Can veteran Zhang Wenzhong lead Dmall to break through Hong Kong stock IPOs three times?

Zhang Wenzhong, a 62-year-old business legend in the retail industry, will once again lead a company to a Hong Kong stock IPO this year.

Recently, Beijing Duodian Digital Intelligence Co., Ltd. Dmall Inc. (hereinafter referred to as “Dmall Dmall”) submitted a prospectus to the Hong Kong Stock Exchange to be listed on the Hong Kong Main Board for an IPO. UBS Group, CMB International, and China Merchants Securities International are co-sponsors. The company previously submitted the forms twice in December 2022 and June 2023.

According to the prospectus, Zhang Wenzhong held about 58.36% of the shares in the Dmall pre-listing structure through several entities. CelestialLimited, which he controls, holds 49.19%, Odor Nice Limited holds 8%, and Retail Enterprise Corporation Limited holds 1.17%. In addition, Industrial Bank, Golden Butterfly, Lenovo, Tencent, IDG Capital, etc. are also shareholders of the company.

According to the prospectus, Zhang Wenzhong held about 58.36% of the shares in the Dmall pre-listing structure through several entities. CelestialLimited, which he controls, holds 49.19%, Odor Nice Limited holds 8%, and Retail Enterprise Corporation Limited holds 1.17%. In addition, Industrial Bank, Golden Butterfly, Lenovo, Tencent, IDG Capital, etc. are also shareholders of the company.

Zhang Wenzhong was born in 1962 in Shandong and has experienced legends. After graduating from the Department of Mathematics at Nankai University, he studied for his doctorate and postdoctoral studies at home and abroad. He founded Wumei Commercial Group in 2003 and took it public, becoming the first private retail enterprise in the mainland to be listed on Hong Kong stocks. However, in 2009, he was imprisoned for 12 years on multiple charges, but was acquitted by the Supreme Court in 2018.

For the market and investors, it is also possible to observe the company's business situation over the past three years through Dmall's latest Hong Kong stock IPO prospectus.

Loss of 3.3 billion yuan in 3 years

Established in 2015, Duodian Dmall is a retail cloud solution service provider that provides a wide range of end-to-end cross-channel services and SaaS solutions for the local retail industry. It has cooperated with Wumei, Metro, Chongqing Department Store, Yinchuan Xinhua, and DFI Retail Group.

At the same time, Duodian Dmall has established cooperative relationships with many customers covering different retail formats, including supermarket chains, warehousing supermarkets, department stores, convenience stores, specialty retailers, and new retail. In 2021, 2022 and 2023, the company had 352, 569 and 677 customers respectively.

According to Frost & Sullivan's data, in terms of total commodity transactions, Multipoint Dmall is China's largest retail cloud solution provider and leading end-to-end omni-channel retail cloud solution service provider in 2023, with a market share of 13.3%.

Meanwhile, Duodian Dmall has successfully expanded its business to other countries and regions in Asia, including Hong Kong, Macau, Malaysia and Singapore. In terms of total commodity transactions, this expansion made Multipoint Dmall the largest retail cloud solution service provider in Asia in 2023, with a market share of 10.9%.

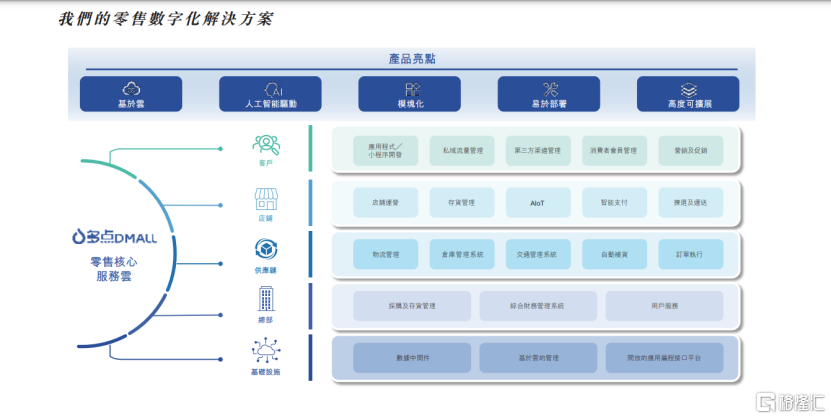

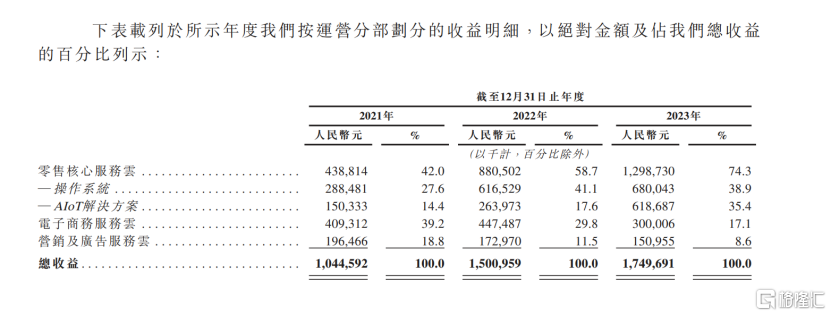

According to the prospectus, the company's main business is divided into three major segments: retail core service cloud, e-commerce service cloud, and marketing and advertising service cloud. In recent years, the company's various main business situations have shown different trends.

Among them, the revenue growth of the retail core service cloud was the most significant, rapidly growing from 439 million yuan in 2021 to 1,299 billion yuan in 2023, and its share of total revenue also increased sharply from 42% to 74.3%, becoming the company's main source of revenue.

In contrast, e-commerce service cloud revenue declined, from 409 million yuan in 2021 to 300 million yuan in 2023, and its share of revenue also fell from nearly 40% to less than 20%. At the same time, the revenue of the marketing and advertising service cloud has also declined, from 196 million yuan in 2021 to 151 million yuan in 2023, accounting for less than 10%.

In terms of overall performance, the prospectus shows that in 2021, 2022 and 2023, Duodian Dmall's operating income was approximately RMB 1,045 million, RMB 1,501 billion, and RMB 1,750 million, respectively, with corresponding net losses of RMB 1,825 million, RMB 841 million and RMB 655 million respectively. Although the company's losses have narrowed in the past three years, the total loss is still as high as 3.3 billion yuan.

Regarding the reason for the company's losses, Duodian Mall stated in its prospectus that it is mainly due to expenses generated as the business grows and develops, including major investments in R&D to support proprietary operations, continuous system development, marketing resources to expand the customer base and stimulate consumer traffic on e-commerce platforms, and logistics costs for comprehensive e-commerce services.

Notably, according to the prospectus, Duodian Dmall said that losses and cash losses may continue in the future. The company's revenue is affected by various factors such as industry development, market environment, and economic conditions. At the same time, continued investment in the company's services and technology will also increase expenses, such as continuing to invest in technology such as Dmall OS to add value to services. However, if the increased revenue does not cover the increased costs, the company's financial situation may deteriorate, and profits and stable cash flow cannot be guaranteed.

In terms of gross margin, the company's gross margin has fluctuated markedly in the past three years, showing a trend of rising first and then falling. According to the prospectus, in 2021, 2022 and 2023, the company's gross margins were 34.3%, 44.6%, and 40.7%.

Revenue is heavily dependent on big “Wumei” customers

It is worth noting that in the past three years, Duodian Dmall has heavily relied on big “Wumei” customers for revenue.

According to the prospectus, revenue from Wumei Group (Wumei Group, Metro China Entity, Chongqing Department Store Group, and Yinchuan Xinhua Group) in the past three years was approximately 709 million yuan, 1,069 million yuan, and 1,311 billion yuan respectively, accounting for 67.9%, 71.3% and 74.9% of revenue, respectively.

At the same time, there are many multi-point Dmall related transactions. According to Duodian Dmall's prospectus, in 2021, 2022, and 2023, four, four, and three of the company's five major customers were also suppliers to the company. Over the same period, Dow Dmall's purchases from these customers accounted for 2.6%, 1.7%, and 1.4% of total purchases, respectively, while sales to these customers accounted for 67.9%, 68.7%, and 71.6% of the company's total revenue, respectively.

Duodian Dmall stated in its prospectus that the company's main customers are relatively concentrated and important. If these important customers are lost, or if they are unable to continue to cooperate with these customers, or if the search for new customers does not go well, the company may not be able to make money and promote services. This will have a huge impact on their company's performance.

Duodian Dmall said that current earnings are mainly dependent on a few major customers such as Wumei Group, Metro China, Chongqing Department Store, Yinchuan Xinhua, and DFI Retail Group. Wumei Group's share of the company's revenue is rising year by year. If relationships with these important customers are broken or cooperation is reduced, the company may make a lot less money, and cash inflows will also be very slow, which will make the overall operation of the company very difficult.

Epilogue

Zhang Wenzhong, a 62-year-old veteran of the retail industry, once again led Dmall to launch a Hong Kong stock IPO. This is his third attempt. This action not only reflects the tenacity and perseverance of a business leader, but also highlights his persistent pursuit of business dreams and his spirit of constantly challenging himself. As a result, Dmall attracted more investment institutions and market attention to the company.

However, in the Hong Kong stock market, more attention is paid to the company's own performance. Returning to the company's fundamentals, the prospectus shows that the company's revenue has grown well in recent years, but the growth rate has slowed down, and the past three consecutive years have lost a total of 3.3 billion yuan. In terms of revenue, the company relies heavily on “Wumei” customers. If business relationships with these core customers are interrupted or reduced, it will have a serious impact on the company's earnings and cash flow. These are probably all things that future secondary market investors who are concerned about this company need to pay attention to.

招股书显示,多点Dmall上市前的股权结构中,张文中通过数家实体持股约58.36%。他控制的CelestialLimited持股49.19%,Odor Nice Limited持股8%,Retail Enterprise Corporation Limited持股1.17%。此外,兴业银行、金蝶、联想、腾讯、IDG资本等也是公司股东。

招股书显示,多点Dmall上市前的股权结构中,张文中通过数家实体持股约58.36%。他控制的CelestialLimited持股49.19%,Odor Nice Limited持股8%,Retail Enterprise Corporation Limited持股1.17%。此外,兴业银行、金蝶、联想、腾讯、IDG资本等也是公司股东。