AT&T (T -1.31%) and T-Mobile US (TMUS 0.79%) are two of the three major telcos that dominate the U.S. wireless market, but each arrived at that point from different places.

AT&T is a former Baby Bell, a one-time regional landline company that's evolved into a wireless giant. It is the current market share leader, rising above the other telco that emerged under similar circumstances, Verizon Communications.

T-Mobile appeared in 1994 as Voicestream Wireless and was the only one of these companies to begin as a wireless company. Thus, the telecom stock did not have to radically transform its business as wireless became more critical.

Still, despite radically different histories, these two companies have now become direct competitors. That leaves investors to ponder whether they should choose the more established telco or the younger company with no history outside of wireless.

Comparing the two businesses

One might assume AT&T's past as a legacy carrier would hamper it. The wireless industry differs significantly from its one-time landline business, which was effectively a monopoly.

AT&T successfully made the transition from a landline monopoly to a wireless giant. However, its attempted entry into managing non-core businesses like DirecTV and Warner Media (now Warner Bros Discovery), has hampered it. Acquiring those companies cost it tens of billions of dollars that it didn't recuperate when it sold them or spun them off. As a result, AT&T's debt total ballooned to $133 billion, more than its stockholders' equity of $119 billion.

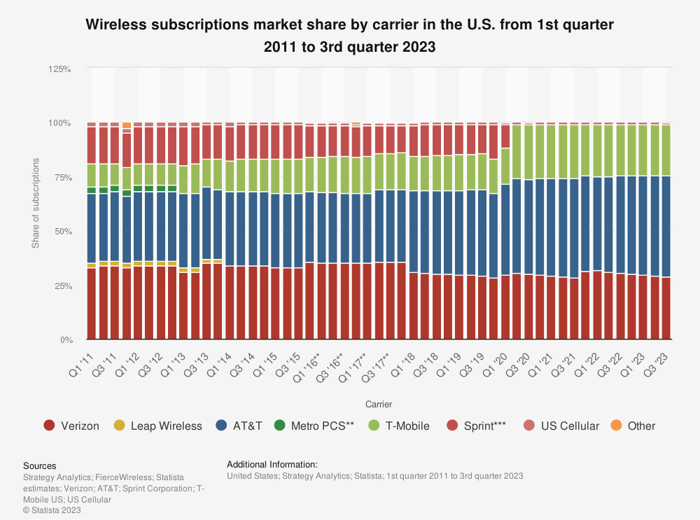

But for all its challenges, AT&T has gradually increased its market share and claims the largest share of the wireless market. In the first quarter, AT&T reported 349,000 phone net adds, well ahead of Verizon at 253,000.

Image source: Statista.

T-Mobile avoided such missteps and invested its capital in the wireless business exclusively. Its 2020 acquisition of the one-time third-largest telco, Sprint, helped make it a force in the industry.

More recently, T-Mobile continued its acquisition strategy by buying out Mint Wireless. Now that it is a major player, it seeks to attract more high-end business customers. According to Opensignal, T-Mobile now has the widest 5G reach and the fastest upload and download speeds, factors that could make it more competitive in the high-end market.

Thus, it should come as little surprise that T-Mobile reported 532,000 net additions. While it remains third in market share, it grew its customer base faster than AT&T, arguably creating a perception that it is a leaner company better able to compete in the wireless marketplace.

AT&T and T-Mobile by the numbers

The financials could reinforce that sentiment. Despite the aforementioned increase in customers, AT&T's revenue for Q1 was $30 billion, falling by 0.4% from year-ago levels. A 6% drop in equipment sales led to the decline.

The $3.4 billion in net income fell 19% from the same quarter last year. A slight increase in operating expenses and a decline in income from non-core sources brought about that drop.

For T-Mobile, revenue was just under $20 billion. As with AT&T, reduced equipment sales led to a drop of 0.2% in T-Mobile's case. Still, it reduced operating expenses, allowing its $2.4 billion net income to rise 22% compared to last year's quarter.

While that only represents one quarter, such disparities seem to have appeared in the stock's performances. Over the last five years, T-Mobile stock has dramatically outperformed AT&T and the S&P 500.

T Total Return Level data by YCharts

Not surprisingly, those gains have come at a premium. Amid AT&T's struggles, it sells at a price-to-earnings (P/E) ratio of 9, compared with T-Mobile's 22 earnings multiple. While T-Mobile is more expensive, its P/E ratio has fallen in recent years, and at such a level, the valuation will likely not deter new investors from buying.

AT&T or T-Mobile?

Under current conditions, T-Mobile is likely to continue driving higher returns. Indeed, AT&T is not going away and will likely continue attracting increasing business.

However, AT&T's signs of growth and low P/E ratio have failed to attract investors' attention. With the more "expensive" earnings multiple still reasonable, the higher level of growth indicates that T-Mobile's stock is worth its premium price.