Andreas Halvorsen's Strategic Exits and New Positions in Q1 2024, Highlighting Major Move from UPS

Insight into Viking Global Investors' Latest Market Maneuvers

Andreas Halvorsen (Trades, Portfolio), a prominent figure in the investment world and founding partner of Viking Global Investors LP, has made significant portfolio adjustments in the first quarter of 2024. Under the leadership of CIO Ning Jin, Viking, established in 1999 and based in Greenwich, Connecticut, continues to implement a research-intensive, long-term investment strategy. The firm focuses on fundamental analysis to select equities worldwide, emphasizing the quality of business models and management teams, as well as industry trends. Halvorsen's background includes pivotal roles at Tiger Management (Trades, Portfolio) LLC and Morgan Stanley, equipping him with a robust foundation for his investment decisions.

Summary of New Buys

Andreas Halvorsen (Trades, Portfolio) added a total of 22 stocks to his portfolio this quarter. Noteworthy new positions include:

Las Vegas Sands Corp (NYSE:LVS), purchasing 16,923,581 shares, making up 3.26% of the portfolio, valued at $874.95 million.

Microsoft Corp (NASDAQ:MSFT), with 1,596,887 shares, representing 2.5% of the portfolio, totaling $671.84 million.

Apple Inc (NASDAQ:AAPL), acquiring 3,870,990 shares, accounting for 2.47% of the portfolio, valued at $663.80 million.

Key Position Increases

Halvorsen also increased his stakes in 19 stocks, with significant boosts in:

U.S. Bancorp (NYSE:USB), adding 13,056,827 shares, bringing the total to 22,626,465 shares, a 136.44% increase, impacting the portfolio by 2.18%, valued at $1.01 billion.

T-Mobile US Inc (NASDAQ:TMUS), with an additional 2,871,298 shares, totaling 4,381,297 shares, marking a 190.15% increase, valued at $715.12 million.

Summary of Sold Out Positions

Significant exits this quarter include:

United Parcel Service Inc (NYSE:UPS), where Halvorsen sold all 8,199,127 shares, impacting the portfolio by -4.73%.

Deere & Co (NYSE:DE), liquidating all 1,406,562 shares, resulting in a -2.06% portfolio impact.

Key Position Reductions

Reductions were made in 29 stocks, notably:

Meta Platforms Inc (NASDAQ:META), reduced by 2,259,650 shares, a -75.53% decrease, impacting the portfolio by -2.93%. The stock traded at an average price of $446.07 during the quarter.

McKesson Corp (NYSE:MCK), cut by 1,642,625 shares, a -73.55% reduction, impacting the portfolio by -2.79%. The stock's average trading price was $507.73 during the quarter.

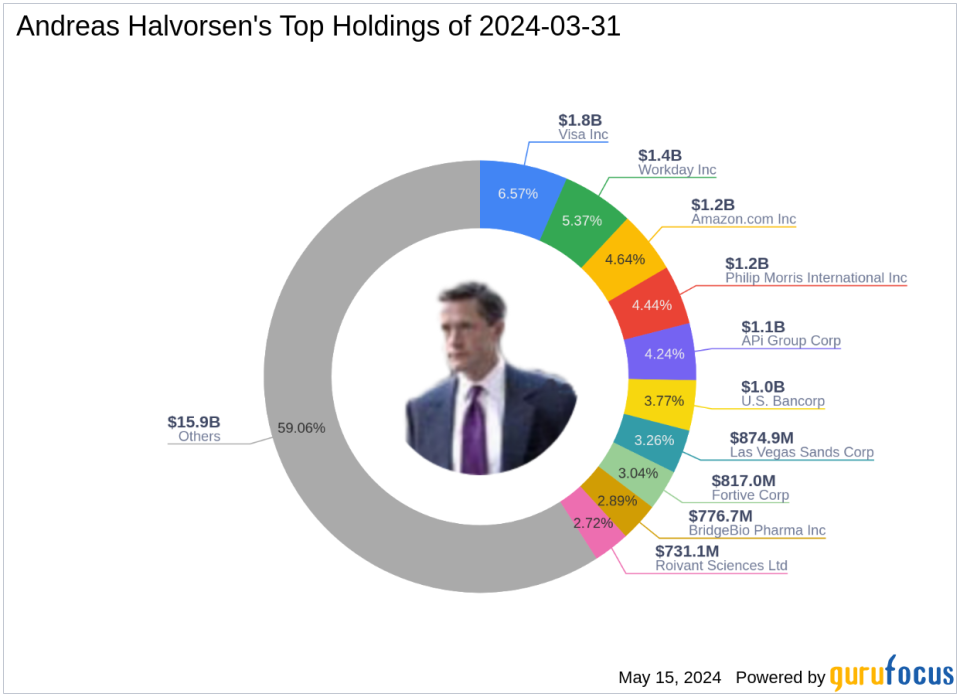

Portfolio Overview

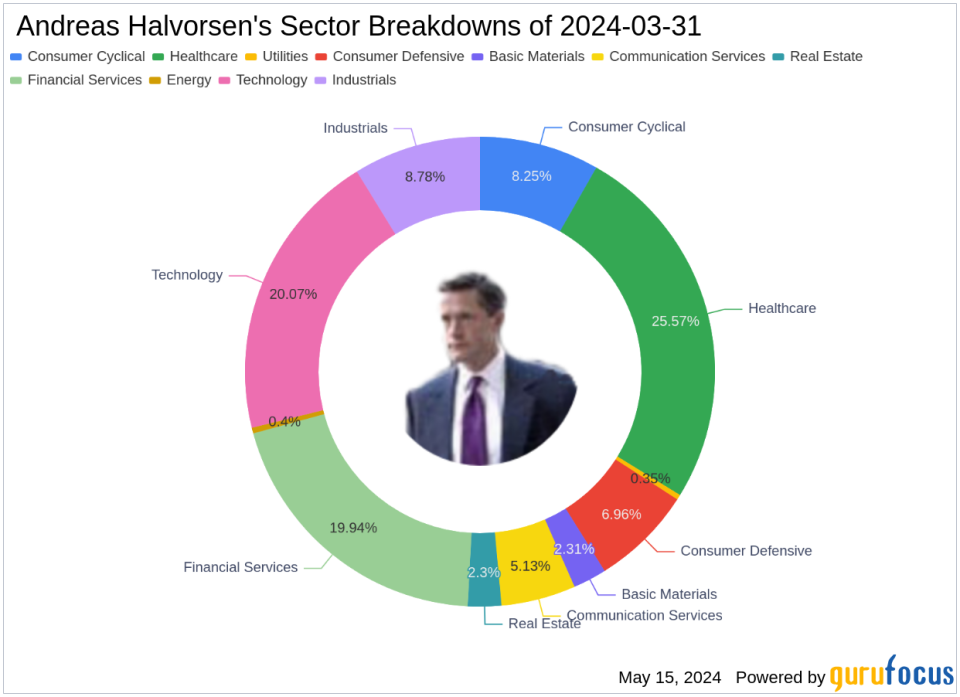

As of the first quarter of 2024, Andreas Halvorsen (Trades, Portfolio)'s portfolio included 84 stocks. Top holdings were 6.57% in Visa Inc (NYSE:V), 5.37% in Workday Inc (NASDAQ:WDAY), 4.64% in Amazon.com Inc (NASDAQ:AMZN), 4.44% in Philip Morris International Inc (NYSE:PM), and 4.24% in APi Group Corp (NYSE:APG). The portfolio is diversified across all 11 industries, with significant concentrations in Healthcare, Technology, Financial Services, Industrials, and Consumer Cyclical sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance