Amgen's (AMGN) Tarlatamab Receives FDA Approval for SCLC

Amgen AMGN announced that the FDA has granted accelerated approval to tarlatamab for pre-treated advanced small cell lung cancer (ES-SCLC).

Tarlatamab is a delta-like ligand 3 targeting Bispecific T-cell Engager (BiTE) therapy, approved by the name of Imdelltra to treat ES-SCLC patients whose disease has progressed on or after treatment with platinum-based chemotherapy.

The approval comes a month ahead of the PDUFA date on Jun 12. With the approval, Imdelltra becomes the first DLL3-targeting BiTE therapy that activates the patient's own T cells to attack DLL3-expressing tumor cells. DLL3 is a protein that is expressed on the surface of SCLC cells in most patients.

The approval was based on an encouraging response rate and duration of response data from the phase II DeLLphi-301 study. The median overall survival in the study was 14.3 months, with 40% of patients responding to treatment with Imdelltra.

Per the company, SCLC patients often experience aggressive recurrences despite showing a strong response in first-line treatment, which adversely impacts long-term survival. Per Amgen, Imdelltra, which is a targeted bispecific therapy, marks a major advancement in the SCLC treatment paradigm.

Imdelltra’s label includes a Boxed Warning for "serious or life-threatening cytokine release syndrome (CRS) and neurologic toxicity.”

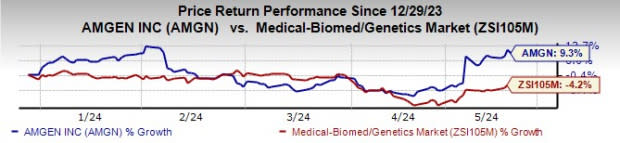

So far this year, Amgen’s stock has gained 9.3% against the industry‘s 4.2% decline.

Image Source: Zacks Investment Research

Imdelltra is Amgen’s second FDA-approved BiTE molecule, the first being Blincyto, which is approved for treating B-cell precursor acute lymphoblastic leukemia. Blincyto is a key contributor to Amgen’s top line and generated sales of $861 million in 2023, rising 48% year over year.

Several studies are currently ongoing on tarlatamab both as monotherapy and in combination in earlier line settings in SCLC that are likely to serve as confirmatory studies for full approval. It is also being evaluated for neuroendocrine prostate cancer in early-stage studies.

Zacks Rank

Amgen currently carries a Zacks Rank #3 (Hold).

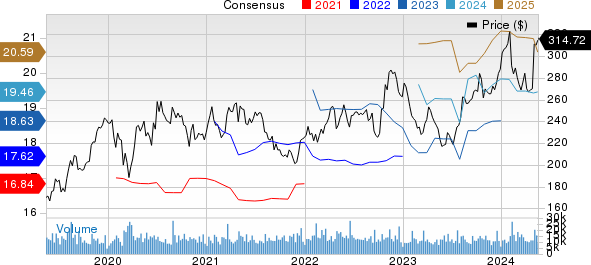

Amgen Inc. Price and Consensus

Amgen Inc. price-consensus-chart | Amgen Inc. Quote

Some better-ranked stocks from the drug/biotech industry are Ligand Pharmaceuticals LGND, ANI Pharmaceuticals ANIP and Annovis Bio ANVS, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, the Zacks Consensus Estimate for Ligand’s 2024 earnings per share has increased from $4.42 to $4.56. During the same time frame, the consensus estimate for Ligand’s 2025 earnings per share has increased from $5.11 to $5.27. Year to date, shares of LGND have gained 19.1%.

Ligand beat estimates in each of the trailing four quarters, delivering an average surprise of 56.02%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have risen from $4.43 to $4.44. During the same period, the consensus estimate for ANI Pharmaceuticals’ 2025 earnings per share has remained constant at $5.04. Year to date, shares of ANIP have climbed 15.7%.

ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering an average earnings surprise of 53.90%.

In the past 60 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.49 to $2.93. Year to date, shares of ANVS have plunged 57.0%.

ANVS beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average negative earnings surprise of 1.39%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance