Michael Burry's Strategic Emphasis on Sprott Physical Gold Trust in Q1 2024

Insight into Burry's Latest Portfolio Adjustments and Market Moves

Michael Burry (Trades, Portfolio), the renowned investor behind Scion Asset Management, has made notable changes to his investment portfolio in the first quarter of 2024. Known for his value investing strategy and prescient bets against the US housing market bubble in 2008, Burry's recent 13F filing reveals a strategic pivot towards commodities, specifically gold, alongside adjustments in tech and healthcare sectors.

Summary of New Buys

Michael Burry (Trades, Portfolio)'s portfolio saw the addition of 5 new stocks in this quarter. Notably:

Sprott Physical Gold Trust (PHYS) emerged as the top new holding with 440,729 shares, representing 7.37% of the portfolio and valued at $7.62 million.

The Cigna Group (NYSE:CI) followed, comprising 20,000 shares or 7.02% of the portfolio, totaling $7.26 million.

BP PLC (NYSE:BP) was also significant, with 175,000 shares making up 6.37% of the portfolio, valued at $6.59 million.

Key Position Increases

Burry also intensified his stakes in several existing holdings:

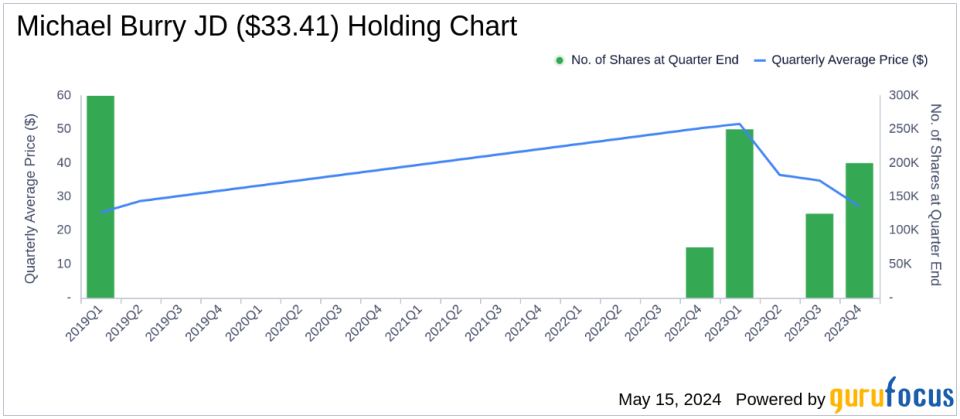

JD.com Inc (NASDAQ:JD) saw a substantial increase of 160,000 additional shares, bringing the total to 360,000 shares. This adjustment marks an 80% increase in share count and a 4.24% impact on the current portfolio, valued at $9.86 million.

Alibaba Group Holding Ltd (NYSE:BABA) also saw an increase, with an additional 50,000 shares bringing the total to 125,000. This represents a 66.67% increase in share count, valued at $9.05 million.

Summary of Sold Out Positions

During this quarter, Michael Burry (Trades, Portfolio) exited 14 positions entirely, including:

Oracle Corp (NYSE:ORCL), where he sold all 50,000 shares, impacting the portfolio by -5.57%.

CVS Health Corp (NYSE:CVS), with all 65,000 shares liquidated, resulting in a -5.43% portfolio impact.

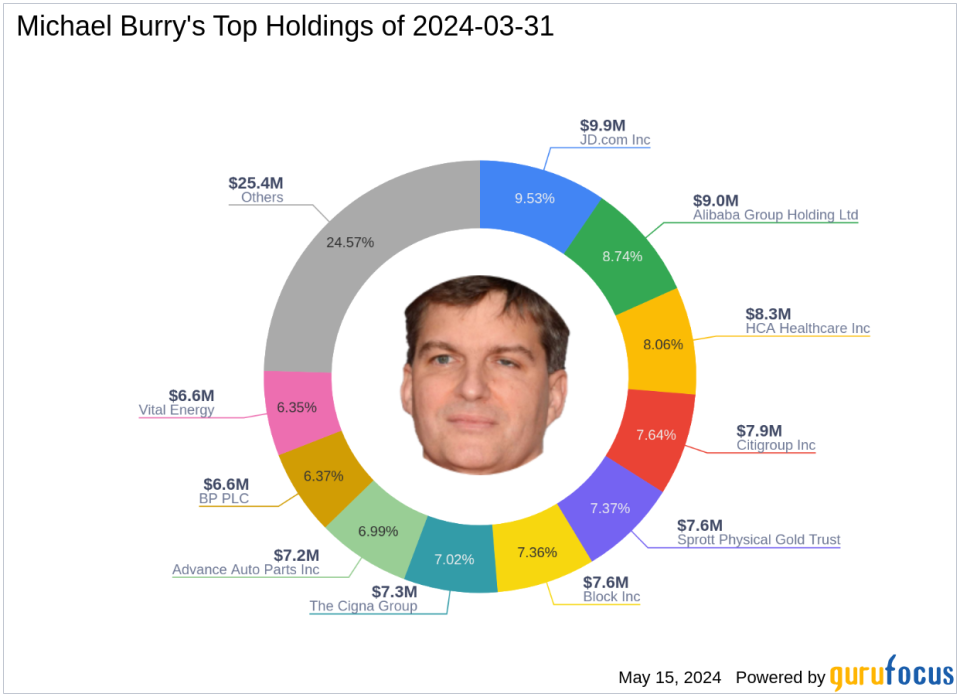

Portfolio Overview

As of the first quarter of 2024, Michael Burry (Trades, Portfolio)'s investment portfolio included 16 stocks. The top holdings were:

9.53% in JD.com Inc (NASDAQ:JD), 8.74% in Alibaba Group Holding Ltd (NYSE:BABA), 8.06% in HCA Healthcare Inc (NYSE:HCA), 7.64% in Citigroup Inc (NYSE:C), and 7.37% in Sprott Physical Gold Trust (PHYS).

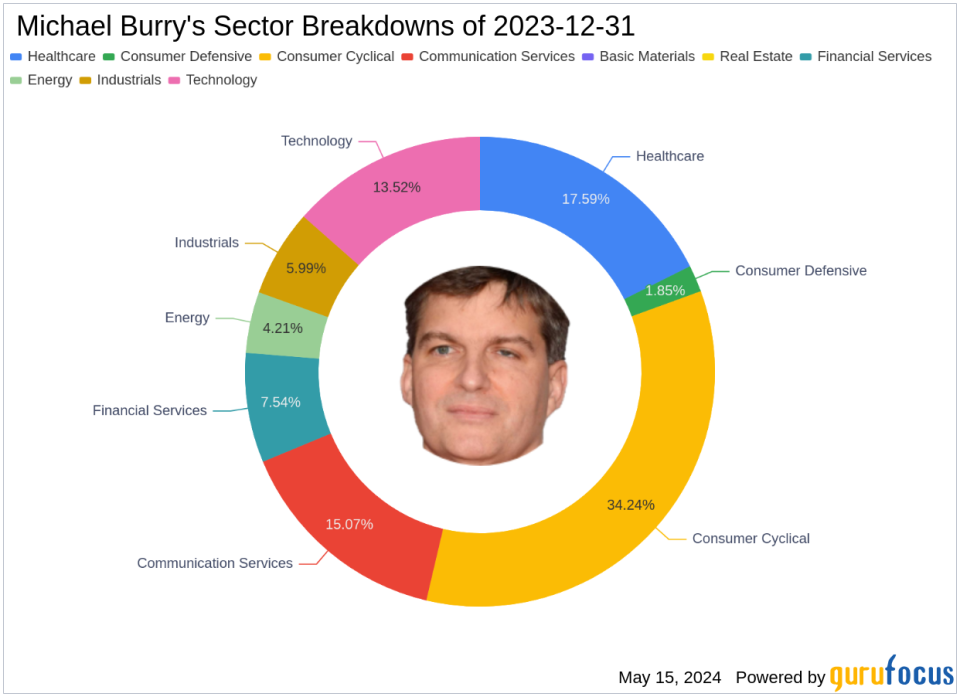

The investments are predominantly concentrated across seven industries: Consumer Cyclical, Financial Services, Healthcare, Energy, Technology, Industrials, and Communication Services.

This strategic diversification and the significant new positions in commodities like gold suggest a defensive posture possibly anticipating market volatility. Michael Burry (Trades, Portfolio)s moves provide valuable insights for value investors looking to navigate uncertain markets.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance