Is Lowe's (LOW) a Smart Investment Choice Ahead of Q1 Earnings?

As Lowe's Companies, Inc. LOW prepares to unveil its first-quarter fiscal 2024 earnings on May 21 before market open, investors are keenly observing the company's performance. With a projected decline in both the top and bottom-line figures, the upcoming earnings release prompts a critical question: should you buy Lowe's ahead of this event?

The Zacks Consensus Estimate for the to-be-reported quarter’s revenues is pegged at $21.1 billion, which suggests a drop of 5.7% from the prior year’s levels. However, the rate of decline shows a sharp deceleration from a 17.1% decrease witnessed in the preceding quarter. The consensus mark for quarterly earnings has remained unchanged in the past 30 days at $2.94 per share, which calls for a decline of 19.9% from the year-ago quarter’s reported figure.

Lowe's confronts the hurdle of softer Do-It-Yourself ("DIY") demand trends, a trend expected to persist for a while as consumers prioritize spending on services over goods. Given these challenges, we anticipate continued pressure on comparable sales, with a projected year-over-year decrease of 6% in the first quarter of fiscal 2024.

Despite headwinds, there are compelling reasons why investors should consider adding Lowe’s to their portfolio. Lowe’s has consistently demonstrated its ability to navigate through challenging market conditions while maintaining profitability.

LOW Poised for Success in the Big Picture

Lowe’s has demonstrated remarkable adaptability in responding to evolving consumer behaviors and market dynamics. Despite softer DIY demand trends, the company has recalibrated its strategies to focus on smaller, non-discretionary projects and enhance value propositions for customers. Initiatives like the MyLowe’s Rewards loyalty program and investments in omnichannel experiences underscore Lowe’s commitment to meeting evolving consumer needs and driving long-term growth.

The Pro segment remains a significant growth driver for Lowe’s, with the company leveraging its multi-year strategy to enhance product offerings, fulfillment options and the overall shopping experience for professional customers. A stable performance in the Pro segment could contribute to revenue diversification and mitigate risks associated with fluctuating consumer demand.

Also, the company’s strategic investments in its Total Home strategy, including modernizing the supply chain and IT infrastructure, localizing and improving merchandising assortments, and enhancing digital and omnichannel experiences, position the company for long-term success.

Lowe’s remains bullish on the medium to long-term outlook for the home improvement industry. Factors such as disposable personal income, home price appreciation and the age of housing stock, coupled with trends like millennial household formation, support a positive outlook for home improvement demand. Moreover, as mortgage rates decline, it could potentially stimulate homebuying activity and subsequently drive demand for renovation and remodeling projects.

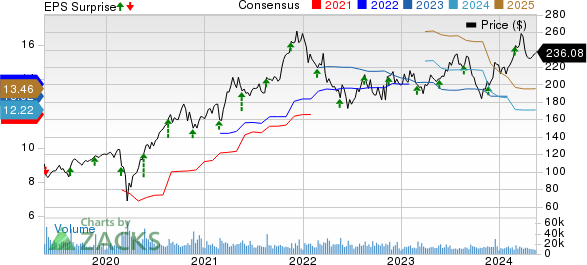

Lowe's Companies, Inc. Price, Consensus and EPS Surprise

Lowe's Companies, Inc. price-consensus-eps-surprise-chart | Lowe's Companies, Inc. Quote

Unlocking Value in Lowe’s

From a valuation perspective, Lowe’s shares present an attractive opportunity, trading at a discount relative to industry benchmarks. With a forward 12-month price-to-earnings ratio of 18.78, below the industry’s average of 20.33, the stock offers compelling value for investors seeking exposure to the sector. Additionally, the stock currently has a Value Score of A, further validating its appeal.

Recent market movements show Lowe’s shares rising 4.1% in the past three months against the industry’s decline of 1.7%. Trading at $236.08 as of May 15, shares of Lowe’s are likely to gain momentum, as our proven model predicts that the company is likely to beat earnings estimates in the impending release.

The Zacks Model

Our proven model conclusively predicts an earnings beat for Lowe’s this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here.

Lowe’s has an Earnings ESP of +1.75% and carries a Zacks Rank #2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Wrapping Up

Despite short-term challenges, Lowe’s offers a compelling investment opportunity. Its adaptability, customer-centric approach and strategic investments set a solid foundation for long-term growth. Coupled with attractive valuation metrics and positive market sentiment, Lowe’s continues to be an appealing choice for investors.

Other Stocks With the Favorable Combination

Here are three other companies you may want to consider as our model shows that these also have the right combination of elements to post an earnings beat this season:

Target TGT currently has an Earnings ESP of +6.39% and carries a Zacks Rank #3. The Zacks Consensus Estimate for first-quarter fiscal 2024 earnings per share is pegged at $2.05, flat year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Target’s top line is expected to decline year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $24.5 billion, which indicates a drop of 3.3% from the figure reported in the prior-year quarter. TGT has a trailing four-quarter earnings surprise of 27.1%, on average.

Macy’s M currently has an Earnings ESP of +48.57% and a Zacks Rank of 3. The company is likely to register a decrease in the bottom line when it reports first-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 18 cents suggests a sharp decline from the year-ago reported number of 56 cents.

Macy’s top line is also expected to decrease year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $4.82 billion, which suggests a decline of 3.2% from the prior-year quarter. Macy’s has a trailing four-quarter earnings surprise of 47.7%, on average.

American Eagle Outfitters AEO currently has an Earnings ESP of +6.84% and a Zacks Rank #3. The company is likely to register an increase in the bottom line when it reports first-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 27 cents suggests an increase of 58.8% from the year-ago quarter.

American Eagle Outfitters’ top line is anticipated to rise year over year. The consensus mark for revenues is pegged at $1.15 billion, which implies an increase of 5.9% from the figure reported in the year-ago quarter. AEO has a trailing four-quarter earnings surprise of 22.7%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance