Renaissance Technologies' Strategic Moves: A Deep Dive into NVIDIA's Significant Reduction

Insights from the Latest 13F Filing for Q1 2024

Renaissance Technologies (Trades, Portfolio), founded by Jim Simons in 1978, is a pioneering quant hedge fund known for its advanced mathematical and statistical trading models. Despite Simons stepping down and his recent passing in May 2024, the firm continues to influence global markets with its sophisticated algorithmic strategies. The latest 13F filing for the first quarter of 2024 reveals significant portfolio adjustments, including new buys, increased stakes, complete sell-offs, and notable reductions.

Summary of New Buys

Renaissance Technologies (Trades, Portfolio) added a total of 566 stocks to its portfolio this quarter. Noteworthy new acquisitions include:

Chevron Corp (NYSE:CVX) with 2,097,623 shares, making up 0.52% of the portfolio and valued at $330.88 million.

Linde PLC (NASDAQ:LIN) with 402,918 shares, representing 0.29% of the portfolio and valued at $187.08 million.

Union Pacific Corp (NYSE:UNP) with 513,179 shares, accounting for 0.2% of the portfolio and valued at $126.21 million.

Key Position Increases

Renaissance Technologies (Trades, Portfolio) also significantly increased its stakes in 1,541 stocks. Major increases include:

Walmart Inc (NYSE:WMT), where shares were boosted by 3,813,100 to a total of 4,347,400, marking a 713.66% increase and impacting the portfolio by 0.36%, with a total value of $261.58 million.

PayPal Holdings Inc (NASDAQ:PYPL), with an additional 2,160,500 shares, bringing the total to 2,284,700. This adjustment represents a 1,739.53% increase in share count, valued at $153.05 million.

Summary of Sold Out Positions

Renaissance Technologies (Trades, Portfolio) completely exited 589 holdings in the first quarter of 2024, including:

Exxon Mobil Corp (NYSE:XOM), selling all 4,502,276 shares, impacting the portfolio by -0.7%.

Boeing Co (NYSE:BA), liquidating all 1,057,900 shares, causing a -0.43% impact on the portfolio.

Key Position Reductions

Significant reductions were made in 1,518 stocks. The most notable reductions include:

NVIDIA Corp (NASDAQ:NVDA), with a reduction of 999,147 shares, resulting in a -64.47% decrease and a -0.77% portfolio impact. The stock traded at an average price of $724.8 during the quarter and has seen a 23.37% return over the past three months and an 84.10% year-to-date increase.

Uber Technologies Inc (NYSE:UBER), with a reduction of 7,338,800 shares, marking a -52.95% decrease and a -0.7% portfolio impact. The stock traded at an average price of $71.78 during the quarter, with a -18.00% return over the past three months and a 5.41% year-to-date increase.

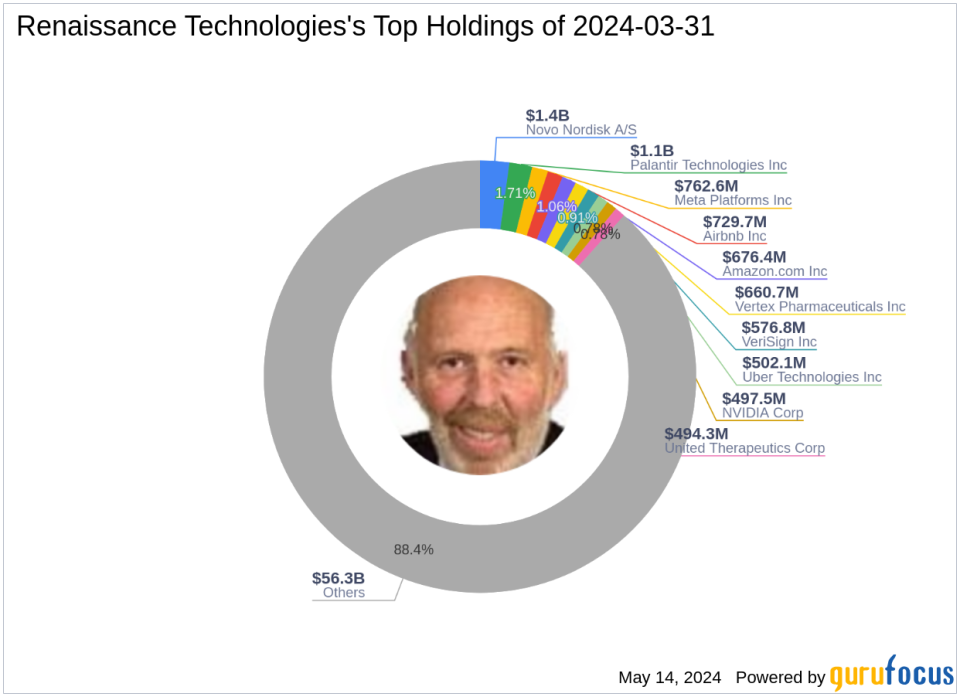

Portfolio Overview

As of the first quarter of 2024, Renaissance Technologies (Trades, Portfolio)' portfolio included 3,659 stocks. The top holdings were:

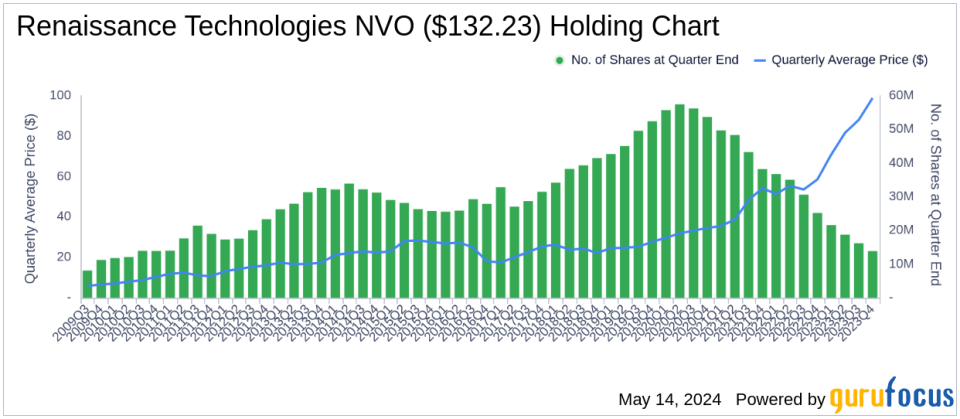

2.18% in Novo Nordisk A/S (NYSE:NVO)

1.71% in Palantir Technologies Inc (NYSE:PLTR)

1.2% in Meta Platforms Inc (NASDAQ:META)

1.15% in Airbnb Inc (NASDAQ:ABNB)

1.06% in Amazon.com Inc (NASDAQ:AMZN)

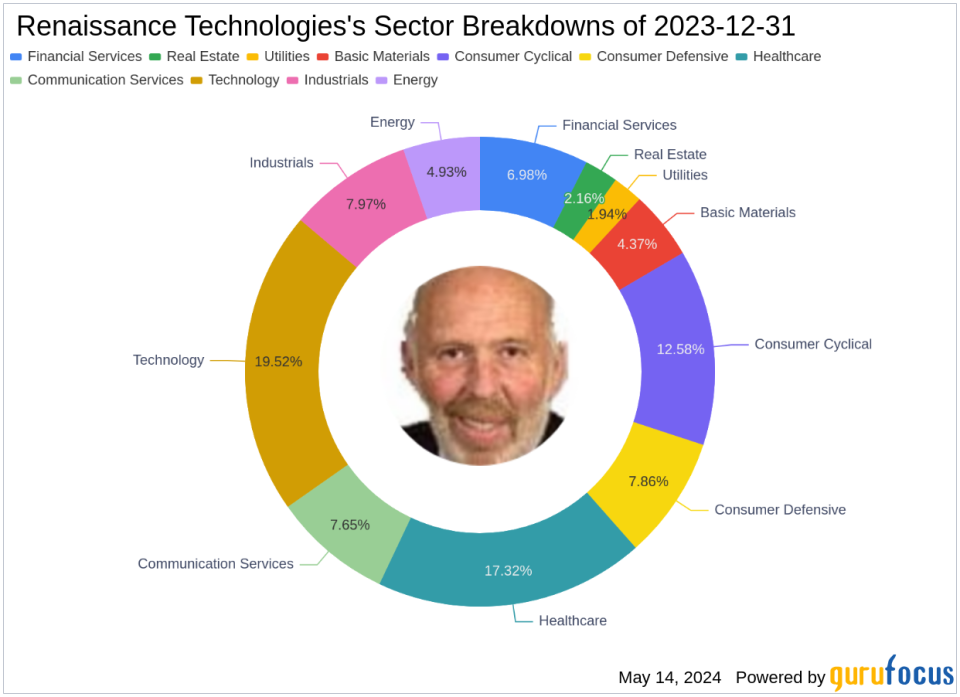

The holdings are mainly concentrated across all 11 industries, including Technology, Healthcare, and Consumer Cyclical.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance