Every few decades the tech world brings up some shiny new thing that promises to change our world in ways that we can never predict. AI, artificial intelligence, started taking the computing world by storm a few years ago, altering the ways that computers interact with each other, and expanding the frontiers of what computing technology can do. But more recently, generative AI has hit the scene – and has forever changed the way that we communicate with machines.

As generative AI makes its way through the tech world, bringing us more realistic chatbots, more intelligent online searching, and smarter devices, the changing technological landscape will open up new opportunities for investors. AI tech stands on a multitude of supports – semiconductor chips to provide the processing power and memory; various sensors, from optics to LiDAR to audio, to provide a more organic input than a keyboard can manage; new software, to tell everything what to do; data centers and supercomputers to put it all together.

Against this backdrop, the analysts at Cantor Fitzgerald have conducted in-depth analyses of the AI landscape, focusing on chip giant Advanced Micro Devices (NASDAQ:AMD) and voice recognition software firm SoundHound (NASDAQ:SOUN). Both companies are at the forefront of the AI revolution, albeit in widely different ways. The Cantor analysts have determined which is the superior AI stock to buy, making a clear recommendation.

Advanced Micro Devices (AMD)

We’ll start with AMD, which ranks among the top ten largest semiconductor chip makers globally. With a market cap of $247.5 billion, AMD holds the sixth position. In terms of annual revenue, the $22.8 billion generated over the past four quarters places the company ninth.

This is a solid position for any company, and AMD has earned it through developing, engineering, and marketing a high-quality portfolio of AI-capable processing chips. The company’s product lines have found ready acceptance and strong demand among AI developers, especially those working with generative AI, which requires higher data processing capacity, and among data center firms, whose aggregated server systems provide the combination of processing and memory needed to run AI and other data-intensive applications.

Prominent among AMD’s newer product lines are the MI300 series accelerators, a line of chip products designed to meet the high-end needs of the most demanding AI applications and high-performance computing systems. The MI300 series can work at a wide range of scales and can deliver the speed and capacity needed at the cutting edge of the AI revolution. The latest MI300 chip series launched in December of last year, and the company has been ramping up sales and production ever since. In the company’s last quarterly release, from 1Q24, AMD announced that its MI300 Instinct series chips are featured in computer systems marketed by Lenovo, Dell, and Supermicro.

Overall, that 1Q24 report showed AMD bringing in $5.5 billion in gross revenues for the quarter, a figure that came with modest gains – a 2.2% year-over-year increase, and a $20 million beat over the forecast. At the bottom line, AMD’s 62-cent non-GAAP EPS, based on $1 billion in net income, beat expectations by a penny.

These results were driven mainly by AMD’s Data Center and Client business segments, which both grew more than 80% year-over-year on the strength of the new MI300 accelerators. The company notes that demand for AI capabilities is proving critical to growth in the semiconductor industry.

Overall, however, AMD’s shares have declined 27% from their March peak, which Cantor analyst C.J. Muse views as an opportune moment for investors. He recommends buying the stock for the long term, citing AMD’s robust market position and significant growth potential as key reasons for his positive outlook.

“At the heart of investor disappointment is lack of earnings leverage upside vis-à-vis consensus for all of CY24. The MI300 ramp is truly impressive, but supply constraints (mgmt. raised guide to $4B, we are hearing sufficient HBM for $5-6B) are limiting a vision for even greater upside where many investors have been discussing much higher #s up until recently… That said, the 2025 and beyond story remains intact where MI300 GPU remains a robust story as the company attacks the $400B 2027 AI opportunity as the #2 merchant AI supplier behind NVIDIA,” Muse opined.

Muse’s comments are supportive of his Overweight (i.e. Buy) rating on AMD shares, and his $170 price target implies a 12-month share gain of ~12%. (To watch Muse’s track record, click here)

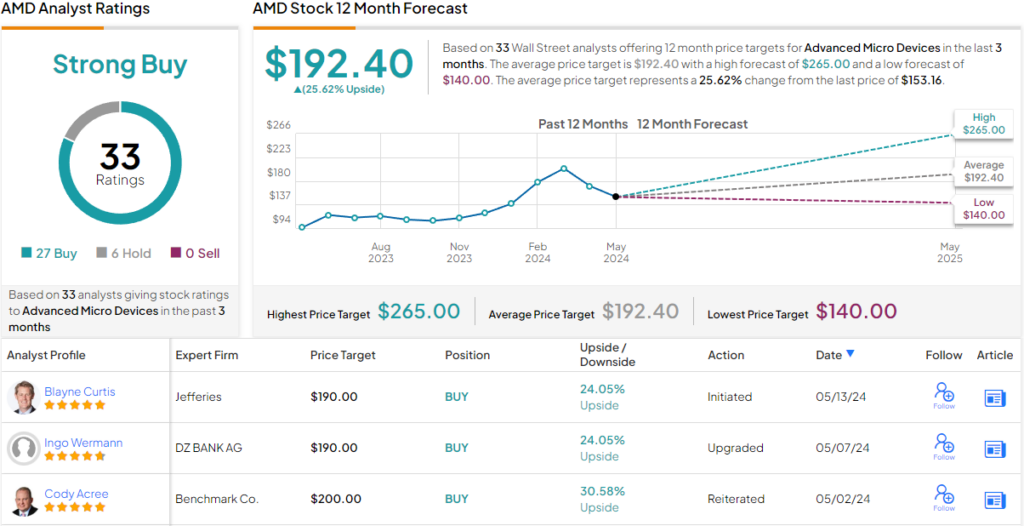

Overall, AMD has a Strong Buy consensus rating from the Street’s analysts, based on 33 recent reviews that include 27 to Buy against 6 to Hold. AMD shares are priced at $153.16, and their $192.40 average price target suggests an upside of ~26% for the year ahead. (See AMD stock forecast)

SoundHound AI

The next stock up is SoundHound, a Silicon Valley tech firm headquartered in Santa Clara, California. The company specializes in conversational intelligence and voice AI solutions – in short, SoundHound is working to make AI applications not just voice activated, but voice interactive. The company uses a proprietary technology that allows its voice AI to deliver industry-leading speed and accuracy in multiple languages. The company’s voice AI products have found applications in IoT, smart TV, the automotive industry, to name just a few.

SoundHound’s product lines include Smart Answering and Smart Ordering, but the groundbreaking product is the real-time, multi-modal customer service interface Dynamic Interaction. In addition, SoundHound offers customers the SoundHound Chat AI, a digital voice assistant powered by an integrated generative AI. The common feature here is turning the user’s own voice into an interface tool for AI applications.

Talking is one of our most natural modes of communication – it is certainly more intuitive than reading or writing text. For SoundHound, this fact underlies a series of advantages inherent in its voice AI platform: an elevated customer experience, based on the spoken word; a more personalized brand, developed through voice interactions; and most important, a wide range of supported languages and accents, so that users can talk to customers in the customers’ language.

Looking at the financial picture, SoundHound brought in $11.6 million in revenue during 1Q24. This translated to 73% year-over-year growth, and beat the estimates by $1.49 million. The company’s earnings came in at a net loss, but the non-GAAP EPS, at negative 7 cents per share, was a penny per share better than had been anticipated. At the end of 1Q24, SoundHound had a $226 million in available cash.

Even though this company offers its customers a valuable product, and investors can point to positives from the earnings report, Cantor Fitzgerald analyst Brett Knoblauch is still wary.

“Given the demand management has highlighted, we believe it might make sense for SOUN to return to investment mode to try and capture as much demand as quickly as possible. We are raising our 2024E/2025E revenue estimates by 3.0%/0.6%, but lowering our adjusted EBITDA estimates by 56.9%/176.6%. We continue to believe that upside and downside risks are more evenly skewed based on SOUN’s current valuation, which keeps us on the sidelines,” Knoblauch explained.

To this end, Knoblauch rates SOUN shares as Neutral, while the analyst’s $5 price target suggests that the shares will slip ~6% this year. (To watch Knoblauch’s track record, click here)

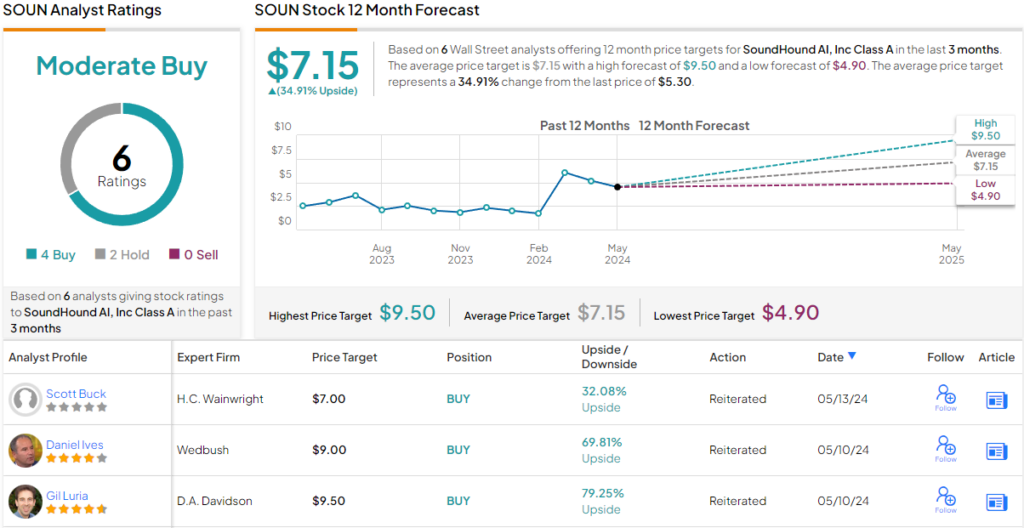

While Cantor’s analyst is cautious on this stock, the Street is more willing to take a bullish stance. The shares have a Moderate Buy consensus rating, with 4 Buy recommendations on file along with 2 Holds. These shares have an average price target of $7.15, implying a ~35% increase from the current share price of $5.30. (See SOUN stock forecast)

Pulling back and looking at both reviews, it’s clear that Cantor sees AMD as the superior AI stock for right now.

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.