Northrop (NOC) Rewards Shareholders With 10% Hike in Dividend

Northrop Grumman Corp. NOC recently announced that its board of directors approved a 10% hike in its quarterly dividend to $2.06 per share, marking the 21st consecutive annual dividend hike. The revised quarterly dividend is payable on Jun 10, 2024, to shareholders of record at the close of business on May 28.

Following the recent hike, Northrop will now pay out an annual dividend of $8.24 per share. This represents an annual dividend yield of 1.75% based on its share price worth $470.69 as of May 15.

NOC’s annualized dividend yield is higher than the Zacks S&P 500 composite’s yield of 1.27%. This signifies Northrop’s strength in the business to generate enough cash flow to reward shareholders with improved dividend payouts.

Can Northrop Grumman Sustain Dividend Hikes?

Northrop Grumman has been consistently boosting its shareholder returns, as is evident by its dividend payout worth $1,052 million and $1,116 million in 2022 and 2023, respectively. Such a solid distribution strategy is generally buoyed by the steady performance of a company in generating sales and stable cash flows from operations.

Notably, NOC recorded an 8.9% year-over-year increase in its sales in the last reported quarter. Its cash and cash equivalents came in at $3.06 billion at the end of the first quarter of 2024, which improved 22.7% from the prior-year quarter’s tally. Such solid cash balance and sales performances are likely to have enabled Northrop to enhance its dividend.

Along with dividend payments, NOC’s management continues to increase shareholder value by repurchasing shares. In the first quarter of 2024, the company repurchased shares worth $1.19 billion, compared to $0.72 billion repurchased in the first quarter of 2023.

It is imperative to mention in this context that Northrop Grumman’s business strength lies in the orders that it receives as one of the prime defense contractors, which converts into a robust backlog. Notably, the company exited first-quarter 2024 with a record backlog of $78.9 billion, backed by increasing demand and a rising global defense budget. This, in turn, shall boost NOC’s sales growth and cash flow in the coming quarters.

Going forward, Northrop Grumman expects to generate sales in the band of $40.80-$41.20 billion for 2024, suggesting an increase of 4.6% from the prior-year reported figure. The upside in sales should allow the company to fund notable dividend hikes in the days ahead.

Peer Moves

Here are some Defense companies that have been rewarding shareholders with impressive dividend payouts.

In October 2023, Lockheed Martin LMT approved a hike in its quarterly dividend of 15 cents per share, indicating an increase of 5% from the prior payout. This marks the company's 21st consecutive year of raising its dividends.

LMT boasts a long-term earnings growth rate of 4.2%. Shares of Lockheed have appreciated 4.3% in the past year.

On May 10, 2024, Curtiss-Wright CW announced that its board of directors had declared a 5% increase in the quarterly dividend to 21 cents per share. Moreover, the company authorized an additional $300 million for future share repurchases, increasing the total available authorization to $400 million.

The Zacks Consensus Estimate for Curtiss-Wright’s 2024 sales suggests growth rate of 6.1% from the prior-year reported figure. CW’s shares have rallied 67.8% in the past year.

On May 2, 2024, RTX Technologies RTX announced a dividend of 63 cents per, calling for an increase of 6.8% over the prior quarter's dividend amount. The dividend will be payable on Jun 13, 2024, to its shareholders.

RTX has a long-term earnings growth rate of 10.3%. Shares of Raytheon have increased 1.6% in the past year.

Price Movement

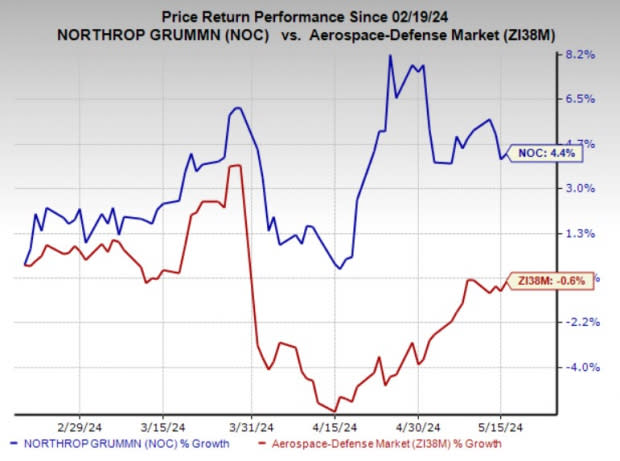

In the past three months, shares of Northrop Grumman have risen 4.4% compared with its industry‘s decline of 0.6%.

Image Source: Zacks Investment Research

Zacks Rank

Northrop Grumman currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Curtiss-Wright Corporation (CW) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance