Deep-pocketed investors have adopted a bullish approach towards Morgan Stanley (NYSE:MS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Morgan Stanley. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 42% bearish. Among these notable options, 6 are puts, totaling $300,163, and 8 are calls, amounting to $594,911.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $110.0 for Morgan Stanley over the last 3 months.

Insights into Volume & Open Interest

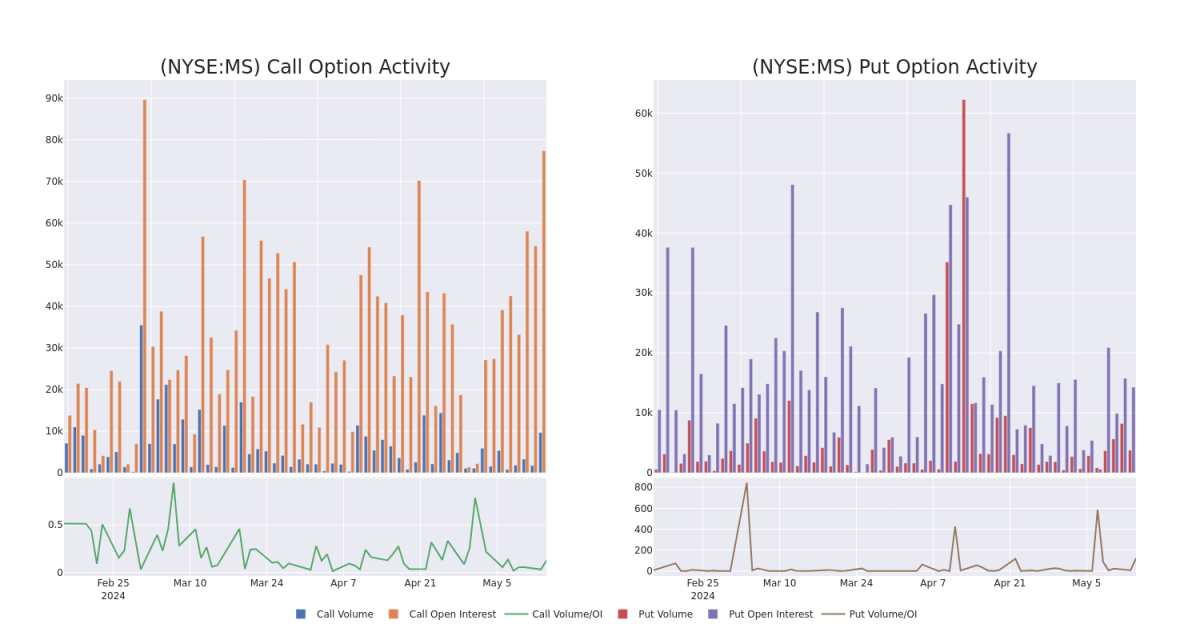

In today's trading context, the average open interest for options of Morgan Stanley stands at 3260.38, with a total volume reaching 3,118.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Morgan Stanley, situated within the strike price corridor from $70.0 to $110.0, throughout the last 30 days.

Morgan Stanley Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | TRADE | BULLISH | 01/17/25 | $15.9 | $15.8 | $15.9 | $90.00 | $127.2K | 7.9K | 80 |

| MS | CALL | TRADE | BEARISH | 06/20/25 | $9.7 | $9.5 | $9.5 | $105.00 | $95.0K | 2.2K | 100 |

| MS | CALL | SWEEP | BULLISH | 07/19/24 | $1.08 | $1.06 | $1.06 | $110.00 | $94.0K | 1.5K | 1.2K |

| MS | CALL | TRADE | BULLISH | 05/17/24 | $11.1 | $10.85 | $11.1 | $90.00 | $88.8K | 5.3K | 94 |

| MS | PUT | TRADE | BEARISH | 07/19/24 | $2.95 | $2.92 | $2.94 | $100.00 | $88.2K | 1.0K | 397 |

About Morgan Stanley

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments. The company had over $4 trillion of client assets as well as over 80,000 employees at the end of 2022. Approximately 50% of the company's net revenue is from its institutional securities business, with the remainder coming from wealth and investment management. The company derives about 30% of its total revenue outside the Americas.

Having examined the options trading patterns of Morgan Stanley, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Morgan Stanley's Current Market Status

- Currently trading with a volume of 1,758,209, the MS's price is up by 1.27%, now at $100.64.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 62 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Morgan Stanley with Benzinga Pro for real-time alerts.