SAP's S/4HANA Cloud Used by NEC for Digital Transformation

SAP SE SAP announced that NEC Corporation has chosen SAP S/4HANA Cloud via the RISE with SAP solution on Amazon Web Services (AWS). NEC will utilize generative AI technology and SAP's Joule copilot to facilitate the migration.

NEC is a leading Japanese multinational in IT and network integration, which aims to cut costs and enhance data integration across its business units. To support its digital transformation, NEC will transition from on-premise SAP S/4HANA to SAP S/4HANA Cloud.

NEC will use generative AI to streamline migration costs and boost efficiency by transforming its system to a clean-core model. SAP's Joule copilot for natural language processing coupled with generative AI will automate essential tasks like add-on analysis, report interpretation and code generation.

SAP SE Price and Consensus

SAP SE price-consensus-chart | SAP SE Quote

The current migration aligns with NEC's 2025 mid-term management plan, which emphasizes digital transformation for internal processes, customers, and society. This will help NEC to minimize future upgrades and operational expenses.

Headquartered in Walldorf, Germany, SAP is one of the largest independent software vendors in the world and the leading provider of Enterprise Resource Planning (ERP) software.

In March, SAP announced its association with Deutsche Telekom DTEGY to bring digital transformation to the latter’s cloud infrastructure. DTEGY is deploying SAP’s RISE with SAP solution to upgrade a significant portion of its ERP landscape to SAP S/4HANA Cloud.

Growing trends in the company’s cloud business, especially the Rise with SAP and Grow with SAP solutions, are boosting its performance. Momentum in SAP’s business technology platform, particularly the S/4HANA solution, along with the proliferation of generative artificial intelligence (AI), bodes well.

SAP remains optimistic about the generative AI trend and expects it to positively impact revenues going forward. The company recently announced that it will be focusing on vital strategic growth areas, especially Business AI, and position the company for future growth.

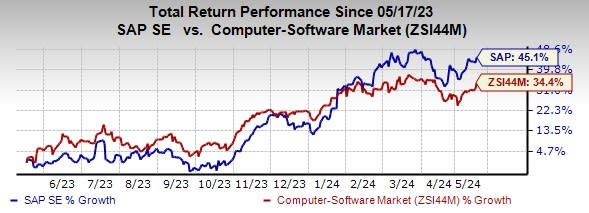

SAP currently carries a Zacks Rank #5 (Strong Sell). Shares of the company have gained 45.1% compared with the sub-industry’s growth of 34.4% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Woodward WWD and Arista Networks ANET. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 earnings per share (EPS) has moved up 9.3% in the past 60 days to $5.76. WWD’s long-term earnings growth rate is 16.3%.

Woodward’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 26.1%. WWD shares have risen 62% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 0.9% in the past 60 days to $7.53. ANET’s long-term earnings growth rate is 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 13.3%. Shares of ANET have gained 127.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SAP SE (SAP) : Free Stock Analysis Report

Deutsche Telekom AG (DTEGY) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance