Honda's (HMC) Q4 Earnings Beat Estimates, Revenues Miss

Honda HMC reported earnings of 99 cents per share for fourth-quarter fiscal 2024, surpassing the Zacks Consensus Estimate of 44 cents. The bottom line also grew from the year-ago profit of 51 cents per share. Quarterly revenues totaled $36.5 billion, missing the Zacks Consensus Estimate of $37.9 billion. The top line, however, increased from $33.1 billion recorded in the year-ago period.

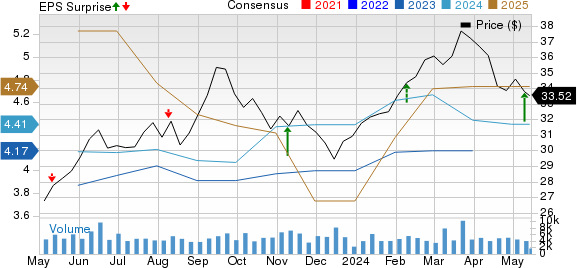

Honda Motor Co., Ltd. Price, Consensus and EPS Surprise

Honda Motor Co., Ltd. price-consensus-eps-surprise-chart | Honda Motor Co., Ltd. Quote

Segmental Highlights

For the three-month period, which ended on Mar 31, 2024, revenues from the Automobile segment increased 25.3% year over year to ¥3.59 trillion ($24.22 billion) and outpaced our projection of ¥3.53 trillion on the back of higher sales from all major end markets except Asia. The segment registered an operating profit of ¥100.1 billion ($674 million), rocketing 177.3% from the corresponding quarter of fiscal 2023 and breezing past our estimate of ¥30 billion.

Revenues from the Motorcycle segment came in at around ¥862.1 billion ($5.81 billion), up 22% year over year and beating our estimate of ¥848.2 billion, amid increased sales across all major end markets except Japan. However, the unit’s operating profit came in at ¥144.7 billion ($975 million), up 29% year over year and surpassing our forecast of ¥104.8 billion.

Revenues from the Financial Services segment totaled ¥862.6 billion ($5.81 billion), up 24.5% year on year and surpassed our prediction of ¥718.1 billion, courtesy of higher sales from all end markets apart from Asia. The unit’s operating profit moved up 5.6% year over year to ¥69.1 billion ($465 million), outpacing our estimate of ¥51.8 billion.

Revenues from Power Product and Other Businesses came in at ¥109.4 billion ($736 million), down 4.6% year over year. However, revenues beat our forecast of ¥100.6 billion. The segment incurred an operating loss of ¥8.3 billion ($56 million), wider than a loss of ¥1.27 billion generated in the year-ago period but narrower than our forecast of ¥13.4 billion.

Financials

Consolidated cash and cash equivalents were ¥4.95 trillion ($32.73 billion) as of Mar 31, 2024. Long-term debt was around ¥6 trillion ($40.2 billion) as of Mar 31, up from ¥4.37 trillion as of Mar 31, 2023.

The dividend for fiscal 2024 was ¥68/share, higher than ¥40 in fiscal 2023. Honda repurchased ¥250 billion shares in fiscal 2024 and plans to buy back ¥300 billion stock in fiscal 2025. The company will play an interim and year-end dividend of ¥34/share each in fiscal 2025.

FY25 View

Honda projects fiscal 2025 sales volumes from the Motorcycle, Automobile and Power Products segments to be 13.06 million units, 2.97 million units and 3.66 million units, respectively. The forecast implies growth of 7% and 4% year over year in Motorcycles and Automobiles units, respectively. However, Power Product Unit sales are likely to decline 4% year over year in fiscal 2025.

For fiscal 2025, Honda forecasts revenues of ¥20.3 trillion, implying a decline of 0.6% year over year. Operating profit is envisioned at ¥1.42 trillion, indicating growth of 2.8% year over year. Pretax profit is forecast to be ¥1.5 trillion, suggesting a drop of 8.7% year over year.

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quarterly Releases of Other Legacy Automakers

General Motors GM reported first-quarter 2024 results on Apr 23. It posted adjusted earnings of $2.62 per share, which surpassed the Zacks Consensus Estimate of $2.08. The bottom line also increased from the year-ago quarter’s level of $2.21. Solid results from the GMNA segment led to the outperformance. Revenues of $43.01 billion beat the Zacks Consensus Estimate of $41.28 billion and increased from $39.9 billion recorded in the year-ago period. General Motors had cash and cash equivalents of $17.64 billion as of Mar 31, 2024. The long-term automotive debt at the end of the quarter was $15.9 billion

Ford F reported first-quarter 2024 results on Apr 24. It posted adjusted EPS of 49 cents, which beat the Zacks Consensus Estimate of 42 cents but declined from 63 cents recorded in the year-ago quarter. The company’s consolidated first-quarter revenues came in at $42.8 billion, up 3.1% year over year.Ford reported a negative adjusted free cash flow of $479 million for the quarter. It had cash and cash equivalents of $19.72 billion as of Mar 31, 2024. Long-term debt, excluding Ford Credit, totaled $19.4 billion at the end of the first quarter of 2024.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance