Datadog, Inc.'s (NASDAQ:DDOG) earnings announcement last week was disappointing for investors, despite the decent profit numbers. We did some digging and actually think they are being unnecessarily pessimistic.

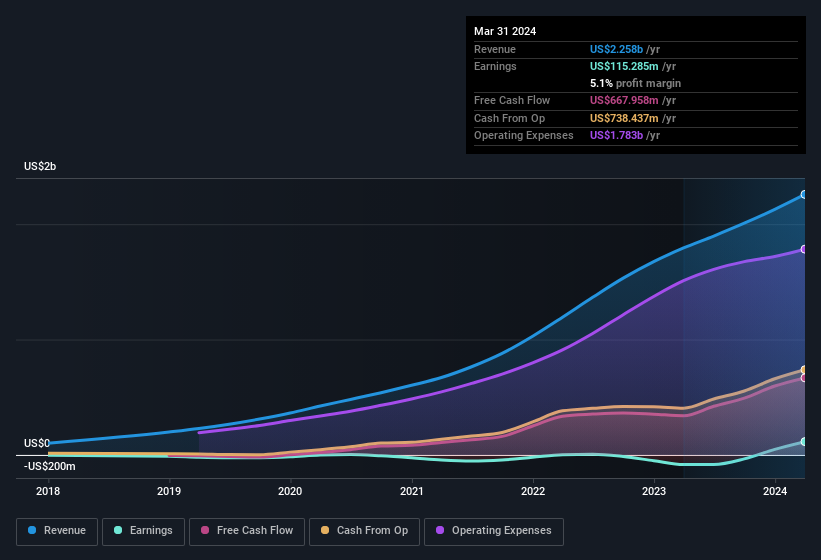

NasdaqGS:DDOG Earnings and Revenue History May 21st 2024

Zooming In On Datadog's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Datadog has an accrual ratio of -2.78 for the year to March 2024. Therefore, its statutory earnings were very significantly less than its free cashflow. To wit, it produced free cash flow of US$668m during the period, dwarfing its reported profit of US$115.3m. Datadog's free cash flow improved over the last year, which is generally good to see.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Datadog's Profit Performance

As we discussed above, Datadog's accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Because of this, we think Datadog's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about Datadog as a business, it's important to be aware of any risks it's facing. Case in point: We've spotted 2 warning signs for Datadog you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Datadog's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.