Amazon Stock: Buy, Sell, or Hold?

From a certain point of view, growth investors might have good reason to move on from Amazon (NASDAQ: AMZN) stock. Its market cap now exceeds $1.9 trillion. Since large companies face greater challenges in achieving high-percentage growth, one might achieve higher long-term returns in a smaller e-commerce stock like MercadoLibre or Sea Limited.

Nonetheless, the majority of Amazon's income is from a business outside of e-commerce, and will likely continue to make Amazon a lucrative buy -- even for growth investors.

Amazon's growth technology

Amazon stock should continue to grow thanks to artificial intelligence (AI). That may come as a surprise to most consumers who knkow Amazon as an e-commerce company. Still, online retail is a low-margin business, and it is possible that ancillary businesses such as third-party seller services, subscriptions, and digital advertising are what keep its e-commerce-driven segments profitable from an operational standpoint.

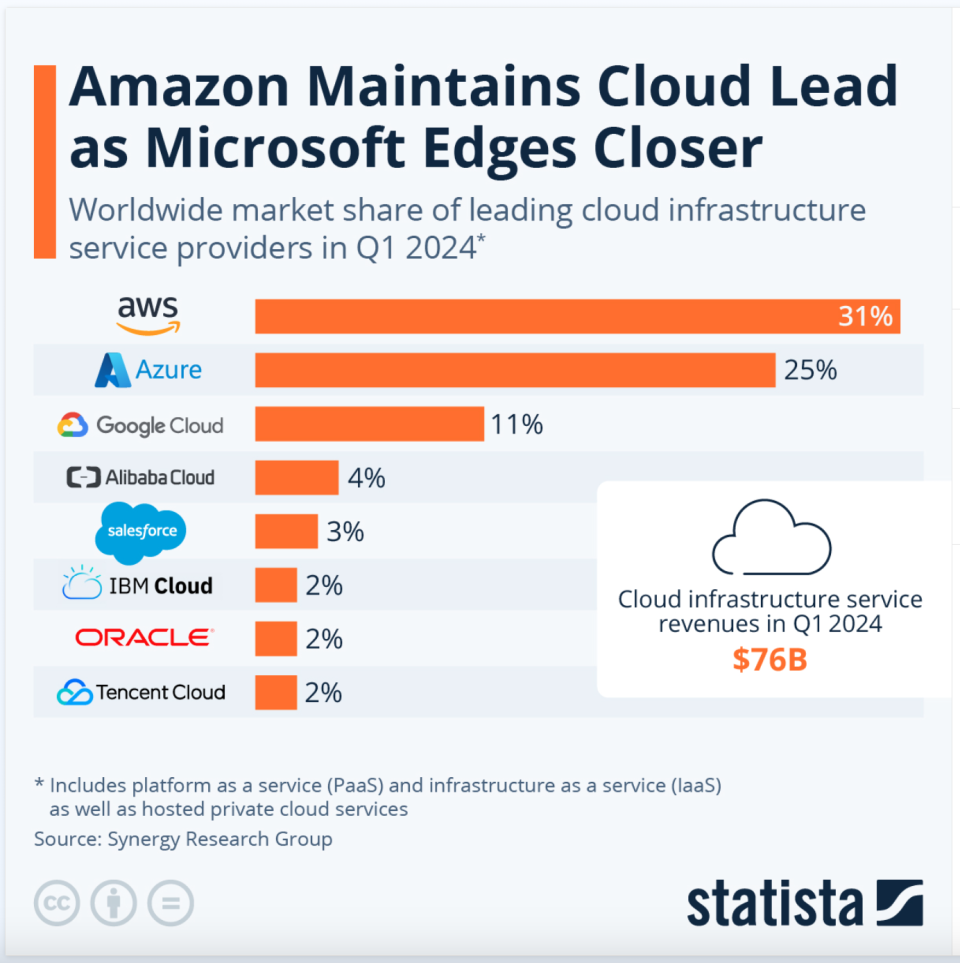

Instead, the majority of Amazon's operating income comes from its cloud computing arm, Amazon Web Services (AWS). This remains the case even though AWS makes up only about 17% of the company's net sales.

As the leading cloud company, it provides a critical role in supporting AI applications for its customers, making it a leader in the technology. Customers can use Amazon's AI to better interact with customers, increase productivity, improve process optimization, and help create content.

One of the more notable moves is its recent $4 billion investment into Anthropic. This company, founded by former OpenAI employees, could bring new business leads to AWS and help it train its generative AI models.

This is critical since Amazon has entered the AI chip market. While it is unlikely to challenge Nvidia's dominance in this area, it could help reinforce Amazon's market share lead in the cloud, further increasing the company's profits.

Also, it holds $85 billion in liquidity and does not pay a dividend. This gives it the financial resources necessary to stay on top of its industry through either innovation or acquisition.

Amazon's financials

Additionally, Amazon's financials appear solid even without this deal. In the first quarter of 2024, net sales totaled $143 billion, 13% higher than last year.

However, as mentioned before, AWS benefits from significantly higher operating margins, 31% in the first quarter versus 5% for the North America segment and -0.4% for international on a year-over-year basis. Consequently, over $9 billion of Amazon's $15 billion in operating income came from AWS.

Moreover, net income surged to more than $10 billion, up from $3 billion in the year-ago quarter. Admittedly, it is still recovering from losses in the 2022 bear market. Also, Amazon limited the growth of costs and expenses to 4%, allowing profits to surge.

The optimism and improving financials helped the stock rise by almost 70% over the last year. Furthermore, its P/E ratio has fallen to 52 despite that growth, a testament to massive profit growth and mild multiple compression. Thus, even with its enormous size, it generates considerable growth at a reasonable cost.

Consider Amazon

The cloud and AI have kept Amazon a growth stock. Although online retailing yields low margins, it keeps Amazon's name in the public eye and makes it one of the leading retailers in the U.S. and much of the world.

However, its high-margin cloud and AI services are a lucrative profit driver, giving it a growth rate resembling that of a much smaller company. As long as it leverages its cloud leadership and vast financial resources, investors should continue yielding market-beating returns from the conglomerate.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $579,803!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Will Healy has positions in MercadoLibre and Sea Limited. The Motley Fool has positions in and recommends Amazon, MercadoLibre, Nvidia, and Sea Limited. The Motley Fool has a disclosure policy.

Amazon Stock: Buy, Sell, or Hold? was originally published by The Motley Fool