KeyCorp's (KEY) Restructuring Initiatives Aid Amid High Costs

KeyCorp KEY remains well-positioned for top-line growth on the back of opportunistic buyouts, restructuring initiatives, solid loans and deposit balances and higher rates, while funding costs weigh on it to some extent. Elevated expenses and weakening asset quality remain concerns.

KEY’s impressive loan growth has contributed to top-line expansion over the past several years. Though tax-equivalent (TE) revenues dipped in 2023 and in the first quarter of 2024, the metric experienced a compound annual growth rate (CAGR) of 0.3% over the last six years ended 2023.

Loans and deposits witnessed a CAGR of 4.3% and 6.8% over the four-year period ended 2023, respectively. While loans declined, deposits witnessed year-over-year growth in the first quarter of 2024. Decent loan demand, alongside the company’s initiatives to boost fee income, is likely to bolster top-line growth. While we project total revenues (TE) to experience a slight dip in 2024, the metric is expected to recover in 2025 and 2026, with growth of 10.3% and 5.7%, respectively.

The Federal Reserve is likely to keep interest rates high in the near term. Amid the high-rate scenario and decent loan growth, KeyCorp’s net interest margin (NIM) is likely to grow while higher funding costs will weigh on it. Though the metric declined in 2023 and in the first quarter of 2024, affected by high funding costs, it is expected to improve in the near term on account of higher rates. We estimate NIM to be 2.20%, 2.49% and 2.56% in 2024, 2025 and 2026, respectively.

Furthermore, KeyCorp’s business restructuring initiatives are encouraging. The company acquired GradFin in 2022 in order to solidify its digital offering capabilities. Similarly, in 2021, it acquired XUP Payments, a B2B-focused digital platform, and AQN Strategies, a data analytics-driven consultancy firm.

These buyouts and expansion initiatives are likely to further KeyCorp’s revenue diversification and market share. The company remains optimistic about pursuing such opportunistic buyouts.

Moreover, KeyCorp has been consolidating its branch network to address the rising demand for digital banking services, with management seeking opportunities to expand its footprint in strategically lucrative locations. Thus, the company’s fee income growth is likely to continue going forward. We project total non-interest income to witness growth of 6.7%, 4.8% and 4.7% in 2024, 2025 and 2026, respectively.

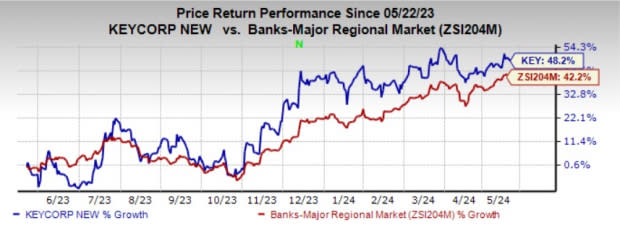

KeyCorp currently carries a Zacks Rank #3 (Hold). Over the past year, shares of the company have rallied 48.2%, outperforming the industry’s growth of 42.2%.

Image Source: Zacks Investment Research

Nonetheless, KeyCorp’s escalating expense base remains a challenge. The metric experienced a 3.6% CAGR over the five years ended 2023. The increase was attributed to higher personnel costs. Though the trend reversed in the first quarter of 2024, overall costs are expected to remain high in the near term amid the ongoing investments in franchise, technological upgrades and inorganic growth initiatives. We estimate total non-interest expenses to rise 2.5% year over year in the second quarter of 2024.

Weak asset quality is another headwind for KEY. The volatile trend recorded by the company’s provisions and net-charge offs (NCOs) is a concern. While provisions dipped in 2023 and first-quarter 2024, NCOs continued to rise. A tough macroeconomic backdrop is likely to put pressure on asset quality going forward. Per our estimates, provisions are expected to decline in 2024, while NCOs are expected to rise 34.3% on a year-over-year basis.

Banking Stocks Worth Considering

Some better-ranked major bank stocks worth a look are Northern Trust Corporation NTRS and Wells Fargo & Company WFC, sporting a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks Rank #1 stocks here.

Estimates for NTRS’s current-year earnings have been revised marginally upward in the past month. The company’s shares have increased 10.9% over the past six months.

Estimates for WFC’s current-year earnings have been revised marginally upward in the past 30 days. The company’s shares have risen 41.9% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance