Sandy Spring Bancorp Leads Three Key Dividend Stocks

As the S&P 500 approaches its all-time high and the Nasdaq sets new records, the U.S. stock market demonstrates resilience amidst fluctuating economic indicators and ongoing discussions about interest rates. In this context, dividend stocks like Sandy Spring Bancorp become particularly noteworthy for investors seeking stable returns in a landscape marked by cautious optimism and heightened scrutiny of inflation trends.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.06% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.84% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.06% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.78% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.45% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.84% | ★★★★★★ |

First Bancorp (NasdaqGS:FNLC) | 5.99% | ★★★★★☆ |

Franklin Financial Services (NasdaqCM:FRAF) | 4.92% | ★★★★★☆ |

Citizens & Northern (NasdaqCM:CZNC) | 6.36% | ★★★★★☆ |

Evans Bancorp (NYSEAM:EVBN) | 4.96% | ★★★★★☆ |

Click here to see the full list of 200 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sandy Spring Bancorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sandy Spring Bancorp, Inc., operating as the bank holding company for Sandy Spring Bank, offers a range of services including commercial and retail banking, mortgage, private banking, and trust services in the United States, with a market capitalization of approximately $1.03 billion.

Operations: Sandy Spring Bancorp, Inc. provides a variety of financial services, encompassing commercial and retail banking, as well as mortgage, private banking, and trust services across the United States.

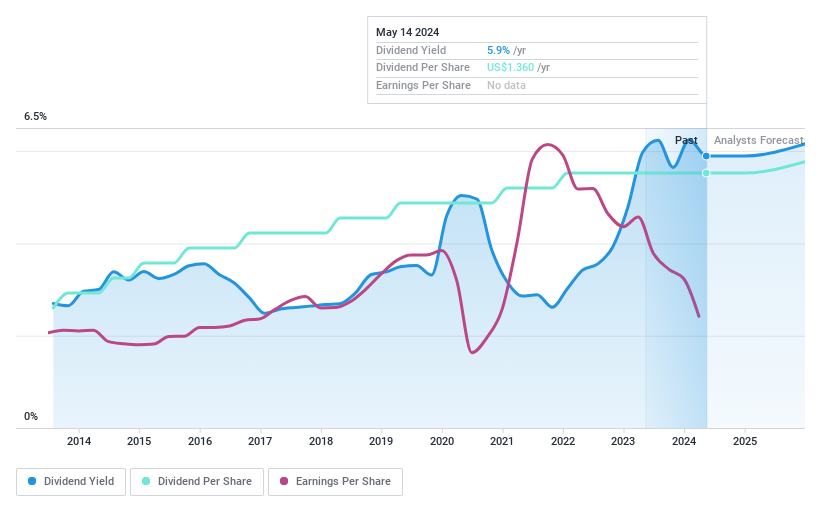

Dividend Yield: 5.9%

Sandy Spring Bancorp has maintained stable dividend payments over the past decade, with a current yield of 5.89%, ranking in the top 25% of US dividend payers. The dividends are well-supported by a reasonable payout ratio of 66.4%. However, recent financials show a decline in net interest income and net profit from last year, indicating potential challenges ahead. Despite these concerns, the company's stock trades at a significant discount to its estimated fair value, suggesting possible undervaluation.

DRDGOLD

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DRDGOLD Limited is a South African gold mining company focused on the retreatment of surface gold tailings, with a market capitalization of approximately $735.72 million.

Operations: DRDGOLD Limited generates its revenue primarily through two segments: Ergo, which contributed approximately ZAR 4.34 billion, and FWGR, which added around ZAR 1.47 billion.

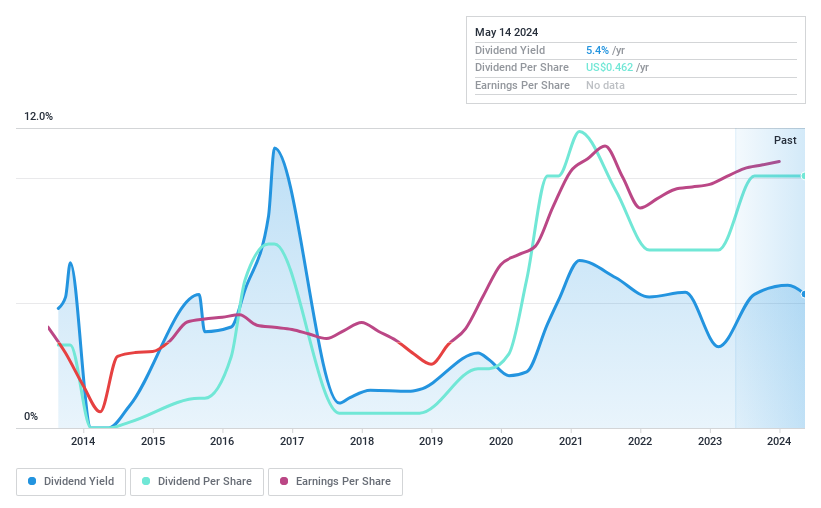

Dividend Yield: 5.4%

DRDGOLD's dividend yield of 5.36% places it in the upper quartile of US dividend payers, supported by a payout ratio of 54.8%. However, its dividends have shown volatility over the last decade and are not well-covered by cash flows or free cash flow, indicating potential sustainability issues. Despite this, DRDGOLD has increased its dividends over the past ten years and reported a revenue growth forecast of 21.23% per year, with earnings up by 14.9% last year.

Click here and access our complete dividend analysis report to understand the dynamics of DRDGOLD.

Our expertly prepared valuation report DRDGOLD implies its share price may be too high.

Entravision Communications

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Entravision Communications Corporation, a global advertising solutions, media, and technology company, has a market capitalization of approximately $200.09 million.

Operations: Entravision Communications Corporation generates its revenues primarily from three segments: Audio, which brought in $52.39 million, Digital at $973.74 million, and Television contributing $119.17 million.

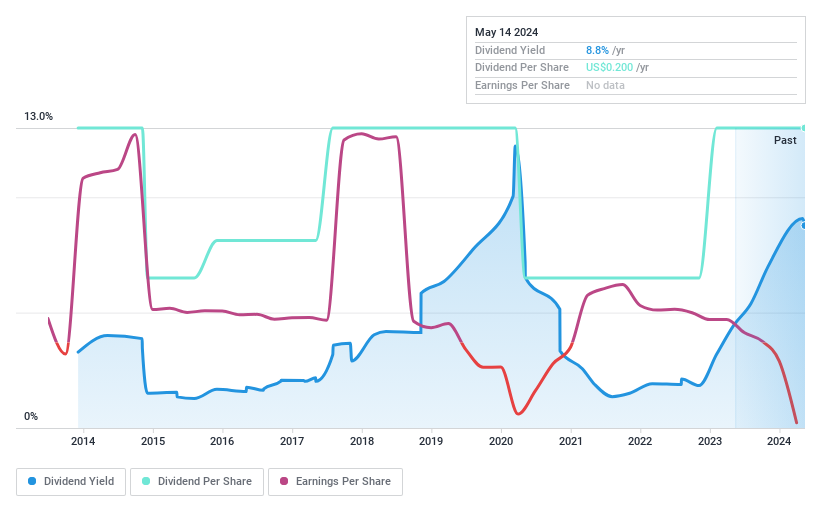

Dividend Yield: 8.8%

Entravision Communications exhibits a high dividend yield at 8.77%, ranking it among the top 25% of US dividend payers. However, its dividends lack growth and stability, remaining unchanged for the past decade with sporadic payments. The company's financial health is concerning as dividends are not supported by earnings or cash flows, evidenced by recent quarterly losses including a net loss of US$48.89 million in Q1 2024. Recent executive changes introduce potential strategic shifts but also add uncertainty during a financially turbulent period.

Turning Ideas Into Actions

Click through to start exploring the rest of the 197 Top Dividend Stocks now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:SASR NYSE:DRD and NYSE:EVC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com