長期看好

選舉結果可能不及預期,印度股債匯市場遭遇三殺。

截至發稿,印度SENSEX指數一度大跌超5%,印度國有企業的股價暴跌。

印度國家銀行股價跌幅高達15%,印度國家火電公司NTPC跌15%,巴拉特電子跌20%,印度電網公司Power Grid跌15%,非銀金融公司PFC跌20%,印度煤炭公司Coal India跌15%。追蹤國有企業的BSE PSU指數跌幅高達14%。

印度VIX恐慌指數跳漲34%,爲2022年2月以來最大單日漲幅。

印度盧比兌美元在前一交易日上漲後,創下10個月來最大跌幅。

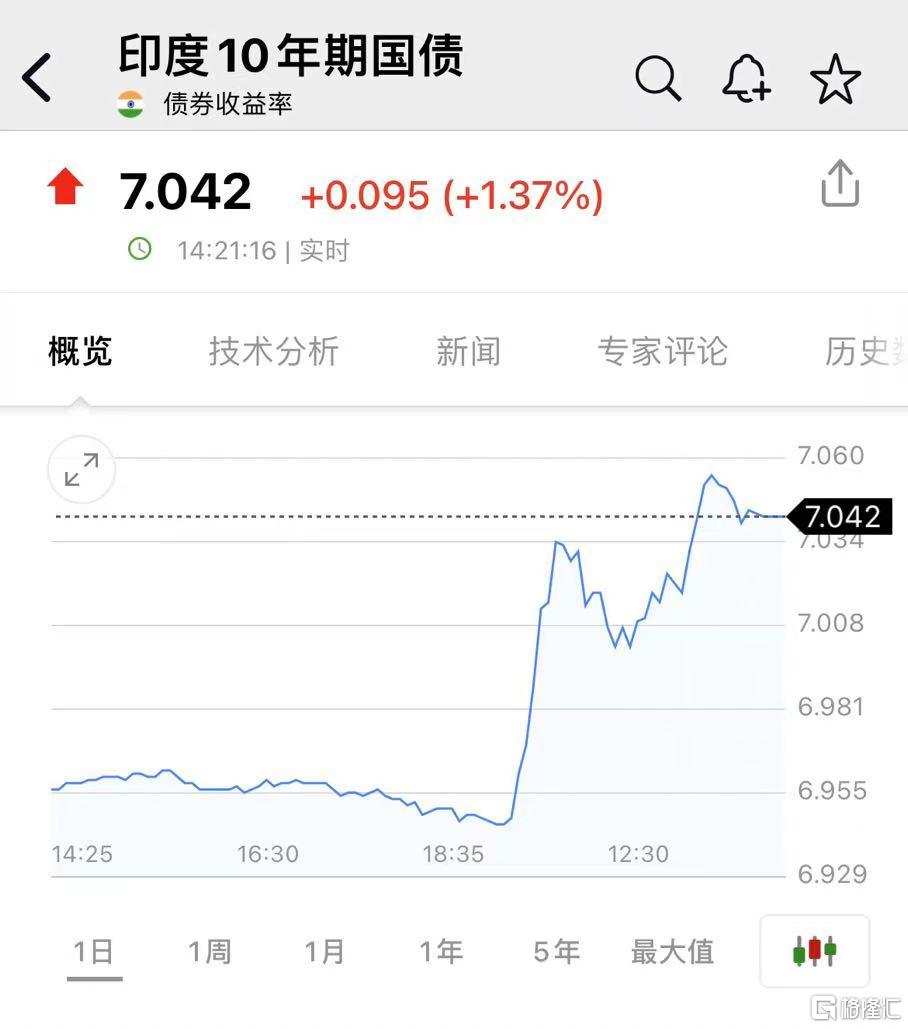

印度10年期國債收益率上漲1.37%,至7.042%。

國內ETF市場上,印度基金LOF(164824)大跌2.37%,最新淨值1.522,成交額5.86億元。

市場漲過頭了?

今日,印度選舉計票已經開始。此前公佈的民調顯示,現任總理莫迪所在黨派將以壓倒性的優勢獲勝,獲得的席位將達到350至400個。

在此預期下,昨日印度股市大漲,NIFTY指數創下三年來最大漲幅,盧比也創下今年以來的最大漲幅。

今日早些時候,印度電視頻道顯示,在早期計票中,莫迪政黨在543個選舉席位中獲得近300個席位,儘管取得了多數席位,但這一數字遠低於民調預測的壓倒性優勢。這就導致了印度資本市場的殺跌。

需要注意的是,電視頻道報道,當時只有大約10%-15%的選票被統計出來。

目前來看,市場已經基本定價了莫迪大選獲勝,當下的拉鋸點在於獲勝優勢到底有多大。

有分析師認爲,金融市場已經消化了莫迪連任的預期,週一的反彈有些過度。

Fintrekk Capital的首席投資官Amit Kumar Gupta表示:“市場預計印度人民黨領導的聯盟將贏得400個席位,但目前看來不會出現這種情況。投資者有點緊張,這種情況將持續幾個小時,直到(該黨)領先地位穩固。”

研究員Siddhartha khemka表示:

“如果全國民主聯盟(NDA)獲得330-340個席位,市場會很高興,但目前的結果顯然遠低於市場的舒適水平,這就是導致一些恐慌和擔憂的原因。”

“說實話,這些趨勢都是早期的。市場不希望出現割裂的議會,因爲那樣會導致很多決策上的延誤。”

此外,經過前期的上漲,印度股市的估值已經不低了。據彭博數據,印度股票的預期市盈率比十年的平均水平還高出一個標準差以上。

Target Investing的創始人Sameer Kalra表示:“印度股市的市值與GDP之比達到140%。如果未來政策舉措存在一些不確定性,可能會出現重大調整。”

選舉結果到底意味着什麼?

影響上,分析師認爲,印度此次選舉的結果將關係着印度改革接下來的推行情況。

Emkay Global首席經濟學家Madhavi arora認爲:“獲勝的幅度可能決定下一階段土地、勞動力和資本改革的力度。即將到來的預算將變得更加重要,特別是在資本支出和收入的組合方面。”

Sharekhan的資本市場戰略主管Gaurav dua認爲,如果莫迪的競爭黨派獲勝,它們可能會阻礙到莫迪推行結構性改革。

在昨天的文章中,我們分析了印度資本市場近期迎來了幾大利好,且印度經濟增長依然強勁,再加上莫迪選舉獲勝已成定局,印度未來將繼續推行改革。

因此,長期來看,分析師還是非常看好印度市場。

Federated Hermes的投資經理Vivek Bhutoria表示:“印度正在制定吸引投資的政策,隨着時間的推移,全球供應鏈的重新調整將使印度受益,我們已經開始看到電子產品和化學品出口上的受益。”

Balfour Capital的首席投資官Steve Lawrence認爲,印度的投資重點是基礎設施:道路和電力。