軟體翻譯。