ASX Growth Companies With High Insider Ownership For May 2024

As the ASX200 shows a modest uptick, driven by strong performances in the materials and healthcare sectors, investors are keenly observing market dynamics and economic indicators like the recent rise in the Wage Price Index. In this context, understanding which growth companies have high insider ownership can provide valuable insights into potential commitment levels from those most familiar with these businesses. High insider ownership often signals strong confidence in a company's future prospects, a particularly reassuring trait during times of economic fluctuation and sector-specific volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Liontown Resources (ASX:LTR) | 16.4% | 64.3% |

Argosy Minerals (ASX:AGY) | 15.1% | 129.6% |

Chrysos (ASX:C79) | 22.2% | 57.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Emerald Resources

Simply Wall St Growth Rating: ★★★★☆☆

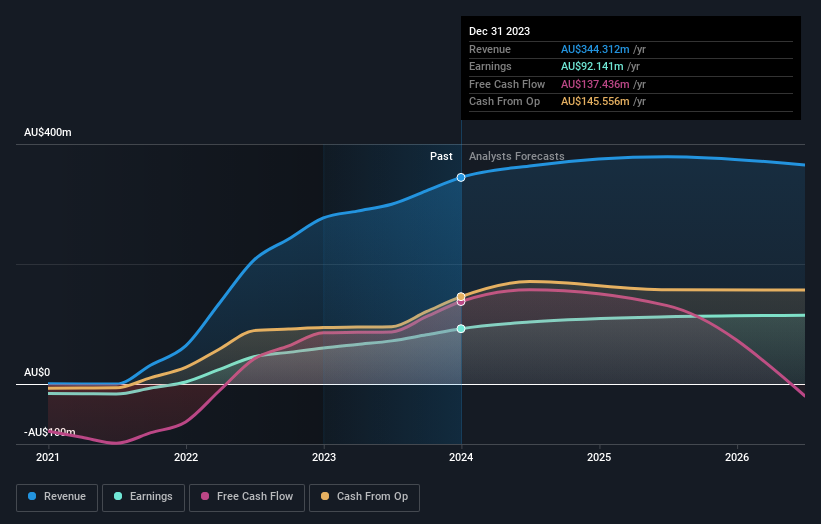

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.34 billion.

Operations: The primary revenue for the firm, totaling A$339.32 million, is derived from mine operations.

Insider Ownership: 18.6%

Earnings Growth Forecast: 22.8% p.a.

Emerald Resources, a growth-oriented company with high insider ownership in Australia, reported substantial earnings growth for the half-year ended December 31, 2023. Sales increased to A$176.75 million from A$133.69 million year-over-year, and net income rose to A$46.87 million from A$26.59 million. Despite trading at a significant discount to its estimated fair value and expectations of continued earnings growth above market rates at 22.8% annually, concerns include below-benchmark forecasted Return on Equity and shareholder dilution over the past year.

Click to explore a detailed breakdown of our findings in Emerald Resources' earnings growth report.

Our valuation report unveils the possibility Emerald Resources' shares may be trading at a discount.

Nanosonics

Simply Wall St Growth Rating: ★★★★☆☆

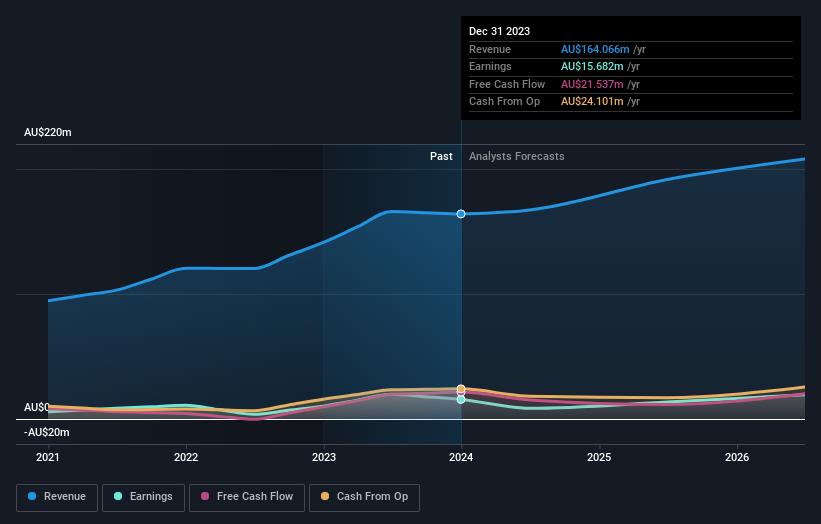

Overview: Nanosonics Limited is an infection prevention company that operates both in Australia and internationally, with a market capitalization of approximately A$902.88 million.

Operations: The company generates its revenue primarily from the healthcare equipment segment, totaling approximately A$164.07 million.

Insider Ownership: 15.2%

Earnings Growth Forecast: 24% p.a.

Nanosonics, an Australian growth company with high insider ownership, has seen a significant drop in net income and earnings per share for the half-year ended December 31, 2023, despite robust past earnings growth of 53.2%. Currently trading at a substantial discount to its estimated fair value, the company is expected to outperform the Australian market with a forecasted annual earnings growth of 24% and revenue growth of 10.1%. However, its Return on Equity is projected to remain low at 12.5% in three years' time.

OM Holdings

Simply Wall St Growth Rating: ★★★★☆☆

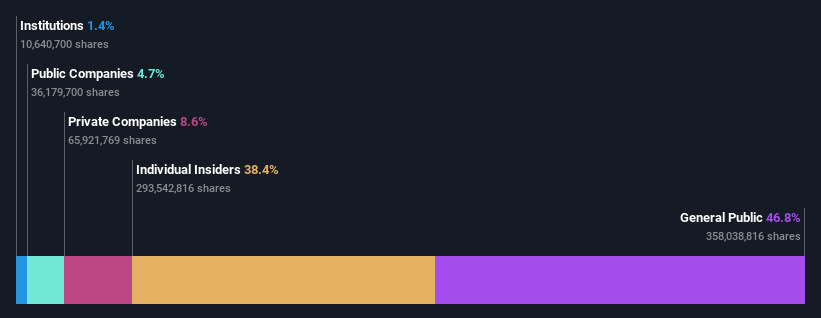

Overview: OM Holdings Limited operates globally, focusing on mining, smelting, trading, and marketing manganese ores and ferroalloys with a market capitalization of approximately A$408.91 million.

Operations: The company generates revenue primarily through its marketing and trading segment, which brought in A$602.07 million, and its smelting operations, which accounted for A$388.84 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 29.8% p.a.

OM Holdings, an Australian growth company with high insider ownership, is trading below the average market P/E ratio at 14.9x. Despite a challenging financial year with significant profit declines and lower margins, OMH's earnings are expected to grow by 29.8% annually over the next three years, outpacing the Australian market forecast of 13.4%. However, concerns include shareholder dilution in the past year and one-off items impacting financial results, alongside a low forecasted Return on Equity of 8.8%.

Make It Happen

Unlock our comprehensive list of 90 Fast Growing ASX Companies With High Insider Ownership by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:EMR ASX:NAN and ASX:OMH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance