It’s no secret that big tobacco firm Philip Morris (NYSE:PM) represents one of the most controversial businesses. Headquartered in Stamford, Connecticut, Philip Morris operates globally through multiple affiliates. However, this global focus, combined with the boom in alternative products such as e-cigarettes or vaporizers, could be the company’s saving grace. Despite the not-so-pleasant storylines, I am bullish on PM stock.

PM Stock Faces Significant Criticisms (and Rebuttals)

Easily, one of the top talking points for PM stock is its dividend yield. Yes, tobacco has long represented a problematic industry. However, these objections may fade in magnitude when considering the generous yield of 5.2%. Also, as TipRanks points out, the tobacco giant has provided over 15 years of consecutive dividend growth.

However, it’s important to acknowledge that PM stock has its critics. As TipRanks contributor Joey Frenette mentioned a while back, Philip Morris is a “sin stock,” and such entities carry potential liabilities. In particular, Frenette pointed to the possibility of regulatory hurdles. For example, the Biden administration could ban menthol cigarettes. If so, it’s possible that other jurisdictions could follow suit with similar mandates, thus negatively impacting the business.

Another big headwind working against PM stock is the moral argument. Thanks to decades of anti-tobacco advocacy, the public has become aware of the high health risks tied to smoking. Further, the harm that the tobacco industry causes clashes with younger investors’ support of environmental, social, and governance (ESG) directives.

As Frenette remarked, “A sin stock is a sin stock, and until a tobacco firm can reduce the health risk to zero, it may not be able to win over socially-responsible investment dollars.” That’s a good point. However, it’s also fair to forward the counterargument: not all young people are supporters of ESG or hold contradictory positions.

Back in 2021, meme stock traders aggressively bid up private prison stock Geo Group (NYSE:GEO). Private prisons easily represent one of the most controversial investments around. Essentially, when you place the profit motive behind incarceration, the safety of both inmates and correctional officers is at risk. In addition, racial disparities in the criminal justice system have long been a contentious issue.

Meme traders apparently saw no issue with that. So, the ESG risk to PM stock is likely minimal.

Further, tobacco smoking is ultimately a personal decision. And since society is now moving toward a paradigm where personal truths may not need to correspond with objective truths, any ban on adult liberties will likely be met with steep challenges.

Personal Freedoms Take Center Stage

Another factor that could help PM stock as a long-term stable dividend provider is the rise in personal freedoms. For example, the Biden administration has sought reclassification of cannabis to a lower enforcement level. Such an effort acknowledges that different demographics have differing views of morality. Further, it’s up to the individual to partake in a practice or not.

Given this concession, it would be odd for the Biden administration to crack down on certain elements of the tobacco industry. Therefore, the regulatory risk is also likely lower than some investors may assume.

Now, it is true, based on smoking prevalence data, that cigarette smoking is in secular decline, to Frenette’s point. However, in its place stands the e-cigarette/vaping subsegment. This relatively new methodology has seen rising popularity, especially among young adults.

What’s more, Philip Morris has seen momentum rise in its alternative product unit. The company noted that approximately 40% of its revenue and earnings stemmed from products other than traditional cigarettes in the fourth quarter last year.

Just as importantly, while smoking prevalence rates are declining, not all countries have witnessed an erosion. A few notable markets, such as Egypt and Moldova, have seen an increase in tobacco usage. Moreover, experts lament that global smoking rates have not declined to the magnitude previously hoped for.

What exacerbates the situation (and presents a favorable argument for PM stock) is that global vaping prevalence has increased. With that being the case, it might not be prudent to dismiss Philip Morris ahead of a potentially powerful catalyst.

A Note on PM’s Valuation

While PM stock is arguably an enticing investment, thanks to its dividend yield, it’s not perfect. A financial concern may center on its valuation. Priced at 4.31x trailing-year revenue, it’s not exactly cheap. In comparison, the average sales multiple for the tobacco industry sits at 1.97x.

Still, the consensus sales target for Fiscal 2024 comes in at $36.94 billion. Given the rising relevance of the business, it wouldn’t be unreasonable to assume that the company could hit the higher end of the sales estimate spectrum, which stands at $37.36 billion. If so, the projected sales multiple would drop to around 4.14x.

That’s still far from undervalued. However, PM stock may see price appreciation along with a continued ability to provide a generous dividend yield.

Is PM Stock a Buy, According to Analysts?

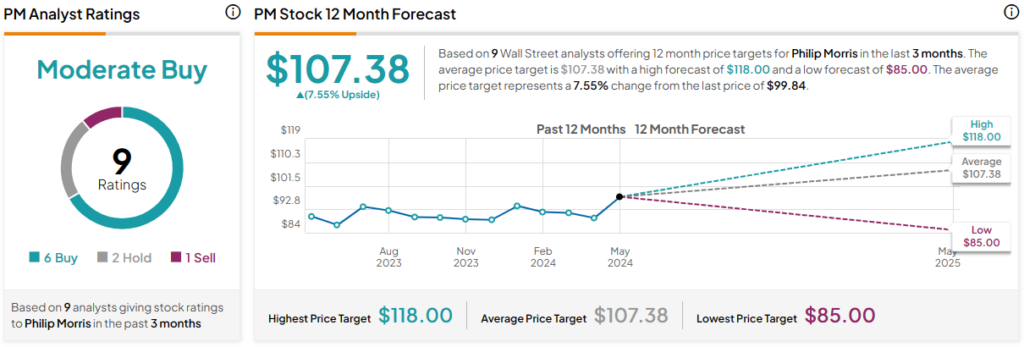

Turning to Wall Street, PM stock has a Moderate Buy consensus rating based on six Buys, two Holds, and one Sell rating. The average PM stock price target is $107.38, implying 7.75% upside potential.

The Takeaway: PM Stock Offers a Surprisingly Relevant Investment

At first glance, the tobacco controversy clouds the bullish case for Philip Morris. However, the moral objection against PM stock may be limited in scope, considering that young investors have shown little qualms about betting on far more contentious enterprises. Looking ahead, the global market offers opportunities for both traditional and, especially, alternative smoking products. Therefore, the rising relevance makes PM a surprisingly relevant deal.