GE HealthCare (GEHC), Medis Medical Partner to Aid CAD Therapy

GE HealthCare Technologies Inc. GEHC and Medis Medical Imaging recently announced their collaboration, which is intended for the the process of advancing precision care for coronary artery disease (CAD) diagnosis and therapy.

The two businesses are set to advance the research and development of Medis Quantitative Flow Ratio (Medis QFR), a non-invasive method for evaluating coronary physiology, as part of GE HealthCare's interventional cardiology portfolio centered on the Allia Platform. The partnership aims to make cutting-edge technologies like Medis QFR more accessible, while also streamlining the cath lab's complexity to enhance the working environment for medical professionals.

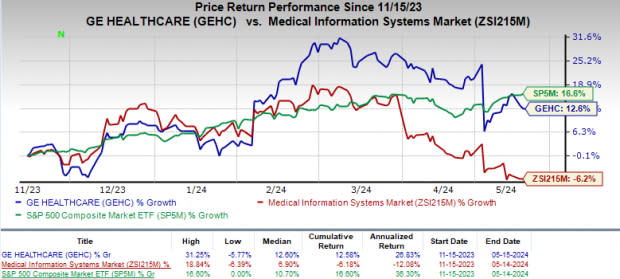

Price Performance

In the past six months, GEHC shares have gained 12.6% against the industry’s decline of 6.2%. The S&P 500 has gained 16.6% in the same time frame.

Image Source: Zacks Investment Research

More on the Collaboration

GE Healthcare’s partnership with Medis Medical is likely to introduce physicians to Medis QFR as a new, non-invasive, image-based diagnostic method for assessing coronary artery physiology and treating coronary heart disease. In the assessment of coronary artery disease, QFR represents a significant advancement in how efficiently it can provide critical insights. Currently, a considerable proportion of individuals may undergo invasive coronary angiography to help doctors assess the severity of their suspected CAD and make an accurate diagnosis.

Medis’ QFR is a proprietary solution that delivers image-based physiology of coronary obstructions based on angiography imaging analysis alone. The technology may be easily included in the clinical workflow of interventional cardiologists, enabling them to quickly and effectively assess if a PCI is necessary to treat the patient or whether treatment should be postponed in favor of continued monitoring or other choices.

If therapy is required, Medis' QFR technology can assist physicians in determining which lesion(s) to treat ultimately, designing the best course of action for a balloon or stent-based PCI operation, and assessing the effectiveness of that course of action. While the patient is on the table, this study can be done in real-time, and the results are shown on the cath lab's large display monitor.

Cutting-edge innovations such as Medis QFR complement GE HealthCare's extensive array of interventional cardiology solutions, which are centered around the Allia Platform and intended to improve patient outcomes, unleash efficiencies, and streamline workflows in the management of cardiovascular disease.

Industry Prospects

Per a report by Data Bridge Market Research, the coronary artery disease market size was valued at $22.9 billion in 2022 and is expected to reach $40.9 billion by 2030 at a growth rate of 8.9%.

The CAD market is driven by the rising prevalence of the disease, which demands CAD diagnosis, treatment, and management., advancement in diagnostic technologies and increasing adoption of minimally invasive procedures like PCI.

Given the market potential, GE Healthcare’s collaboration with Medis Medical is likely to boost its business and increase revenues.

Notable Developments

GE HealthCare recently announced plans to evolve its long-term AI partnership with Mass General Brigham’s commercial AI business, Mass General Brigham AI. Through the collaboration, the companies aim to integrate medical imaging foundation models into their AI research work, with a strong focus on responsible AI practices.

The company also announced the publication of data that depicts its AI models’ ability to predict patient responses to immunotherapies accurately. The study collected clinical data to predict the effectiveness and toxicity of cancer immunotherapy accurately. A pan-cancer sample's data revealed that the company’s AI models' accuracy ranged from 70% to 80%.

GE HealthCarerecently used NVIDIAtechnology to develop its recent research model, SonoSAMTrack. This builds upon its long-term AI collaboration with NVIDIA. SonoSAMTrack combines a promptable foundation model for segmenting objects on ultrasound images called SonoSAM.

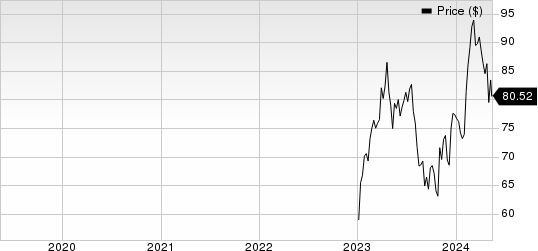

GE HealthCare Technologies Inc. Price

GE HealthCare Technologies Inc. price | GE HealthCare Technologies Inc. Quote

Zacks Rank & Stocks to Consider

GEHC carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2024 adjusted EPS of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

GE HealthCare Technologies Inc. (GEHC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance